Constant price changes from tariffs. Labor costs that continue to rise. A soft housing market and low consumer confidence.

Looking at all the recent economic headlines, it can feel like there is little retailers can do to control eroding margins and protect their bottom lines. But it is not all bad news—there are ways retailers can manage margin by addressing different operational areas, including payroll, operational expenses, pricing, inventory management and others. It all starts with knowing your key performance indicators (KPIs) and using resources like the North American Hardware and Paint Association’s (NHPA) Cost of Doing Business Study to compare your KPIs to industry averages.

Tracking KPIs is crucial for taking the temperature of your business, and for George Ruckersfeldt, vice president of finance, human resources and information technology at Hagan Ace Hardware, gross margin percentage is at the top of the list. Ruckersfeldt says leadership at the 11-location operation in Florida is always looking for areas where margin has eroded and making necessary pricing adjustments to keep up margins. They review gross margin return on investment (GMROI) to identify underperforming categories and products.

Tracking KPIs is crucial for taking the temperature of your business, and for George Ruckersfeldt, vice president of finance, human resources and information technology at Hagan Ace Hardware, gross margin percentage is at the top of the list. Ruckersfeldt says leadership at the 11-location operation in Florida is always looking for areas where margin has eroded and making necessary pricing adjustments to keep up margins. They review gross margin return on investment (GMROI) to identify underperforming categories and products.

To report and monitor margins, Hagan Ace Hardware utilizes the Compass function in the Epicor Eagle system, which allows for a limitless range of custom data reporting in various formats, including printing, emailing, exporting and FTP as needed, Ruckersfeldt says.

“Another important tool used to manage margins on a large number of our items is Margin Master, which is software that allows customization and creation of pricing rules, strategies and price rounding to help manage our margins to their fullest potential,” he says.

Discover four strategies retailers are utilizing and the operational areas they are honing in on to expand and protect both profit and operational margin dollars in their businesses.

1. Pinch Payroll Pennies

Payroll is the No. 1 operational area Hagan Ace Hardware looks at to manage profit margin, Ruckersfeldt says. Managers are given weekly payroll hour budgets and are held accountable to adhere to those budgets. The operation has reduced tasks in the areas of inventory management by centralizing back office functions, moving them from the store level to centralized personnel.

“We are currently in the process of evaluating a more streamlined process using wireless handheld devices to check-in products, making the process quicker and more accurate,” he says. “We are always reviewing tasks to see how they can be minimized.”

At Ricciardi Brothers, general manager Glen Morosohk says payroll has always been an important factor in controlling margin but has become a laser focus more recently, especially since it is the No. 1 expense for their operation and for most retailers. He and the leadership team are working to fill each of the store’s back office and sales positions and focusing on managing the appropriate number of hours for each employee rather than the number of employees.

margin but has become a laser focus more recently, especially since it is the No. 1 expense for their operation and for most retailers. He and the leadership team are working to fill each of the store’s back office and sales positions and focusing on managing the appropriate number of hours for each employee rather than the number of employees.

“This strategy also allows us to minimize overtime, which is another large contributor to payroll costs,” Morosohk says. “To manage all of this, we recently implemented a proprietary software package to budget those hours, which is done on a bi-weekly schedule and based on a combination of gross profit in that particular store and gross sales with seasonal adjustments.”

2. Go Line-by-Line on Operational Expenses

Those bills you pay each month for electricity, garbage collection and more add up and can eat into any operational margins. The team at Ricciardi Brothers has made a concerted effort to examine each location’s operational expenses and find areas to cut costs.

“We’re reviewing all operational expenses that can be controlled or reduced, such as our IP provider, trash collection, phones, cell phones, electricity and others,” Morosohk says. “Those can be controlled in various ways, depending on the store’s location or the company itself, but technology can help significantly in negotiating and reducing costs.”

Insurance is another major cost for many operations, so leadership at Ricciardi Brothers annually renegotiates its employee healthcare and vehicle insurance policies. They have also brought on a fleet management company that negotiates contracts for service and vehicle maintenance and programs for the purchase of gasoline and diesel.

Insurance is another major cost for many operations, so leadership at Ricciardi Brothers annually renegotiates its employee healthcare and vehicle insurance policies. They have also brought on a fleet management company that negotiates contracts for service and vehicle maintenance and programs for the purchase of gasoline and diesel.

“We found that process to be an eye-opener. Sometimes you hold onto a vehicle because it’s paid off, but in reality, even though it’s paid off, it’s costing you more money to maintain the vehicle as it is,” Morosohk says. “This company uses algorithms to determine what maintenance should or should not be performed on a vehicle so we can spend our money on vehicles in the best way possible.”

3. Finding the Right Price

Pricing is tricky to get right in an ideal economic environment and is even more of a moving target when tariffs, soft spending and other factors play in.

Ruckersfeldt reviews pricing at Hagan Ace Hardware daily with multiple reports run each day showing product that has undergone a change in price. Daily reports show if the cost of an item has changed from the purchase order compared to the actual vendor’s receiving paperwork. All stores receive price changes weekly and make daily changes on items with immediate impacted costs.

