Business owners often struggle to protect their enterprises against a wide range of employment-related issues, such as employee discrimination, harassment, wrongful termination and retaliation.

Finding the right balance between effective risk management and affordable employment practices liability insurance is more crucial than ever and has a direct impact on a company’s bottom line.

A recent influx of high-profile lawsuits and increased regulatory oversight have brought new exposure to what is not covered by employment practices liability endorsements afforded under a business owners insurance policy or general liability sublimit: wage and hour violations under the Fair Labor Standards Act.

The business owners policy is typically designed to cover property damage and bodily injury. Employment claims are not based on either of these perils, let alone failure to pay overtime. Some policies may provide a small defense limit but typically not enough to engage an attorney to defend a company against an employment claim.

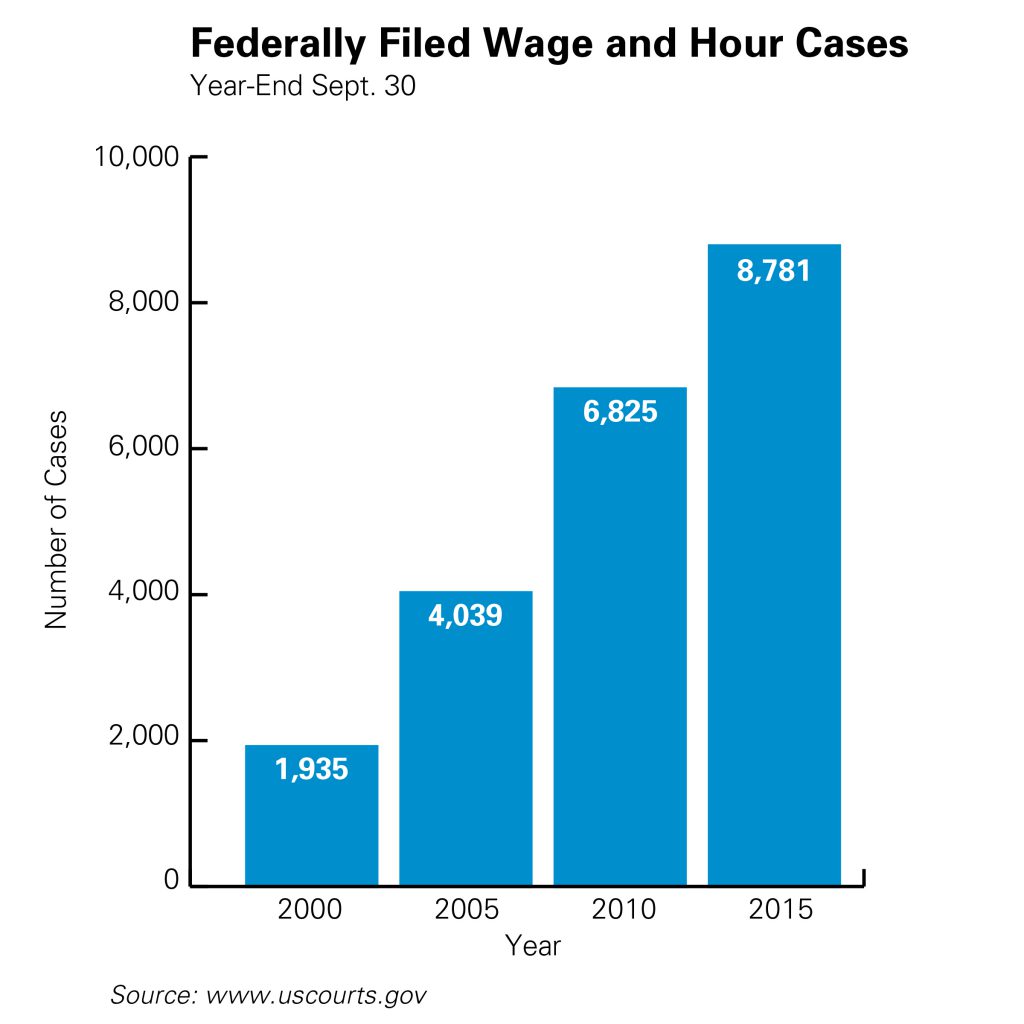

According to statistics released by the Federal Judicial Center, federal wage and hour lawsuits have increased dramatically over the past 15 years and similar trends have been realized at the state level. Defense and settlement of these lawsuits have proven to be expensive for employers.

The reasons for the increase in claim activity can be attributed to several different trends. The residual effects of the downturn in the economy have led to budget constraints for employers and forced employees to work off the clock. The proliferation of smartphones has blurred the line between employees’ personal and work time. Poor record keeping and improper classification of employees have made it difficult for employers to provide a defense.

You may ask yourself, “How do I avoid the common pitfalls that bring about a claim?” Keeping an updated employee handbook and discrimination policy, and having detailed record keeping are all imperative. But the reality is, even with stringent procedures in place, an employment practices liability claim is likely to happen.

So how do you protect yourself and, more importantly, your business? Making sure you have broad insurance coverage and for not only defense but indemnity. In addition, finding the right coverage that not only gives you the coverage you need but also provides human resources risk management consulting services is imperative to help navigate these often complicated matters.

Employment practices liability insurance covers not only actual but also alleged acts of discrimination, harassment, retaliation, wrongful termination and other similar acts.

The financial ramifications of not having this insurance can be crippling, especially for small businesses because they do not have the operating budgets to handle defense costs, let alone settlements or judgments of an uninsured claim. Having a standalone policy ensures you will have adequate limits and breadth of coverage to protect the assets of a company in the event of a claim.

When purchasing insurance, you want to look for a policy that has defense outside the limit, a wage and hour sublimit that includes indemnification, which pays back wages owed for overtime, and third-party coverage protecting you from suits by vendors, customers or anyone outside your organization.

For more information about they types of insurance available, contact Carl C. Dent, North American Retail Hardware Association (NRHA) Member Insurance coordinator. Dent can be reached at 704-237-8709 or nrha@memberinsurance.com.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information