Advertising your home improvement business is critical. Whether you rely on print, radio, TV, digital or some combination therein, every home improvement retailer must decide on a message and a medium to let potential customers know about their business. targeted marketing

But how can you be sure you’re maximizing your advertising reach and ensuring as many customers as possible respond to your messaging? Experimenting with different advertising formulas can be a slow and costly process. While you search for the winning combination, you may be siphoning off customers to competitors.

To answer that question, market research firm The Farnsworth Group recently surveyed 1,200 consumers from three different age groups. Their incisive data reveals how millennials, Generation X and baby boomers digest different types of marketing and which marketing messages resonate with them most strongly.

Advertising isn’t an exact science, but it also shouldn’t be a gamble for your business. Discover what kinds of information different generations seek and how you can best meet their needs with clear and compelling marketing outreach.

Generational Import

Mark Harris is the founder of The Harris Development Group, an organization that works with businesses from an array of industries to help teams strengthen communication, augment diversity and collaborate more effectively.

Through his 25 years of experience, Harris says he has seen younger generations place a greater emphasis on digital communications, and that is something retailers should notice.

Harris says each generation has different cultural, economic and personal touch points that define their views on every aspect of life, including retail.

“If you can truly reach out to customers and understand what’s important to them, the messages they respond to and the communication vehicles that interest them, you’re going to drive more sales,” he says.

The Playing Field

It’s important to understand that while The Farnsworth Group data reveals different generations use different forms of media to get home improvement marketing, separate generations are still searching for the same kinds of information.

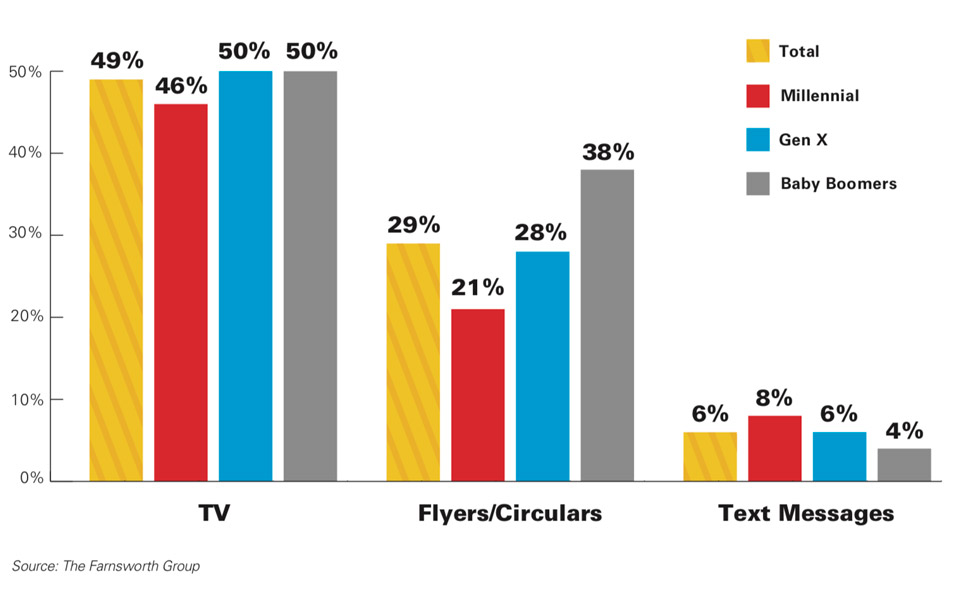

When shopping for home improvement products, data reveals television is the most frequently used method of communication at 49 percent for all generations. Text messages were the least frequently sought method of communication when shopping for home improvement products at just 6 percent for all age groups.

The communication method with the greatest variance between age groups proved to be flyers and circulars included with newspapers. Just 21 percent of millennials reported using this type of messaging for their home improvement shopping, while 38 percent of baby boomers relied on them.

Most Frequently Sought Advertising By Generation

Harris says being able to convey the same message, whether it’s about sales prices, in-store events or new products, across multiple forms of communication is critical and only growing more important as younger generations show a preference for digital marketing. “The data shows different generations look for the same kinds of information, using that to guide your marketing is critical,” he says.

Harris says being able to convey the same message, whether it’s about sales prices, in-store events or new products, across multiple forms of communication is critical and only growing more important as younger generations show a preference for digital marketing. “The data shows different generations look for the same kinds of information, using that to guide your marketing is critical,” he says.

Methodology

The Farnsworth Group surveyed 400 millennials (ages 22-38), 400 generation Xers (ages 39-53) and 400 baby boomers (ages 54-72) via a questionnaire in 2019 to understand how consumers use media and integrate technology into their home improvement product shopping. All respondents were active hardware and home improvement shoppers.

What Customers Want

What Customers Want

By knowing where your customers look for home improvement information, you can fortify your marketing reach by including the specific information customers seek.

When asked what information they look for in home improvement advertising, sales prices were the clear driver. At 78 percent for all

age groups and 84 percent for baby boomers, information about sales proved persuasive across generations and was strongly desired by all age groups.

It may be surprising to some retailers that project information was the least frequently sought element of home improvement communications at just 29 percent for all respondents and 23 percent for baby boomers specifically.

“It’s clear that younger customers still seek information on new products and sales, but there’s also an indication they need project how-to videos and other resources,” Harris says.

More than one-quarter of millennials are researching products and visiting brick-and-mortar locations to get in-store advice, according to the data. Preparing resources to guide young customers and incorporating those into your marketing are critical.

One of the main reasons customers shop or research in-store is to check prices, but touching and seeing products are also driving in-store visits. Promoting live product demonstrations could be a persuasive way to bring more customers through your doors.