Making retail changes in your store before you have to buy at a higher cost is ideal, but it requires monitoring cost changes on the vendor side instead of waiting for a vendor invoice to tell you a cost has changed. Many retailers wait until their landed cost changes, losing the opportunity to make more money when the market will support a higher retail price.

Making retail changes in your store before you have to buy at a higher cost is ideal, but it requires monitoring cost changes on the vendor side instead of waiting for a vendor invoice to tell you a cost has changed. Many retailers wait until their landed cost changes, losing the opportunity to make more money when the market will support a higher retail price.

“Our buyers are always reviewing vendors and vendor programs to purchase at lower costs, while maintaining retails and keeping margins equal or improving them,” Ruckersfeldt says.

Promotions currently do not play a large part in the margin strategy process at Hagan Ace, but Ruckersfeldt says they are making more buying decisions on closeout products they can promote below competitors and, in most cases, online retailers.

“Promoting at these lower prices while maintaining more margin allows us to show customers we are sometimes less expensive than the competition and can offer great deals,” he says.

Morosohk says in challenging economic times like these, purchasing and pricing become even more important. The team at Ricciardi Brothers keeps in close contact with manufacturers, particularly those who do a lot of importing.

“Keeping those conversations open helps us generate a strategy for moving forward,” he says. “Pricing reviews right now are happening daily. We run customized reports that break down sales and margin by product line, product category, store and customer, and we take action when margin cools in any of these areas.”

The team is also looking at variable pricing instead of automatically using the standard markup from the manufacturer.

manufacturer.

“There are A, B, C and D items, but not all of them are highly visible,” Morosohk says. “So where you have to be competitive, you have to be competitive, but where you can spread those margins—particularly on those C and D items—it adds up. And every fraction of a point means something.”

Promotional pricing also plays a role in Ricciardi Brothers’ margin management strategies, and Morosohk says the company engages in promotional purchasing frequently.

“Promotional pricing is usually offset by promotional purchasing and that minimizes the impact on the margins,” he says. “While the promos negatively impact the margin percentage, the purpose is to turn cash flow and add margin dollars by increasing sales.”

4. Make Merchandising Work Harder

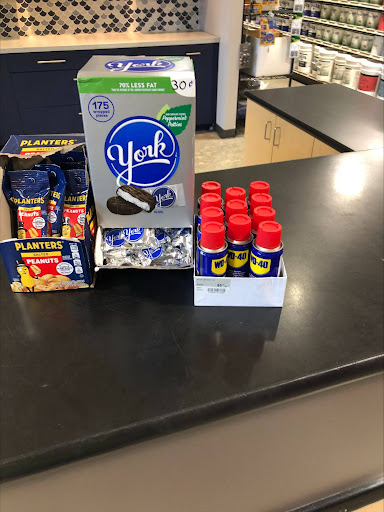

Another way to manage margins already exists in every brick-and-mortar store—merchandising. In early 2025, the North American Hardware and Paint Association (NHPA) conducted the third iteration of the Merchandising for Profit Study. For the study, NHPA selected products that lent themselves to the technique being tested and were commonly stocked in hardware stores and home centers. Retailers agreed to leave the items stocked in their in-aisle position, but also stock the product using the featured merchandising technique.

Sales were monitored during a 30-day period following the remerchandising. Sales at a similar “control” store for each retailer were also recorded during the same period. The results from test stores and control stores were then compared and reported.

Sales were monitored during a 30-day period following the remerchandising. Sales at a similar “control” store for each retailer were also recorded during the same period. The results from test stores and control stores were then compared and reported.

The study found a number of merchandising techniques provided significant sales lift, with increased sales in

high-margin products helping to improve languishing margins in other areas.

The power aisle stack out technique showed an increase of 150% in sales when tested with trash cans. This technique works best with a single SKU larger items that can be bulk stacked and placed in strategic locations throughout the store.

A service counter display resulted in an increase of 105% in

sales, while a checkout display led to a 300% increase in sales. Both work best with a single SKU of smaller items that can be easily added to a purchase at the last minute. Other techniques that boosted sales included clip strips (200% increase), a feature endcap (109%) and a feature endcap with a percent-off sign (125%).

With over 45 years in home improvement retailing, including 15 years as the vice president of merchandising at Friedman’s Home Improvement, Tony Corsberg founded Merchant5 Advisors, a strategic merchandising service provider that provides merchandising assessments and training in merchandising management. Corsberg says that one of the most economical ways to increase sales is by increasing the average transaction value with the customers already in the store.

Friedman’s Home Improvement, Tony Corsberg founded Merchant5 Advisors, a strategic merchandising service provider that provides merchandising assessments and training in merchandising management. Corsberg says that one of the most economical ways to increase sales is by increasing the average transaction value with the customers already in the store.

“When promotional spaces are managed with purpose and intent, and not just randomly merchandised, they will provide positive results,” Corsberg says. “The retailer creates a more complete shopping experience for the customer, while meeting the overarching objective of merchandising management to optimize the performance of the inventory and improve margins.”

The How, Why and When of Cycle Counting

By Darrell Baker

If you hear team members (or yourself) saying, “the system shows we have this on hand, but it’s probably wrong” then you may have an inventory accuracy issue to address. But even if the issue isn’t that obvious, there may be an opportunity to explore cycle counting.

