To download a PDF of this story, click here. Visit hardwareretailing.com/2015pricing-study to view the NRHA’s 2015 State of Pricing Study.

Whether you like it or not, today’s consumers have access to detailed pricing information for every item in your store. In fact, in some cases, consumers may even be better informed than you on item pricing for everything from PVC pipe to water heaters.

Cost-savvy customers now have access to Internet tools and price-shopping information at the point of sale—and they use it. They can take photos of products in your store with their smartphones to compare elsewhere, or scroll through websites to price-shop while standing in front of your endcap displays. But it’s not just your customers mining this digital pricing data. Big boxes and online-only retailers are using even more sophisticated pricing tools to stay one step ahead of the increasingly informed consumer.

So, as an independent retailer, how do you remain competitive in this environment? While there’s no one-size-fits-all formula for remaining sharply priced and competitive, there are tactics you can employ to ensure your operation stays relevant to consumers who place a high value on price.

In this article, we will discuss some pricing strategies, from aggressive variable pricing and price-matching to the relatively new concept of dynamic pricing, and will examine the different techniques retailers are using to remain competitive while protecting margins in this new age of retail. We will also provide you advice from industry experts and specific examples of retailers who are implementing these methodologies into their stores.

Additionally, Hardware Retailing recently surveyed 260 independent home improvement retailers on topics such as how often they price-shop and whether their prices on their overall product mixes are trending up. Some of that data will be discussed in this story, and the rest of the survey results can be found at hardwareretailing.com/2015pricing-study.

The Hyper-Informed Consumer

In many ways, this new era of pricing and the hyper-informed consumer was brought on by a perfect storm.

On one front, the recession came roaring into the U.S. in 2008, putting consumers on high alert when it came to spending. At that point, pinching pennies became a necessity for many people. Today, even with the toughest years of the recession behind us, consumers’ frugal habits persist.

Secondly, the last several years have brought about a sea change in consumers’ access to information. According to a Pew study, about 60 percent of American adults own a smartphone, so consumers are much more dialed in to all levels of product information than before.

“We’re not only operating in a new era of pricing— we’re operating in a new era of retail because of greater price transparency and instant access to online home improvement product information,” says Scott Wright, executive director of North American Retail Hardware Association’s Retail Leadership Institute.

Pricing is a topic that is top-of-mind for retailers participating in NRHA retailer roundtables, as well as for students who participate in the organization’s Retail Management Certification Program.

“It’s on everyone’s mind, and it’s a big concern for our industry,” Wright says.

As the mobile revolution and recession have driven retailing into a new pricing era, it is imperative that you examine your pricing strategies. And while today’s variable pricing has come a long way from keystone pricing (when retailers commonly paid one amount for an item, and then sold it for twice as much), variable pricing is just one component to remaining competitive.

Where is Pricing Headed?

Variable pricing has evolved into a modern, high-tech, adaptable methodology that uses information about product movement, market dynamics and more to help you price products according to a variety of complex characteristics. But just as independent home improvement retailers like you have begun to truly embrace the concept, the pricing paradigm is shifting.

Pricing has become increasingly complex, with automatically generated, real-time data keeping online marketplaces, such as Amazon, up-to-date on consumer habits and competitors’ prices. This access to real-time purchasing data means retailers can go one step beyond variable pricing, implementing what’s known as dynamic pricing. Dynamic pricing allows retailers to make constant, educated decisions to increase or lower prices to compete for customers and profits in a real-time environment using individualized consumer-purchasing data.

That means prices could change by the minute for consumers based on their real-world purchasing habits. In fact, according to a report by Accenture, 55 percent of consumers would like to receive unique pricing, automatic discounts and free returns based on their shopping history and loyalty.

The age of personalized pricing seems to be upon us.

Though this may sound a bit daunting, this concept is still relatively new to mainstream retailing and isn’t widespread across any major retail model. Nonetheless, as an independent retailer, you should have a good understanding of what is on the horizon so you can take time to ensure your own pricing methodology is solid and well-maintained.

Pricing Foundations

What does all this change in the marketplace mean to your operation? First and foremost, it is a call to action. In this new era of pricing, you have to be more vigilant than ever and use whatever tools you have to gain insights into pricing.

