U.S. home improvement sales (NAICS 444) stood at $43.2 billion in April, down slightly from $43.4 billion in March, new data from the U.S. Census Bureau shows. However, sales for the sector are roughly 33 percent higher than one year ago, showing continued economic strength for the industry.

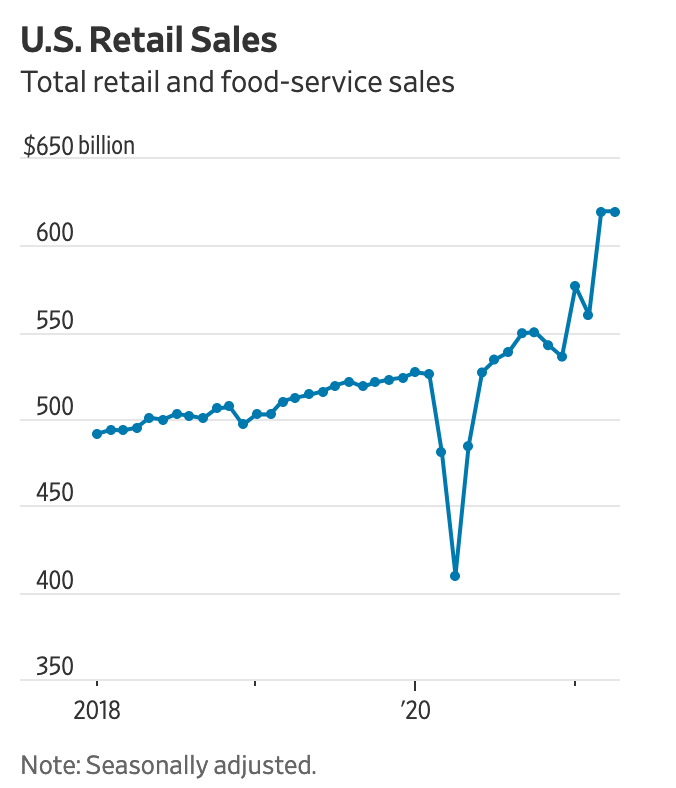

Total U.S. retail sales saw a 9.8 percent surge in March, and that figure held steady in April, reaching $619.9 billion, up slightly from $619.8 billion the month prior.

Compared to April 2020, NAICS 444 sales now stand roughly 33 percent higher than one year ago. So far in 2021, U.S. home improvement sales have garnered a seasonally adjusted $164.7 billion, up more than 25 percent from 2020 sales figures.

Sales were up roughly 3 percent at auto and parts dealers, the data shows. Sales for restaurants and bars also grew 3 percent in April. Sales for nonstore retailers, which includes Amazon, slipped slightly from $88.3 billion in March to $87.7 billion in April.

Earlier this year, the National Retail Federation explored sales possibilities for 2021. The organization reviewed several key economic factors that could lead to increased retail sales in 2021, including increased home prices, record-low interest rates alongside growing employment and wage figures. The New York Times reports U.S. GDP is nearly back to pre-pandemic levels.

Economists say the latest retail sales figures point to an engaged consumer base.

“Flat sales going from March to April is still pretty strong. The level of sales is much higher than before the pandemic,” says Scott Brown, chief economist at Raymond James Financial. “It’s still a sign that consumer spending is pretty healthy at this point.”

One year ago, U.S. retail sales plunged 16 percent as COVID-19’s initial impact on the economy began.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information