Click the picture to download a PDF of this story.

For years, Amazon has been racing to compete with and beat brick-and-mortar retailers in selling nearly every product category, while setting a breathtaking pace for sales growth.

The company has also cemented itself in consumers’ minds as convenient and inexpensive. For many shoppers, Amazon is the ideal in-your-pocket price checker, product search engine and ordering tool, available on the devices they use every day. In a recent filing with the U.S. Securities and Exchange Commission, Amazon CEO Jeff Bezos reports that the company has surpassed 100 million paying Amazon Prime users worldwide, who subscribe to a service that includes free two-day shipping on many products and discounts at brick-and-mortar Whole Foods stores.

The growth of online retail has changed customers’ expectations for in-stock position, prices, convenience and experiences within brick-and-mortar stores.

What has not changed is that independent home improvement retailers offer expertise; immediate help for homeowner emergencies; high-quality, specialized products; competitive pricing in many areas; and a contribution to local communities that has always outstripped Amazon.

The North American Retail Hardware Association (NRHA), shop-local organization Independent We Stand and the Paint and Decorating Retailers Association (PDRA) commissioned the study, which quantifies the difference between what Amazon can offer a community compared to independents.

The study, Home Sweet Home: Locals vs. Amazon, reveals that sales from locally owned home improvement businesses contribute a local economic impact that is nearly seven times more than Amazon’s contributions.

The following pages detail the study findings and how retailers can use them to highlight the significance of what their independent businesses offer communities.

Methodology

To analyze the local economic impact of independent home improvement stores versus Amazon, research firm Civic Economics worked on behalf of NRHA, Independent We Stand and PDRA. Civic Economics used prior research, including its study Prime Numbers: Amazon and American Communities; public company data from Amazon, Home Depot and Lowe’s; and NRHA’s 2017 Cost of Doing Business Study.

Civic Economics’ research compares the economic impact of the typical independent hardware store, which has average annual sales of $1.9 million, to big-box competitors and Amazon.

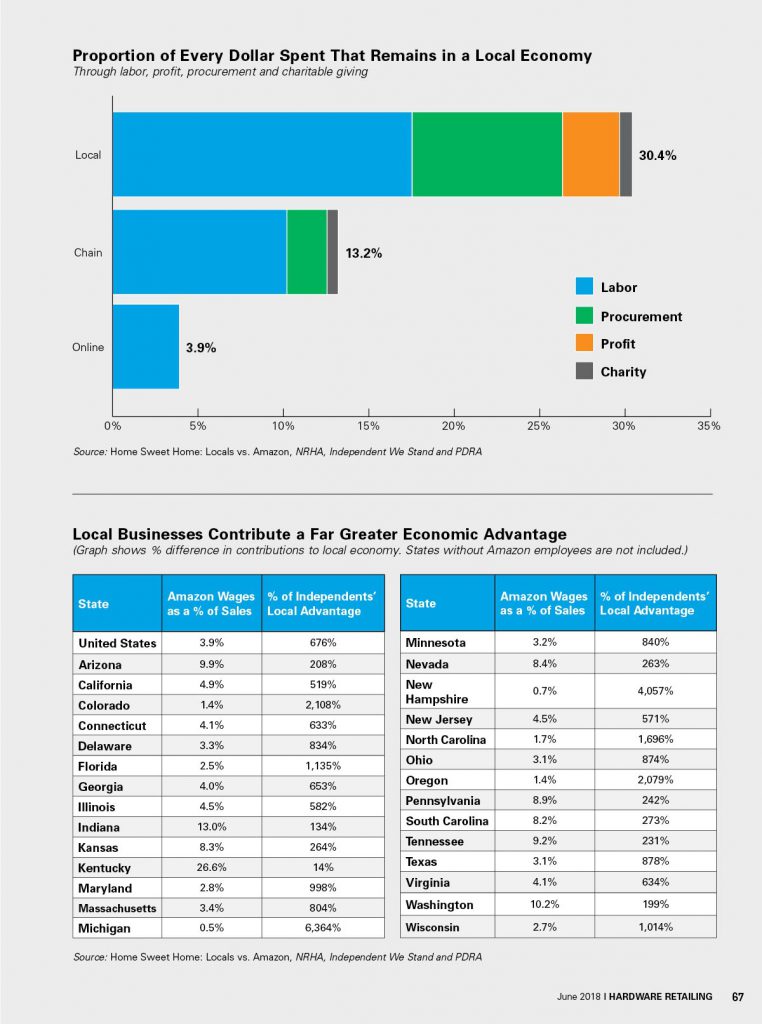

To quantify the advantage customers gain from buying home improvement products at local stores, Civic Economics considered the four major ways businesses contribute to a local economy: labor, profit, procurement and charity.