Obviously, pricing is just one component consumers consider when determining where to shop. Other factors such as service, convenience, selection and reputation all play an equally important role in the retail value equation. There are also a finite number of hours in a day, and you could spend every hour poring over pricing comparisons to adjust item-by-item. So, it is important to find a balance in how you approach pricing in relation to your overall operation.

A Measured Approach

So it is clear that pricing continues to evolve, but what can you do to make sure you are more in tune with this new environment? Here are some simple places to start:

• Look beyond the brick-and-mortar stores in your market to check prices, since Amazon and other online retailers have brought big-box competition to even the smallest towns. Price-shop your market often, using software, Internet tools and store visits.

• Get to know and invest in technology that can help you make informed pricing decisions. Be aware of the price shopping tech tools, such as the RedLaser mobile app, that open your store up for easy price-checking by customers and competitors. Invest in technology that crawls the Internet for price comparisons, and walk into a competitor’s store with a smartphone to snap pictures of SKU numbers and associated price tags.

• Fight the high-price image that independent retailers often have by developing pricematching guarantees. Your store will be known as pricey if you aren’t willing to follow the lead on—or outdo—the promises of other home improvement retailers vying for customers. The new era’s consumers want guarantees that they’re getting the best prices, and you can offer them what they want while making up margin elsewhere.

• To improve margins, you need to maintain an aggressive variable pricing program. You should keep prices low on the cost-sensitive items most visible to customers, while increasing prices on blind items shoppers aren’t likely to price check. You can’t sustain your business long-term if you try to beat every competitor on every price.

• Don’t lose sight of business practices that have always been important to good retailing when you focus on improvements to your price-shopping, technology, price-matching and variable pricing. Be sure to watch your expenses and buy right. Reduce your overhead wherever you can and take advantage of cost savers such as dealer specials on product.

Price Shopping

While any variable-pricing program can get you started down the path to a solid strategy, independent retailers, markets and assortments are so unique there isn’t any real one-size-fits-all variable-pricing program.

To fine-tune your pricing strategy beyond the variable-pricing program is a hands-on task. That means conducting regular competitive price-shops in your local trading area. But don’t forget that your local trading area has changed. While you are competing against the brick-and-mortar stores in your market, you also must be cognizant of the prices online retailers are charging, particularly on the most price-sensitive items.

That means you have to know what your competition is doing on price, and how your store compares, says Rob Mathews, owner of Mathews True Value Home Center in Pendleton, Indiana. He also works with entrepreneurs and students through the Entrepreneurship Center in Ball State University’s Miller College of Business in Muncie, Indiana.

Physical price-shopping can be easy. Simply take an afternoon and head to the local big box in your market with a pre-planned list of items and browse the aisles.

Technology has made doing physical price-shopping much easier than in the past. With a smartphone in hand, you can easily refer to your market basket, write down pricing data or scan labels as you walk a store.

Online tools that check prices for specific items are also important, but those programs often miss products or aren’t region-specific, Mathews says. He spot-checks product prices in person at nearby stores about once per month to ensure his store is on track, he says.

Online price-comparison subscriptions and Web searches make price-shopping easier than perusing competitor aisles, but you need more than that.

“If you’re on a variable-pricing system that is not based on your specific market, you could be way off,” says John Dillon, senior vice president of pricing for distributor Orgill, Inc., in Memphis.

Companies that do market studies and provide market-specific data on competitor prices can help independents like you make more accurate pricing decisions.

Customers pay close attention to similar items sold in independent and box stores, especially if the products are expensive or they buy them often, Mathews says.

An independent should be close in price to competitors—by 5 percent, at minimum—so a customer doesn’t look at a comparable item and judge an entire store based on one product’s price difference, he says. A price disparity on an important item could result in permanent loss of customers.

“Consumers are fickle. They judge us on one item,” Mathews says.

Key areas he monitors to stay competitive with the big boxes include paint primers, lumber, water softener salt and high-priced products.

“I think those are really critical,” he says.

Most independent stores use a form of variable pricing—but they often don’t do the price-shopping or market research they need to compete well.

