Provided by the Home Improvement Research Institute

Smart home technology continues to expand its footprint in U.S. households. New insights from The Home Improvement Research Institute’s (HIRI) 2025 Secondary Homes Report reveal that secondary homeowners are significantly outpacing primary homeowners in both recent and planned purchases of home automation and security products.

Secondary Homes Lead in Smart Product Purchases

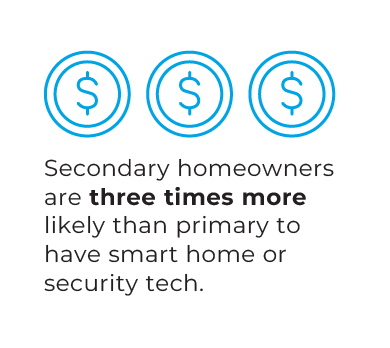

Around 15% of secondary homeowners reported buying smart home or security tech, which is three times the rate of primary homeowners at just 5%. When the research assessed purchase intent for the next 90 days, that gap persisted. Around 16% of secondary homeowners planned to make similar purchases, again three times the 5% of primary homeowners. These findings, based on data collected between May 2024 and January 2025, signal a robust market segment that retailers and manufacturers of smart home, automation and security products should not overlook—secondary homeowners.

Around 15% of secondary homeowners reported buying smart home or security tech, which is three times the rate of primary homeowners at just 5%. When the research assessed purchase intent for the next 90 days, that gap persisted. Around 16% of secondary homeowners planned to make similar purchases, again three times the 5% of primary homeowners. These findings, based on data collected between May 2024 and January 2025, signal a robust market segment that retailers and manufacturers of smart home, automation and security products should not overlook—secondary homeowners.

A Desire to Protect Their Investments

Why the outsized interest from secondary property owners? One likely factor is the increased value secondary homeowners place on automation for convenience, security and remote control. These homes, often used seasonally, as rentals or for future retirement, benefit uniquely from features like smart locks, security cameras and environmental monitors.

seasonally, as rentals or for future retirement, benefit uniquely from features like smart locks, security cameras and environmental monitors.

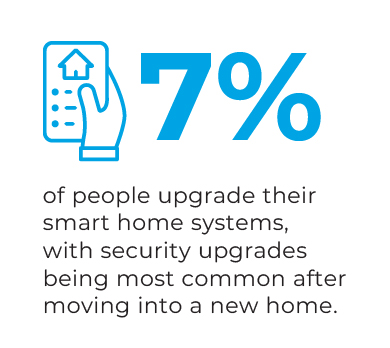

HIRI’s Recent Home Buyer and Seller Report found smart home and security upgrades are more common in the homes people move into (7%) than in the ones they sell (2%). While this data speaks to primary residences, it reinforces a pattern—homeowners prioritize smart investments where they plan to stay involved, whether living there full-time or managing the property from afar.

Homeowners Invest Where It Matters Most

What drives these purchases? Homeowners say a mix of functional and aspirational reasons. Around 15% pointed to a desire to support new features, reflecting both lifestyle upgrades and practical benefits like energy management, safety and convenience.

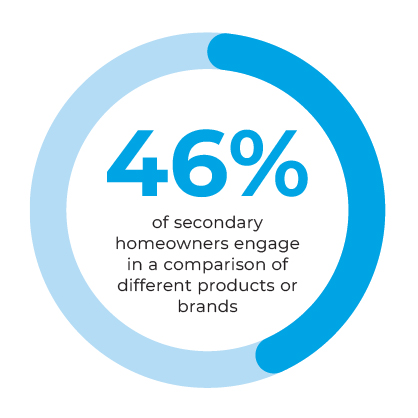

Taken together, these data points tell a clear story. Secondary homeowners represent a high-intent, high-investment audience for smart home and security products. Their properties, often used for vacation, rental income or future retirement, are being equipped to meet evolving expectations around convenience, safety and remote management.

Taken together, these data points tell a clear story. Secondary homeowners represent a high-intent, high-investment audience for smart home and security products. Their properties, often used for vacation, rental income or future retirement, are being equipped to meet evolving expectations around convenience, safety and remote management.

For home improvement retailers and product manufacturers, this opens new opportunities. Smart thermostats, doorbell cameras, leak sensors and app-connected lighting are no longer niche. They’re fast becoming expected features, especially in homes with multiple occupants or shared usage.

Making Strategic Adjustments for Success

If you’re not yet a HIRI member, consider joining for enterprise-wide access to $1M+ annually in home improvement research. Learn more at HIRI.org/pricing.

With membership, you get access to quarterly U.S. Size of Market Reports and HIRI’s Bi-Annual Product Purchase Tracking Study. This comprehensive research covers a variety of items, analyzing the purchasing behavior and preferences of homeowners across various building product groups and identifying factors most important for homeowners as they make product selections and purchasing decisions for their homes.

For additional insights, make plans to attend HIRI’s 2025 Home Improvement Insights Summit, October 22-23, in Chicago, which is open to non-members and members alike.

Learn more and register at hirisummit.com.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information