For more than 125 years, the North American Hardware and Paint Association (NHPA) has helped retailers improve merchandising effectiveness. Through the years we’ve written thousands of magazine articles, developed merchandising-focused training programs (both online and in-person) and conducted research to gauge the effectiveness of merchandising techniques at independent stores.

In 2002, NHPA conducted its landmark Merchandising for Profit Study and then repeated it again in 2016. The purpose of the study was to quantify the sales lift generated by different merchandising techniques. Last month at the National Hardware Show in Las Vegas, NHPA released the results of its latest Merchandising for Profit Study, where it worked with retailers across the country to test the effectiveness of a variety of merchandising techniques including:

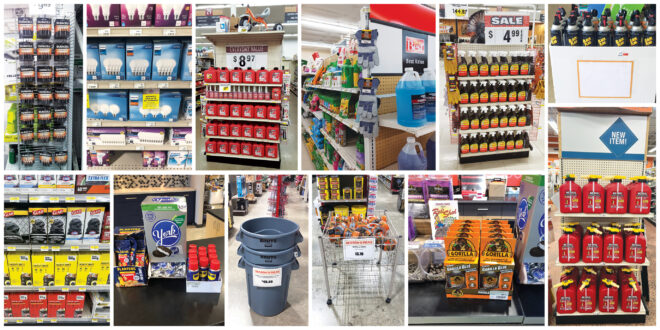

- Endcaps

- Dump bins

(both permanent and manufacturer supplied) - Clip strips

- Bulk stack-out displays

- Countertop displays (for both service counters and checkout)

- Sidekick displays (also known as sidewinders)

These time-tested techniques make up the core of your store’s promotional merchandising system. When done effectively, your promotional merchandising system can accentuate your strength as an independent, communicating to customers that you have curated a meaningful assortment specific to the needs of your customer in your specific trading area. Merchandising can also help soften a high-price image that, right or wrong, consumers typically associate with independent stores.

Methodology and Results

The 2025 Merchandising for Profit Study was conducted similarly to previous merchandising studies and used the same methodology.

For the study, we selected products that lent themselves to the technique being tested and were commonly stocked in hardware stores and home centers.

Retailers agreed to leave the items stocked in their in-aisle position, but also stock the product using the featured merchandising technique.

Sales were monitored during a 30-day period following the remerchandising. Sales at a similar “control” store for each retailer were also recorded during the same period.

The results from Test Stores and Control Stores were then compared and reported.

The Resulting Sales Lift

Permanent Dump Bins

Product Tested: Duct Tape

While the impact didn’t register as highly as the past two studies, these merchandisers are still delivering a solid sales lift.

The portability and familiarity with customers for delivering bargain merchandise make them ideal for impulse sales.

- 2025: 55.8%

- 2016: 86%

- 2002: 197%

Temporary Dump Bins

Product Tested: Wasp Spray

Temporary dump bins were an effective technique tested in the study, just not to the degree as in past studies.

The “temporary” nature and the ability to move them to strategic areas of a store create a sense of urgency among shoppers.

- 2025: 25%

- 2016: 660%

- 2002: 427%

Power Aisle Stack Out

Product Tested: Trash Cans

Power aisle stack-out displays delivered greater results than in the past two versions of the study.

These work best with a single SKU (larger items) that can be bulk stacked and placed in strategic locations throughout the store.

- 2025: 150%

- 2016: 114%

- 2002: 98%

Service Counter Display

Product Tested: WD-40

This technique remains effective at driving impulse sales and delivered greater results than the past two versions of the study.

These work best with a single SKU of smaller items that can be easily added to a purchase at the last minute.

- 2025: 105%

- 2016: 85%

- 2002: 81%

Checkout Display

Product Tested: Gorilla Glue

Like service counter displays, this technique remained a solid performer compared to past studies.

The results reflect the added importance of merchandising at checkout. Small, grab-and-go items make it easy for customers to pick one up at the last minute.