Hardware Retailing surveyed about 260 independent retailers to check what they’re doing to stay relevant on price. About 7 percent reported that they never price-shop, while 40 percent said they price-shop a couple of times per year.

Dillon recommends that retailers make one employee responsible for watching prices in a market and adapt to compete.

Dillon recommends that retailers make one employee responsible for watching prices in a market and adapt to compete.

“We’re dealing with a much more price-aware and price-driven customer than we’ve ever dealt with,” Dillon says. “If you start from that standpoint, pricing is more important than it ever was, because we are dealing with someone who has their antennae up as it relates to price.”

Making Tech Work for You

While mobile and online price-shopping services can help you in conducting your pricing research, these same tools are empowering your customers with pricing information.

Whether you like customers having access to this information or not, it’s a reality of today’s mobile generation. In the past, some retailers would try to prevent customers from using devices in their stores as a means of avoiding those comparisons, but that does little to earn customer loyalty. Instead, focus on how you can turn a price-shopping experience into a positive outcome.

Devices can be the launching point for sales conversations, according to Mathews. He teaches his staff to watch for customers standing in aisles with their eyes on their smartphones. Once an employee spots one, the worker can start a conversation about what answers the shopper is looking for online. If the customer claims not to be price-shopping, the employee can pull back, but follow up if the shopper is still looking for product information several minutes later, Mathews says.

Those consumers don’t worry Mathews because they’re already inside the store’s doors, and his workers can approach them. The consumers who don’t walk inside are much harder to identify and compete for.

“I think it’s a tough area, because there’s a lot that we can’t see or touch that are people researching at home,” he says.

To reach those at home, you can focus on delivering pricing information via a website or social media outlet. This doesn’t necessarily mean listing prices on every item. Instead, focus on promoting items that you know you are price-competitive on. A Facebook page and website are useful for putting your information out where the customers are often shopping, and where consumers are seeking online specials, Dillon says. A banner ad isn’t enough, he says.

“I really think, if at all possible, a retailer needs to have some sort of online presence,” Dillon says.

Aggressive Variable Pricing

Price-savvy customers, conservative consumer spending and deeply discounted products at the big boxes have turned variable pricing into a higher-pressure, profit-margin preservation game. That means you should use price-shopping to help modify prices not only to compete, but also to stay profitable.

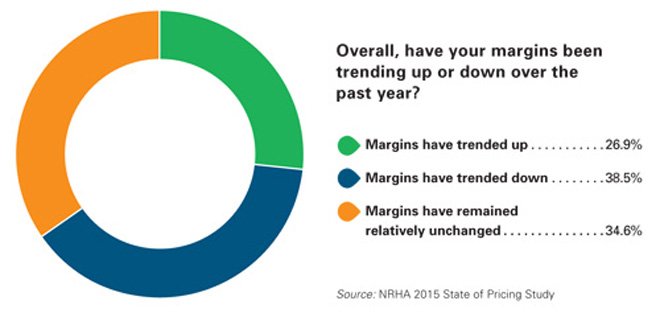

For about 40 percent of the retailers who responded to Hardware Retailing’s pricing survey, margins have trended down. That’s in the wake of thrifty customers upping the price sensitivity of more and more products and putting pressure on your shrinking profits.

It’s important to accept lower profit margins on the products you have to price head-to-head with competitors so you don’t lose the consumers to the big-box stores.

But you also need to know where you can afford to boost prices to make up for the losses, says Jim Robisch, retail consultant with The Farnsworth Group in Indianapolis. His company provides research and retailing expertise to retailers and other channel partners within the building products, hardware, home improvement and farm and ranch industries. The Farnsworth Group has worked with businesses such as Kohler and numerous Orgill, Ace Hardware and Do it Best dealers.

You can typically make up some margin on blind items that shoppers don’t take the time to research, Robisch says. It may take increasing the prices on five items to make up for a competitive price drop on one price-sensitive product, he adds.

Stores should be “price-optimized” so they can make higher margins on smaller items and sustain the necessary low prices on other products, Dillon says.

To improve margins, Mathews suggests always looking for unique products and brands the big chain stores don’t carry. For example, his Pendleton store offers a garden center with healthier, higher-end plants than competitors have. The seasonal plants have become a successful niche for the store.

