To understand how COVID-19, shelter-in-place restrictions and customers’ new expectations for safe, reliable home improvement shopping were impacting the industry, the North American Retail Hardware Association (NRHA) recently deployed the COVID-19 Business Impact Survey. In total, nearly 300 independent home improvement operators representing roughly 1,500 storefronts participated in the survey, shedding light on the obstacles and opportunities the pandemic has brought to the industry.

“Now that everyone has been living in this environment for a few months, we wanted to understand the impacts COVID-19 has had on independent home improvement businesses, from a performance perspective and an operational perspective,” says Dan Tratensek, executive vice president of NRHA.

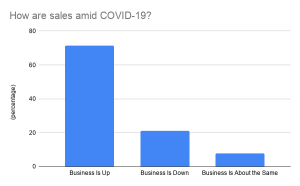

Sales Are Strong for Retailers

Nearly 72 percent of retailers say sales have risen at their businesses amid COVID-19 compared to the same period in 2019. On average, retailers say sales have risen about 17 percent.

Nearly 72 percent of retailers say sales have risen at their businesses amid COVID-19 compared to the same period in 2019. On average, retailers say sales have risen about 17 percent.

Additionally, more than 90 percent of surveyed retailers say COVID-19 has had some impact on their overall sales performance, cementing the pandemic as a major challenge.

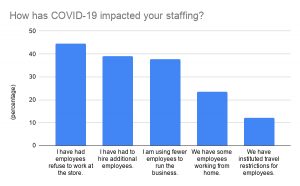

Staffing Remains a Constant Concern

Roughly 45 percent of survey respondents say they have employees who opted not to work at the store during the outbreak. More than one-third are running their businesses with fewer employees at their operation. Less than 15 percent of respondents have furloughed or laid off employees.

Roughly 45 percent of survey respondents say they have employees who opted not to work at the store during the outbreak. More than one-third are running their businesses with fewer employees at their operation. Less than 15 percent of respondents have furloughed or laid off employees.

“The number of operators who have furloughed or laid off employees is still relatively small,” Tratensek says. “It looks like most of the reasons for laying off or furloughing employees center around areas of the businesses that couldn’t function during COVID-19, like remodeling crews or delivery teams.”

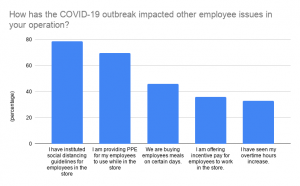

NRHA’s research also found the vast majority of respondents are instituting social distancing at their stores. Nearly 70 percent of retailers are providing personal protective equipment (PPE) to their employees. Almost 36 percent of retailers are offering incentive pay to employees during the pandemic.

NRHA’s research also found the vast majority of respondents are instituting social distancing at their stores. Nearly 70 percent of retailers are providing personal protective equipment (PPE) to their employees. Almost 36 percent of retailers are offering incentive pay to employees during the pandemic.

Curbside Pickup Is Gaining Traction

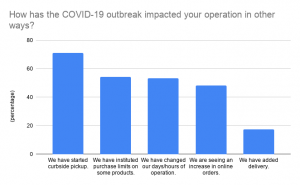

Retailers have adjusted their operations in myriad ways, but one of the clearest developments is the growth in curbside pickup services. More than 71 percent of retailers say they have instituted it in their stores. Supporting that business model is a simultaneous growth in online orders, which almost half of all respondents report.

Retailers have adjusted their operations in myriad ways, but one of the clearest developments is the growth in curbside pickup services. More than 71 percent of retailers say they have instituted it in their stores. Supporting that business model is a simultaneous growth in online orders, which almost half of all respondents report.

“It’s a very interesting development,” Tratensek says. “One of the reasons retailers are finding it so advantageous is not only because it’s a necessity, it’s also something big boxes weren’t doing. This is a great example of a process independent retailers figured out quickly.”

COVID-19 Is Shifting Relationships With Suppliers

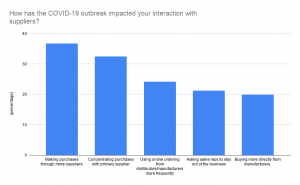

NRHA’s research also found amid COVID-19, independent home improvement retailers’ relationships with suppliers is changing slightly.

NRHA’s research also found amid COVID-19, independent home improvement retailers’ relationships with suppliers is changing slightly.

Thirty-six percent of independent retailers are sourcing products through more suppliers than before the pandemic. However, that’s only a small margin above the 32 percent of retailers who are concentrating product purchases through a single supplier. Nearly one-fifth of retailers are buying products directly from manufacturers.

Retailers See New Business Realities

Nearly half of all retailer respondents believe it will be 4-12 months before their operation emerges from COVID-19 restrictions. Roughly 20 percent believe COVID-19 disruption will linger for a year or more.

Nearly half of all retailer respondents believe it will be 4-12 months before their operation emerges from COVID-19 restrictions. Roughly 20 percent believe COVID-19 disruption will linger for a year or more.

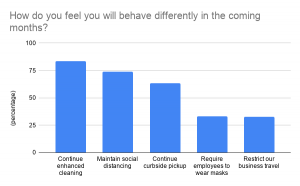

In the meantime, retailers say many of the operational adaptations they made to serve customers amid COVID-19 will likely remain in place for the foreseeable future. Eighty-three percent of respondents will continue enhanced cleaning protocols for their businesses. About 75 percent will continue social distancing protocols and nearly two-thirds say curbside pickup is here to stay for their operation. Only 19 percent say they will continue to adjust their hours of operation.

A Field of Opportunity

Tratensek says even against the uncertainty and channel shifts COVID-19 has brought, retailers have persevered to continue serving customers with stellar service.

“This data really reinforces some of the positive things that may come out of this situation,” he says. “For generations, home improvement retailers have been able to adapt to changing situations and find new ways to serve customers. These new strategies can really be a differentiator for your business. Don’t lose sight of the knowledge you’ve gained about how to operate successfully during challenging times.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information