Click the picture to download a PDF of this story.

By Kate Klein, kklein@nrha.org

All story data were compiled from a survey of manufacturers and distributors conducted by the North American Retail Hardware Association (NRHA).

Recently announced and proposed tariffs on raw materials continue to be an ongoing discussion worldwide as the U.S. and its trading partners shift their positions on international trade.

The North American Retail Hardware Association (NRHA) recently conducted a survey of more than 75 of the home improvement industry’s top manufacturing and distributing companies to help determine the potential impact of the tariffs on the industry.

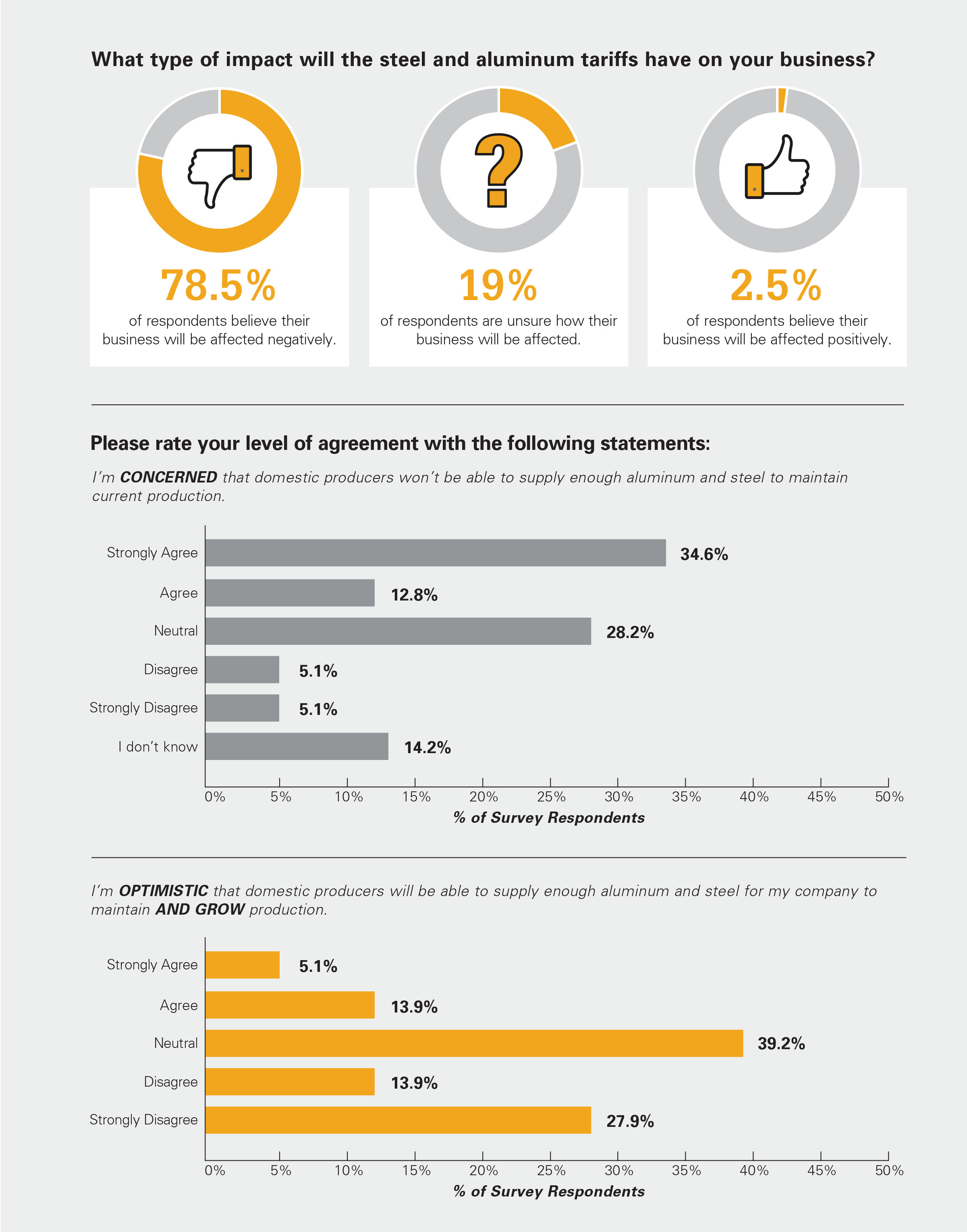

According to the results of this survey, nearly 80 percent of the companies that expect the tariffs to impact their operations believe the effects will be negative. About 19 percent say they don’t know if the effects will be good or bad, and a small percentage think they will be positive.

Study participants who expect positive results say they think the tariffs will strengthen the U.S. economy, help get trade concessions for the country from other nations and push their companies to look for operational efficiencies.