Price-Matching for the Reputation

Competing well involves guarding your store’s price reputation. Price-matching can help refresh your store’s pricing image.

Consumers are sensitive to stores’ pricing reputations, and they know what everyday items, like batteries, and more expensive items, such as heaters, cost. And even though consumer confidence is up in the U.S. and the recessionary years have passed, shoppers are still conservative spenders and aren’t backing off their pursuit of the lowest prices.

Currently, 30 to 40 percent of customers view price as the most important reason for choosing where to shop, Dillon says. That leaves 60 to 70 percent of customers shopping for value before price, but “it’s trending more to price only,” he says.

“Now, it’s become in vogue. People are sitting around at high-end cocktail parties talking about deals,” Robisch adds.

Offering to match prices with other businesses is important because it shows you understand what consumers value, Dillon says. A good price-matching policy should be easy for a customer to understand, affordable to a store and well-publicized, he says.

“It’s a recognition of how important price is to a customer,” Dillon says.

Home improvement warehouses, such as Lowe’s and Home Depot, do variable pricing well, which means they effectively adapt product prices to a market, a region or even the demands of a day, and compensate for the dips by increasing prices on other items.

On the other hand, many independent retailers haven’t improved the value they offer to compete with the price-savvy big boxes, and they’re reluctant to match prices with other stores, or even to say they have low prices, Robisch says.

Enforcing his point, about 65 percent of the respondents to NRHA’s 2015 State of Pricing Study say they don’t offer price-matching.

In general, independent home improvement retailers want to rely on what’s drawn customers in the past—their convenient locations, clean stores and customer service, Robisch says. But the big-box stores have improved in those areas, and customers want to be wowed by independents before they’re willing to spend extra money to support them, he says.

“They’re good, but they’re high-grade mediocrity,” Robisch says of many independent home improvement retailers.

Offering to price-match can reduce price deterrence. And price-matching doesn’t come at a high cost, Dillon says. A $10 discount that satisfies a customer could win a new customer, or reinforce an existing relationship.

“That’s $10 of advertising expense,” Dillon says.

Often, customers don’t take advantage of price-matching because they understand they’re comparing different brands and different qualities of product, Mathews says.

“For the most part, if you have a better brand, better quality of an item, people expect to pay more for it,” he says. “The price-matching is not what I worry about. What I worry about is the person who doesn’t talk to us, but judges us and leaves.”

Retailing Well

Beyond price-shopping, gaining tech acumen, getting aggressive on variable pricing and offering price-matching, the basics of good retailing are still key to staying competitive.

Some businesses get so involved in price-shopping that their customer service suffers because of the manpower they’re devoting to pricing, Mathews says. Stocking shelves, helping customers and keeping stores clean are still important for keeping shoppers.

You need to keep shelves stocked, and set up stores so customers can get in and out easily, Robisch says. If your store doesn’t have an item in stock, your business will lose customers, he says.

In-stock items meet the needs of the many spontaneous customers who are heading to your store because they need to make a quick repair or only have a weekend to complete a project, Mathews says.

“As a consumer, I might have better access to what these items cost on Amazon. It’s doubtful that I would order many of these items online because I need that item now, and I’m willing to pay a bit more to have it when I need it,” NRHA’s Wright adds.

For those consumers, buying online requires too much planning.

“They have a project at home, and they need a spool of rope or twine. Are they really going to price-shop every one of those items? I don’t think so. In our business, we do have the advantage of timeliness,” Mathews says.

Plus, the most successful of you aren’t just tinkering with prices. You’re finding ways to save money when buying products, so you can pass savings on to customers, Robisch says.

You need to protect your margins in various ways, including by cutting utility costs or taking advantage of supplier pallet specials, deals at markets and other opportunities for discounts on product.

You need to learn to communicate with and work more closely with manufacturers and dealers to stay competitive.

“How do we take cost out?” has to be an important part of those discussions, Robisch says.

Question and Answer

Phil Mitchell : Co-founder of Discovery-Based Retail. Co-author of two books on retailing. Consults for and teaches retailers to improve operations.

Phil Mitchell : Co-founder of Discovery-Based Retail. Co-author of two books on retailing. Consults for and teaches retailers to improve operations.

