Understanding how home improvement customers research products online and ultimately make their purchases is critical. As customers begin to expect more online interaction from the businesses they shop, discover how you can position your website for ongoing success.

The 2019 research report “Communicating With Hardware and Home Improvement Customers” from The Farnsworth Group sheds light on how customers access and interpret retailers’ websites. The report tracks the opinions of 1,200 home improvement customers from diverse backgrounds. While shoppers research and shop for home improvement products online more regularly, Robisch tells High Performance Retailer that the data reveals brick-and-mortar home improvement stores are more relevant than ever. Read more of his thoughts here.

On average, 72% of consumers’ home improvement shopping was done in brick-and-mortar stores.

Why is it important for home improvement retailers to track customers’ online behavior? The Farnsworth Group is committed to bringing operational insight to all of our clients, many of whom are home improvement retailers. When we conduct advertising studies, clients always want to know how best to communicate with pros and DIY consumers. Retailers are struggling to understand how to best serve their customers, and digital outreach is a huge part of that equation.

What are the main motivations for customers shopping online, specifically in the home improvement vertical? Convenience is the main driver. No matter where you are, you can look around and usually see someone shopping on their mobile devices. Beyond convenience, I think price transparency is a big factor for increasing online shopping. People can compare products and prices quickly, in their kitchens or at a ball game. Many people say the main motivation for customers to shop online is lower prices—and that’s definitely part of it—but above all, online shopping provides convenience.

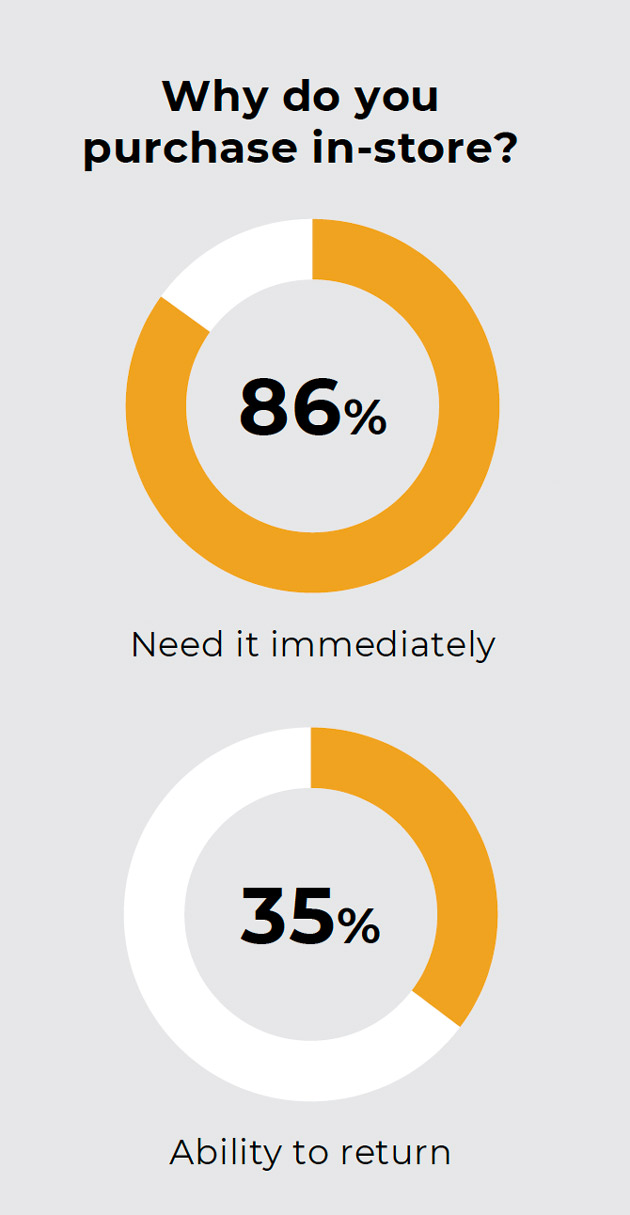

Is home improvement insulated from online competition from the likes of Amazon and other e-commerce players? Home improvement is not insulated from online competition, but it is resistant. The nature of the products plays a big role. Customers need home improvement products immediately, which causes them to visit brick-and-mortar locations in person when they need products. Customers might be willing to wait to receive housewares and decorative products, but if you need nails or key plumbing parts, the chances of waiting to receive them is slim.

How can independent retailers build their websites to best meet customers’ needs? People are starved for time. Hands down, customers want to be able to visit your website and see what you have in stock and if you have competitive prices. When you offer that information quickly, it motivates online browsers to visit your store.

What were some of your biggest takeaways from the report? The data reveals just how important having a web presence is. Beyond that, offering e-commerce—or at least an overview of the products you carry and their prices—is increasingly important. The data also shows just how many touchpoints there are before a customer makes a purchase. These are chances to engage customers, and digital tools enable you to leverage those opportunities. Ultimately, you should research your market and see which advertising methods—print, TV, digital, some combination—appeal to your specific customer base.

Consumer Shopping Preferences

Consumer Shopping Preferences

Put It to Use: Even if you don’t yet offer e-commerce, ensure your website includes subpages for your key departments with general pricing information.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information