Spending on local labor generally includes a larger share of operating costs for a locally owned operation than for an outlet of a national chain. Online retailers, including Amazon, have little or no local labor force in many U.S. cities. The larger companies consolidate administrative functions, such as bookkeeping, at a national headquarters. Independents often carry out those functions in-house, resulting in a larger share of sales being paid to local residents in wages and benefits. Local businesses also tend to hire local attorneys, financial advisers and technology professionals.

Amazon’s operations take place in its headquarters and in sporadically placed distribution centers and data centers, which, unlike independent hardware stores, do not employ residents in most U.S. communities.

Purchases from large public companies, such as Home Depot or Amazon, generate profits that are reinvested in national or global operations or are distributed to shareholders.

An independent retailer’s profits may be reinvested in the business or community. Owners often procure goods and services locally and contribute to local causes that interest their families and staff.

Findings

The Home Sweet Home: Locals vs. Amazon study tells a story that every small business owner should promote loudly—independents keep a vastly greater proportion of their revenues in local economies than Amazon, the giant.

The average independent hardware store with $1.9 million in sales recirculates at least 30 percent, or about $577,600, of its sales each year into its community.

In comparison, Home Depot and Lowe’s recirculate 13.2 percent of $1.9 million in sales and Amazon only contributes 3.9 percent of the same amount.

Payroll is one of a business’s largest financial contributions to a community. The average independent hardware store or home center pays wages that are about 20 percent of store sales.

Amazon needs strikingly fewer employees to generate vastly more revenue, operating with disproportionately lower labor costs than small businesses do. On average nationwide, Amazon employees’ wages are only 3.9 percent of the company’s sales. In the states where Amazon doesn’t employ anyone, the company essentially contributes nothing to local economies.

Locally owned hardware stores beat Amazon nationwide at a dollar value that is 676 percent higher than what Amazon offers communities. Small business owners contribute by hiring their neighbors, spending their profits where they live, paying for goods and services locally and giving donations to their local churches, 4-H Clubs and Little League teams.

New Marketing Material

Your business makes a significant economic difference in your community because you invest in employees, products, services and charities where you operate.

Your business makes a significant economic difference in your community because you invest in employees, products, services and charities where you operate.

Be sure to let your customers know how much more you contribute locally than Amazon does. Showing customers how important your business’s impact is could go a long way in convincing them to buy from your business instead of shopping online.

NRHA and Independent We Stand have created a collection of marketing materials to help retailers promote the findings of the Home Sweet Home: Locals vs. Amazon study. The new posters, social media posts and other informational online graphics are available for free. They can be downloaded here.

Free marketing materials are also available for retailers to use to promote their businesses’ local economic impact compared to big-box stores. These posters, social media graphics, shelf talkers and other signage are targeted to consumers or professionals, so you can choose your audience or market to both customer segments. See below for more information.

A Library of Research

NRHA and Independent We Stand have produced research that provides hard numbers retailers can use every day.

Consumer Research

In 2015, NRHA and Independent We Stand introduced the Home Sweet Home Study, which showed the positive impact consumers have on their local economies when they shop at locally owned independent home improvement stores.

The research shows that every dollar spent on project materials at an independent retailer generates twice as much local economic impact as Home Depot or Lowe’s. To read about the original research, click here.

Marketing materials for the study are available for download here.

Pro Research

In 2017, the organizations expanded on the original Home Sweet Home Study to provide retailers with data on the impact pro customers’ spending has on a community.

The project, Home Sweet Home: Pros’ Edition, found that for every dollar contractors and other pros spend at independent home improvement businesses, twice the money remains in a local economy than when they buy from national chains.

Read more of the pro research here. Marketing materials for the study are available to download here.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information