Hardware Retailing spoke with Phil Mitchell, founding partner of the consulting service Discovery-Based Retail. Here are his thoughts on pricing in the independent home improvement industry.

HR: Do you encourage attempts to match online prices?

PM: It absolutely depends on how a store is slotted within its competitive arena. The strategy for a convenience store is different from that of a regional competitor and a destination store, for example. But, as a rule, I do not recommend matching online prices. People are not only evaluating price, but they’re also considering value. Part of the value that a brick-and-mortar store offers is the tactile experience—holding a drill to check for balance, for example. The store also offers shoppers the advantage of taking items with them to solve immediate needs. Those attributes have value.

Create the most visually attractive shopping environment possible, focus on creating pleasant experiences and then communicate the value you have created.

I had a friend who once told me, “Price is not the most important thing; it’s the only thing.” Thankfully, he was wrong.

If price were the only focus, there would be only one winner, and we see there are a lot of winners. It’s a matter of understanding where competitors are priced, setting a price within a reasonable range and then working to understand what other value you offer. Once you understand that value, constantly reinforce it with your communication pieces.

HR: How have changes in price impacted what retailers carry in traditional stores?

PM: The first thing that comes to mind is a move toward privately branded items. If the quality is good, and that’s an important “if,” then an alternate brand can offer additional value and make price attractive.

HR: How are successful independent retailers maintaining profit margins while trying to compete on prices with big-box stores such as Lowe’s and online marketplaces like Amazon?

PM: There are three elements to profit margin: cost, retail price and expenses. So the retailers you have described have to buy right, which means they constantly examine their sourcing. They have to be aware of what prices are out there and then assign margins that are competitive enough to appeal to and attract customers. They then have to constantly ride expenses to ensure the margin is adequate to achieve their profitability goals.

HR: How should employees be trained to talk to customers about pricing?

PM: Your employees should be aware, in general terms, what is meant by variable pricing. It should be communicated to them that your prices are fair and necessary to fund their salaries. The amount of information that would be shared would vary from store to store and certainly the level of the job.

HR: How should employees deal with common customer reactions to prices?

PM: The common response, it seems, regardless of pricing is, “You’re too darned high” or “I can buy it somewhere else for less.” But, honestly, I believe if you were selling for 10 cents on the dollar, you’d probably still hear that. Employees should always be courteous, of course, but an awareness of brand and the value-added equation may help customers process it all.

HR: What should employees be trained to do when they see customers price-shopping on their phones?

PM: Employees should be available to any customer at any time and, once again, I think the communication of value is important.

But, remember, knowledge is king. On higher-ticket items, particularly, knowing what prices are out there is extremely helpful. If someone is comparing prices, you’re not caught off guard. Perhaps your saw has a bonus blade or your drill comes with an included option. Price against price does not always paint the entire picture.

Case Studies

Going Head to Head on Price

Fuller & Son Hardware

Little Rock, Arkansas

Customers who walk into Fuller & Son Hardware in Little Rock don’t have to drive to another store to find out if they’ll save money on a heater elsewhere. To fight the reputation that independent stores charge more than big boxes for products, Fuller & Son has chosen not only to price-match, but also to use in-store computers to help customers price-shop.

Customers who walk into Fuller & Son Hardware in Little Rock don’t have to drive to another store to find out if they’ll save money on a heater elsewhere. To fight the reputation that independent stores charge more than big boxes for products, Fuller & Son has chosen not only to price-match, but also to use in-store computers to help customers price-shop.

“It just seemed like no matter what we did, no matter what we advertised, no matter what we said, it was hard for people to believe a small, independent retailer could match the prices of the big boxes,” co-owner Jeff Fuller says.

He and his brother built kiosks within the stores and put computers with monitors on top for price-shopping. Nearby signs advertise that Fuller & Son will match local brick-and-mortar store prices, and the business also advertises its price-matching policy on local TV.

Keeping the customers in Fuller stores to do their price-shopping is key to making sales, so the computer price match centers have made a difference, Fuller says.

Customers stick around to let Fuller workers check prices and show shoppers the comparisons on the computer. More often than not, they’ll choose to buy instead of quickly moving on, Fuller says. Customers appreciate the help comparing prices, and the option Fuller offers for them to do it, he says.