Cycle counting your inventory is widely hailed as a mandatory practice in many well-run retail operations and a way to enhance profit margin by ensuring accurate inventory data. But to determine if it’s right for you, take a pulse in these areas before deciding on your cycle count strategy.

Shrink. What have your historical shrink numbers looked like? If you are not cycle counting today, how are you generating your shrink data? If your inventory shrink is of concern, cycle counting should be seriously considered. If shrink is occurring in certain areas of the store or in certain departments, cycle counting should be undertaken more frequently in those areas.

E-Commerce. If you are displaying any inventory online, inventory accuracy is massively important. This activity makes the investment in cycle counts even more vital.

Inventory Control Procedures. Oscillations in inventory counts are symptoms of other problems. Simply engaging in cycle counting without addressing underlying issues that impact inventory accuracy will not ultimately benefit operations. Proper item set up, purchase order processing, receiving practices, special order processing, point of sale procedures, theft prevention practices and other inventory-impacting processes all factor into inventory accuracy. If there are deficiencies in any of these areas, fix these areas first before engaging in a substantial cycle counting investment. Theoretically, if everything else goes right with all these processes and procedures, your inventory will always be accurate. Inaccurate inventory points to opportunities in operational areas that should be addressed.

It’s also helpful to ask yourself these questions.

Does your system facilitate cycle counts efficiently? If cycle counting is clunky and unnecessarily time consuming, consider working with your software provider to optimize the process. If you can’t efficiently count and update your inventory, it will adversely impact the return on your time invested.

Do you have the personnel in place to manage cycle counting? If you aren’t going to be able to dedicate the personnel resources to the effort to count and post changes quickly and efficiently, you may make more errors than you fix. Make sure those involved in cycle counts are very detail oriented and have high trust. Do you have an employee who questions a $2 return and wants to see the receipt? They are probably a good candidate.

Once you determine that cycle counting is for your operation, follow these best practices for success.

Start small. Target a specific area, category or department you think may be a problem area and test your processes there. Don’t try to cycle count the entire store every day.

Implement a cadence you can sustain. Pick a small area once a week to work on. High value items like power tools are a high theft risk and can therefore be a good area to focus on first. High traffic areas could also use some attention. Put that idle cashier to work counting the candy bars every once in a while.

Focus on the biggest opportunities. Keep track of the biggest dollar and quantity movements in your cycle count efforts and focus more attention on areas where you see the most significant movement. If you saw a significant shrink on one hook, cycle count adjacent hooks to see if the product moved to the wrong hook.

Keep all inventory movements in consideration. Track items in overstock, backstock, in the receiving area, in the returns area, committed on a special order, in a customer’s shopping cart, etc. Be sure to take into consideration every possible location an item could exist in your facility or on paper that would impact your inventory accuracy.

Leave time to investigate and correct discrepancies. There’s no point in counting if you’re not going to be able to fix the error.

Look to refine processes and procedures. In many cases, there are opportunities to refine purchasing, receiving, returns processing or special order processing that all may help keep inventory more accurate.

Look at zero audits. If a significant cycle count effort isn’t in the cards, consider at least doing regular zero audits. This involves walking the store and making sure the system shows zero on hand for anything that isn’t on display. Make sure backstock is moved into the selling position first and go hunting for any discrepancies; just doing this one step can pay off by making sure you aren’t losing sales. Update the item setup in the system if it’s no longer available from a supplier and remove the tag from the display.

Like many operational optimizations, they sound really good on paper, but can be challenging to execute in your individual situation. Make sure you get the most bang for the buck for your efforts. You need to take a complete and comprehensive look at your inventory control practices throughout the organization in order to extract the most value out of a cycle count effort. Your cash flow and customer satisfaction depend on it.

If any step along the inventory control journey is problematic, inventory accuracy will be nearly impossible to achieve. By looking at inventory control as a comprehensive program, including a robust and measured cycle count program, you can keep extremely accurate inventory that will keep your accountants and your customers happy. Hopefully staff won’t have to make excuses for bad counts in front of customers anymore.

About Darrell

Growing up in his family’s toy store, Darrell Baker was sweeping floors at 10 years old and running his own department in his teens, as the company computerized its inventory.

Fast forward past college and a stint running a concrete R&D company, Darrell returned to the family business to be a part of doubling sales in a short period of time, including launching transactional e-commerce with live inventory before Amazon existed. Local dynamics ultimately led to selling off the business, and he joined another family business with four locations in the hardware and building materials market. From there, he moved on to support distributor operations before becoming vice president of marketing & merchandising at Aubuchon Hardware.

Darrell now pursues his dream of helping many retailers as the owner of Prescott Business Advisors. He serves as a consultant with the NHPA Strategic Consulting program with a focus on retail operations assessment and planning, inventory management and change management. He was a graduate of the NHPA Retail Management Certification Program class of 2015 and has been a participant in the NHPA Marketing & Merchandising Roundtable since 2013.

Learn more about Darrell and the other consultants at YourNHPA.org/consulting.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information