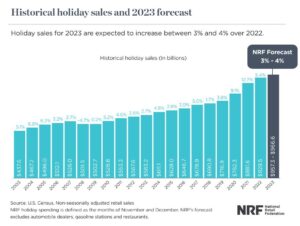

$966.6 billion. That amount is how much the National Retail Federation (NRF) forecasts will be spent on gifts and decorations from November 1 to December 31, a 3-4% increase from 2022.

NRF’s holiday forecast is based on economic modeling that considers employment and unemployment data, wages, consumer confidence and other factors.

“It is not surprising to see holiday sales growth returning to pre-pandemic levels,” says Matthew Shay, NRF president and CEO. “Overall household finances remain in good shape and will continue to support the consumer’s ability to spend.”

“It is not surprising to see holiday sales growth returning to pre-pandemic levels,” says Matthew Shay, NRF president and CEO. “Overall household finances remain in good shape and will continue to support the consumer’s ability to spend.”

Overall, holiday sales have grown around 22% since 2020.

Shay says that although many households are facing economic challenges, he’s seen strength and resilience across the consumer section.

“Certainly, there’s been an evolution in the way consumers are allocating their dollars from month to month on their spending,” Shay says. “And yet consumer spending, which makes up approximately 70% of our economic activity has kept the economic expansion on a steady and solid path forward.”

A combination of a historically low unemployment rates, wage growth and the resilience of the job market will support consumer spending through this holiday season, Shay says.

Retail sales have grown for 47 consecutive months since the COVID-19 pandemic, according to NRF data. To meet the demand of the holiday season, NRF experts expect retailers will hire as many as 450,000 seasonal workers, more than the 391,000 seasonal hires in 2022.

“We know the winter holidays are especially important for retailers, but also an important tradition for American families who are out celebrating and who make decisions throughout the year to prioritize and allocate the resources they need to make those spending decisions and holiday purchases,” Shay says. “All these factors play a role in the way we think about this forecast and the way in which we anticipate consumer behavior.”

Online shopping has been one of the biggest shifts in consumer behavior since the COVID-19 pandemic. Online shopping, which is included in the total, is expected to increase between 7% and 9% to a total of between $273.7 billion and $278.8 billion. That figure is up from $255.8 billion last year.

With online shopping slowly taking over the retail sales industry, shopping from their homes may be necessary for some consumers.

“Depending on the strength and persistence of this weather phenomenon that we’re seeing right now, like with El Niño, it could leave footprints on the holiday retail spending,” says Jack Kleinhenz, NRF chief economist.

In addition to weather, supply chain issues have also changed the way consumers shop around the holiday season. Shay says consumers do not shop the same way they did 20 years ago, and a lot of holiday shopping isn’t just done in November and December.

“We did see during the pandemic that people did shop much earlier. We know a couple of years ago when we had supply chain issues and stock outs on things we know, sales got pulled forward in that season, even more dramatically because people were concerned that they wouldn’t have the goods in place,” Shay says. “It does make it a little bit challenging to get the exact comparisons because of the change in behavior.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information