“I think this is a big step toward people perceiving us as being just as good, if not better, on prices as the bigger stores,” Fuller says.

Fuller & Son competes on price with chains such as Lowe’s, and having a reputation for being expensive isn’t accurate or good for the family’s six stores, Fuller says. The company buys products at warehouse prices and sells competitively, and the Fullers listen if customers think they’re paying too much for a product. The price-match centers also set customers’ minds at ease.

“We help them be sure they get the best price on whatever they’re getting,” Fuller says.

A Two-Pronged Approach

Buccheit

Perryville, Missouri

For Buchheit home improvement stores in Missouri and Illinois, guiding customers’ price perceptions is a perpetual journey.

For Buchheit home improvement stores in Missouri and Illinois, guiding customers’ price perceptions is a perpetual journey.

Company business practices include having employees visit and call competitors daily, check out websites and use Web crawling software to keep an eye on other retailers’ pricing. Buchheit stores can then adapt prices to compete.

The stores also keep prices in line or lower on highly visible, often-used products, such as ½-inch PVC pipe and two-by-four lumber, with big-box stores.

“Customers know the prices of those items when they come in,” district manager Tyler Russom says.

To stand out, the family-owned company is aggressive about its price matching. Buchheit stores also rotate through displays near the front doors that are stocked with products such as bottled water and windshield de-icer. While those items are front and center, Buchheit ensures that no sale or special offer from a competitor can beat their prices, Russom says.

The goal is to offer ongoing promotional deals so Buchheit can cultivate a best-price image with small items, he adds.

Price-matching on all items is also an emphasis. Customers saying another store sells a product cheaper will automatically get a lower price if the discount is in the $5 range—and store employees won’t even verify the other stores’ promotions, Russom says.

“Every ad is a Buchheit ad” is a company tagline, and that means every other store’s sales equals discounts at Buchheit, if the other businesses are local competitors and selling the same products. Store staff verifies the deals offered by other businesses when the discounts get high, such as 20 percent off a gun safe.

Buchheit’s promotional displays and their price-matching policy teach consumers to be confident they can go to Buchheit and ask for a better price. Buchheit is cultivating that price security in customers so they’ll keep coming back.

“We want our customers to feel comfortable shopping with us, knowing that we’ll match any local competitors’ prices that they bring to our attention,” Russom says.

Art And Science

Griffin Ace Hardware

Santa Ana, California

The owners of Griffin Ace Hardware in California have to watch their product prices more closely than in the past, especially now that customers are keenly aware of what might be a typical or good price for an item.

The owners of Griffin Ace Hardware in California have to watch their product prices more closely than in the past, especially now that customers are keenly aware of what might be a typical or good price for an item.

However, CEO and co-owner Bill Griffin still works to promote his stores as better overall values than competitors, not as price leaders.

Maintaining clean stores, keeping product in stock and having knowledgeable sales associates are what Griffin emphasizes, he says. However, he still says he’s had to adapt the pricing model that’s worked for him over the years.

Products that cost $10 or more are more price-sensitive than they were before the recession, and shoppers come into Griffin’s stores with research and price comparisons on their minds, Griffin says.

If customers ask, his three stores usually match prices on the same products offered for less at other stores and online—as long as the cost of shipping is factored into the cheaper Web prices.

Griffin also sets prices by taking advice from Ace corporate and having his staff price-shop a few items at competitors every month. His workers check competitors’ prices on a product if the stores run out of it too often or sales drop, he says. The employees also listen to customers who talk about good deals elsewhere and then try to understand why specific products are price-sensitive.

If customers pull out cellphones to price-shop, Griffin’s sales associates are trained to walk up and ask questions about what they’re looking for and if they have a brand preference.

Griffin also promotes services, rather than prices. Online home improvement retailers don’t provide experts to walk customers through installation problems over the phone, as Griffin employees are trained to do, he says.

“We don’t just sell price—we sell the overall value we offer compared to an online retailer,” Griffin says.

Rather than using complex, data-driven strategies for pricing, Griffins’ employees prioritize talking to customers and watching inventory.

“I think it’s still an art, not just all science,” Griffin says.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information