- 2025: 300%

- 2016: 467%

- 2002: 39%

Clip Strip

Product Tested: Work Gloves

Essentially this serves as a cross-merchandising/impulse technique and retailers continue to see solid lift.

While clip strips saw positive results in the past two studies, the results from the current study suggest that more retailers are using them in strategic areas of the store to drive add-on sales.

- 2025: 200%

- 2016: 25%

- 2002: 15%

In-Aisle Feature/Benefit Sign

Product Tested: LED Lightbulb

Calling out the features and benefits of products in aisle still clearly delivers a sales impact.

This is especially true on items such as the LED light bulbs tested (non-LED bulbs were tested in 2002), where retailers can illustrate the actual ROI on a purchase.

- 2025: 50%

- 2016: 37%

- 2002: 6%

Feature Endcap: Single Item

Product Tested: Gas Cans

Results from single-item endcaps continue to produce solid result for retailers.

Single-item endcaps grab customers’ attention, showcasing new and innovative items. Endcaps should be well stocked, clean, bold and dramatic.

- 2025: 109%

- 2016: 11%

- 2002: 25%

Multi-Item Endcap: Primary Item

Product Tested: Gas Cans

Multiple-item endcaps with price signage once again showed positive results in this year’s study.

Secondary items should be merchandised on the “Belly Shelf” and should not exceed 20% of the designated promotional space.

*In 2002 and 2016, sales on multi-item endcaps were combined.

- 2025: 29%

- 2016: 63%

- 2002: 25%

Multi-Item Endcap: 2nd Item

Product Tested: Fuel Stabilizer

The secondary item on multiple-item endcaps should also be complementary to the primary item so customers don’t think twice about grabbing both items.

The secondary item should carry a higher margin compared to the primary item to help increase the overall profitability of the display.

- 2025: 98%

- 2016: 63%

- 2002: 25%

Feature Endcap: % Off Sign

Product Tested: Contractor Trash Bags

Endcaps are clearly still effective at driving sales lift for products as they bring items into a customer’s view.

Simple endcaps with clear signage have emerged as the industry standard.

*In 2002, only endcaps were tested and signage options were not swapped.

- 2025: 125%

- 2016: 38%

- 2002: 25%

Feature Endcap: Sale Sign

Product Tested: Weed Spray

Side by side, it appears as if “sale” signage is slightly more effective at providing sales lift for endcap items.

Simple endcaps with clear signage have emerged as the industry standard.

*In 2002, only endcaps were tested and signage options were not swapped.

- 2025: N/A

- 2016: 53%

- 2002: 25%

Wing Panel (New for 2025)

Product Tested: Batteries, Super Glue

Also called sidewinders or sidekicks, these displays are great for merchandising smaller, higher margin impulse items.

It’s best to limit selection to one item per wing panel and make sure displays remain stocked at a minimum 75% of capacity level.

- 2025: 38%

- 2016: N/A

- 2002: N/A

Thank You to Our Partners

A special thanks to the National Hardware Show for being the exclusive sponsor of the 2025 Merchandising for Profit Study. NHPA would also like to thank the following retailers who participated in the test:

- Stine Home & Yard

- Marvin’s Home Center

- Town & Country

Home Center - Randy’s Do it Best

- Friedman’s Home Improvement

- Koopman Lumber

- TAL Building Centers

“It’s good to see that minding the basic ‘details of retail’ can still make a big difference in driving sales and productivity in a tough retailing environment,” says Scott Wright, NHPA’s vice president of content development. “This was clearly illustrated through the results of the 2025 study, just as it was when we conducted the research in 2002 and 2016.”

Wright says that of all the ways to drive sales at retail, merchandising is one of the most effective methods.

“Merchandising is where art and science converge on the retail salesfloor to work magic on shoppers’ wallets,” Wright says. “But it takes proper planning, discipline, execution and thinking like a merchant to make it work. It’s what we teach students in NHPA’s advanced education programs, including our Foundations of Merchandising Management and Retail Management Certification Program. These time-tested merchandising techniques and principles work just as well today as they ever have in driving sales and profits.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information