The Social Side

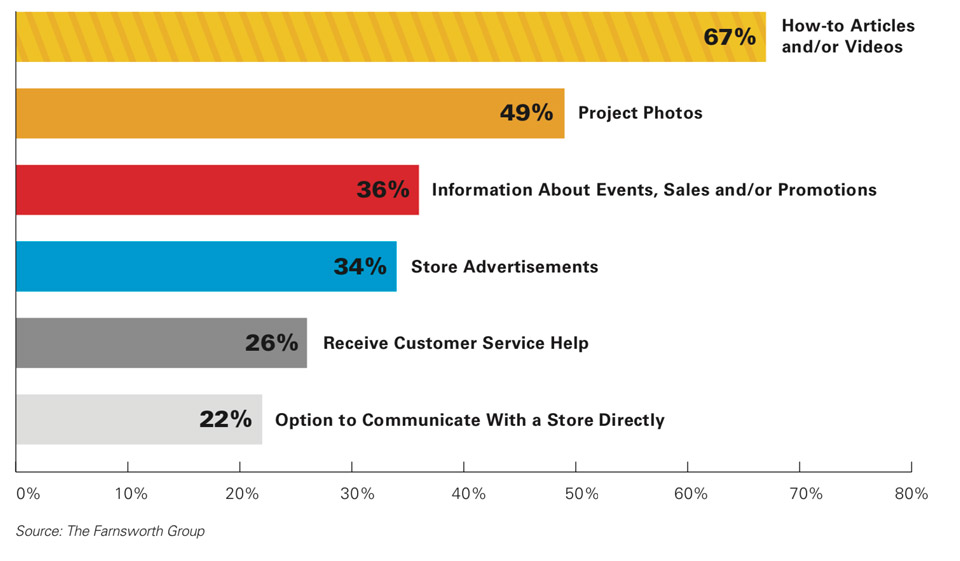

Social media plays a large role in modern home improvement communications. Roughly 88 percent of all home improvement customers have a social media account, so Harris says developing your social media outreach is critical.

“As millennials and Generation Z grow, having a social media presence and using that to drive foot traffic and sales will become even more important,” he says.

When asked how often they use social media for information on home improvement products, 36 percent of millennials report always or frequently using it, compared to 29 percent of Generation X and just 8 percent of baby boomers. Interestingly, 42 percent of baby boomers report never using social media for product information.

Facebook, YouTube and Pinterest were the three most popular social networks across all generations.

What Information Generations Seek on Social Media

The Search Continues

The Search Continues

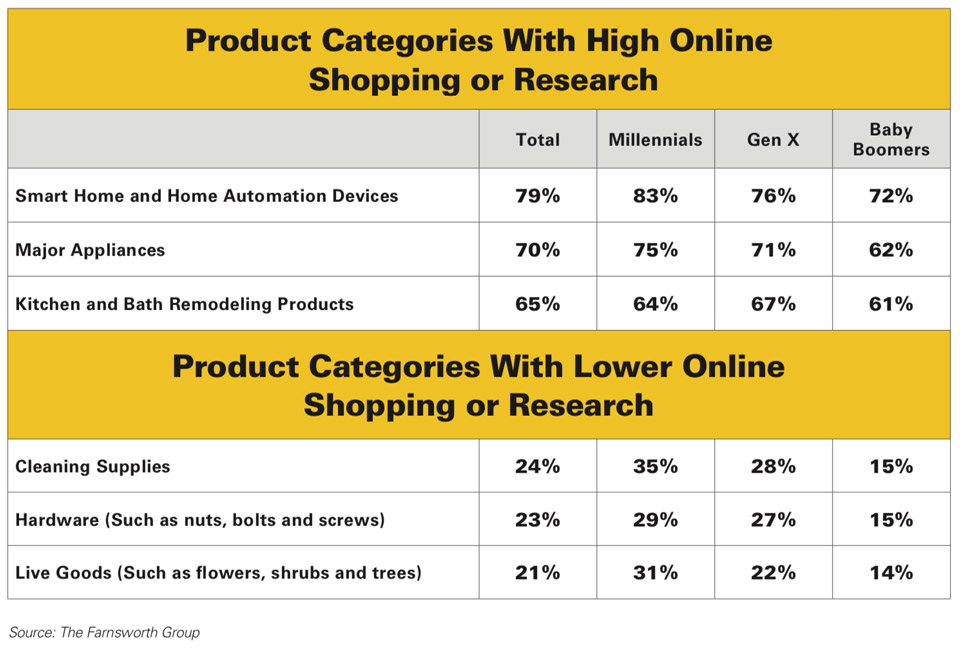

As online engagement and e-commerce become more important, understanding the products that drive online searches can benefit retailers. By recognizing the products most commonly researched online or online and in store, retailers can refine their ads for greatest impact.

Smart home and home automation devices were the most popular products researched online or online and in stores for all consumer segments. Major appliances followed at 70 percent. Kitchen and bath remodeling products were the third most common drivers at 65 percent.

Conversely, of the products consumers had purchased in the last year, live goods were the least popular at 21 percent. Basic hardware was the next at 23 percent.

“Retailers should take note and be sure they’re using the information they know customers need in their advertising,” Harris says.

Taking Action

The Farnsworth Group’s data is clear: Consumers’ media use is changing rapidly, but all customers are seeking the same type of information from home improvement marketing. A truly compelling ad works for all generations, but customers often access them through different media.

Establishing a digital presence for your business is critical, particularly among younger generations who research home improvement products before buying at least half of the time.

Millennials have grown up with technology and expect to use it in all aspects of their lives. The research shows this mentality applies to

home improvement purchases and instructions, too. Find ways to incorporate how-to resources in your marketing or on your website to establish a closer bond with young customers as they start their own families and manage their homes.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information