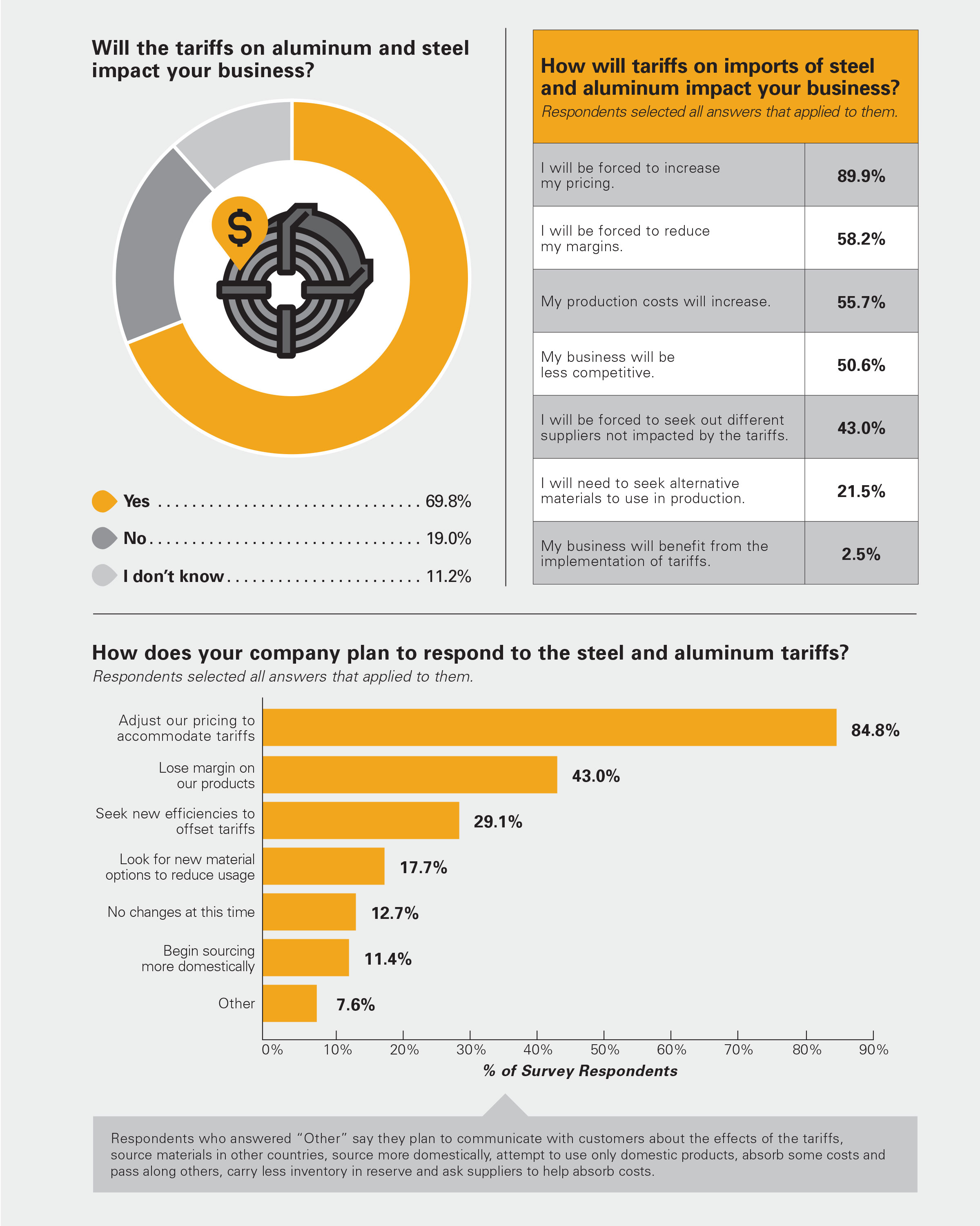

Nearly 90 percent of manufacturers and distributors surveyed expect tariffs on imported aluminum and steel from countries such as China to force them to raise their product prices.

Because overseas suppliers have increased their raw material prices to accommodate the new

import tariffs, domestic suppliers have also been able to raise their prices, some respondents say.

The survey results show that increases in the costs of sourcing steel and aluminum domestically have further contributed to U.S. manufacturers and distributors needing to increase prices on their finished goods.

Higher prices on raw materials produce higher manufacturing and distributing costs, which will result in consumers paying more at retail, respondents say.

Some survey participants believe increasing their prices may not impact them negatively, since their competitors’ pricing will also have to go up.

Only 2.5 percent of the respondents think the tariffs will benefit their businesses.

Some of the manufacturers and distributors say it’s too soon to know how the tariffs will impact them. They are waiting to find out what else happens with the tariffs, international trade negotiations and the industry before deciding how to react.

A few survey participants say the tariffs could put U.S. products in a better price position compared to Chinese goods and reduce the amount of low-quality items in the marketplace.

The tariffs are motivating many companies to begin sourcing products domestically or expand how much they buy from U.S. producers, survey participants say.

Multiple respondents say they will be looking for more domestic suppliers of aluminum and steel, while others will source more offshore.

Some of them expect not only to source more raw materials in the U.S., but also to make more of their products stateside to reduce their reliance on imports.

However, they are uncertain about whether domestic companies will be able to keep up with existing manufacturing—let alone provide for industry growth—if manufacturers try to source dramatically more materials in the U.S. than in the past.

About 60 percent of the operators who expressed opinions on domestic production say they are concerned U.S. companies will not be able to supply enough aluminum and steel to maintain current manufacturing.

For other survey participants, buying materials made in the U.S. remains cost prohibitive and they will continue to rely on imports.

The tariffs on raw materials from China specifically may benefit some companies’ suppliers in other countries, respondents say.

Several participants say they plan to start sourcing aluminum and steel from other countries that are less affected by increased trade duties.

They listed India, Taiwan and Vietnam as countries that may become bigger, more competitive players in supplying imported products to manufacturers in the U.S. home improvement industry.

More than half of the manufacturers and distributors report that their production costs will be rising because of the tariffs and they will have to find ways to compensate.

In addition to raising prices, many of the respondents say they will ask their suppliers to help offset the higher costs.

Nearly 60 percent of the companies NRHA surveyed expect to be forced to reduce their margins and about half of them think their businesses will be less competitive as a result of the tariffs.

Only 13 percent of the survey participants do not plan to make changes because of the added tariffs.

“Steel and aluminum tariffs are a growing concern for manufacturers and distributors, which will have to share cost increases,” says Dan Tratensek, executive vice president of NRHA and publisher of Hardware Retailing magazine. “The results of this survey make it clear that, at the very least, the tariffs and the prospect of additional tariffs could factor heavily into future pricing within the industry.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information