Home Depot is a formidable competitor in the home improvement industry.

By sales volume and number of store locations, the company is the largest retailer in the home improvement sector. Despite being known for its 104,000-square-foot stores, Home Depot has, in recent times, contradicted big-box stereotypes.

Those stereotypes include poor customer service, high employee turnover, untrained workers, limited career paths and top-level executives who don’t know what it’s like to work in the stores.

Unlike other big boxes, Home Depot has made an effort to hire employees who can serve as product category experts in departments such as plumbing. The company has also promoted from within—Ann-Marie Campbell, a former cashier, is now executive vice president of U.S. stores—and has invested in employee training and benefits packages that are enviable in retail.

At the same time, the company has worked hard at adapting to changes in the retail industry and invested on a multibillion-dollar scale that only a giant corporation can afford.

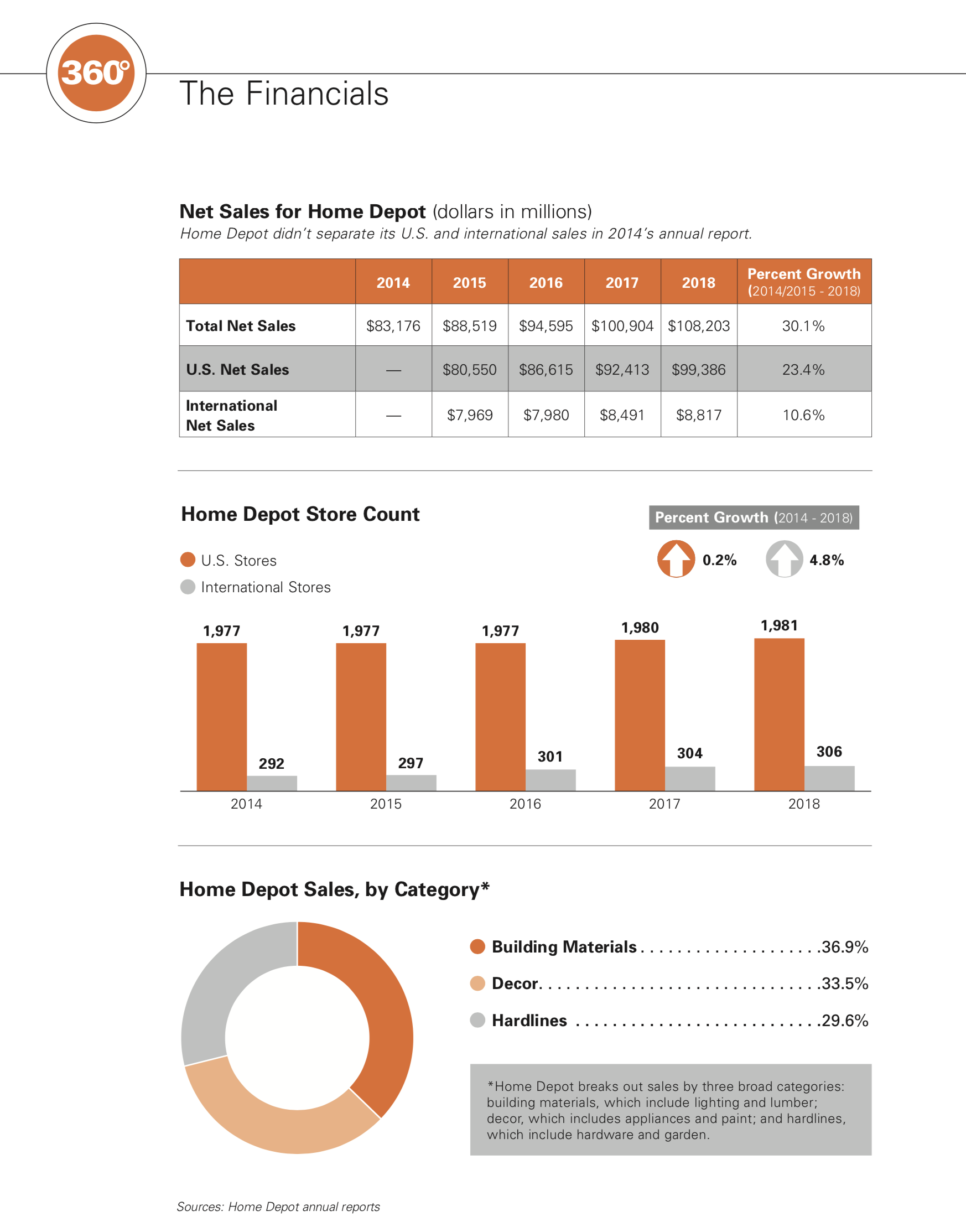

In recent years, Home Depot has played for consistency instead of glitz. That focus has resulted in nine years of sales growth, an impressive feat, considering the burden the economic downturn in 2008 placed on many home improvement companies.

Read on to learn about Home Depot’s beginning, its successes and struggles over the past four decades, current initiatives and what the company looks like now.

The History of Home Depot

Home Depot was born in the shadow of an unexpected firing.

In the 1970s, Bernie Marcus and Arthur Blank held executive positions with Handy Dan

Home Improvement Centers. In 1978, they were summoned to a meeting to discuss company initiatives, but were instead fired in unison.1

After the firing, Marcus and Blank imagined their ideal home improvement store: 75,000 square feet or more, stocked with products bought directly from manufacturers so savings could be passed to customers.2 They would cut product margins and count on sales volume for profitability.

Above all, Marcus believed the cornerstone of the business would be highly trained salespeople who could guide DIYers through every home improvement project.2

The partners enlisted investment banker Ken Langone to secure funds to make the business plan a reality and connected with Patrick Farrah, a California lumber market merchandiser.2

By the end of the 1970s, Home Depot had three stores in Atlanta, 200 employees and average weekly sales of $81,700.2

To fund expansion in the 1980s, Home Depot released its initial public offering in 1981 and opened more stores. In 1984, it acquired the nine-store chain Bowater Home Center and converted them into Home Depots.2 By 1989, the company had 100 locations.2

The 1990s proved to be an experimental time. In 1991, Home Depot opened its first EXPO Design Center store, launching a home decor chain that would grow to 34 locations before Home Depot deemed it unsuccessful and closed it in 2009.3 In 1994, Home Depot bought a 75 percent stake in Aikenhead’s Home Improvement Warehouse, a Canadian company. The investment enabled Home Depot to gain territory outside the U.S.4

In 1997, Home Depot purchased Maintenance Warehouse, which became The Home Depot Supply in 2004.5 In 1999, the company tried its hand with a small-format store called Villager’s Hardware to compete with neighborhood hardware businesses.6

New Millennium, New Changes

Prior to 2000, Home Depot’s company culture erred on flexibility, with store managers getting so much freedom that they could ignore instructions from the corporate office if they disagreed and were encouraged to spend so much time with shoppers that back-office work often fell to the wayside.7

The company then hired Robert Nardelli, a former General Electric Co. executive, in 2000 to establish more discipline.8 Nardelli reduced store staff and cut employee benefits, leaving employees feeling unhappy and the stores short-staffed. The company gained a reputation for underserving customers.8

Under Nardelli, the company began adding new U.S. stores at a fast clip, opening 1,211 locations from 2000 to 2007 while he was CEO.3 The company also bought 12 stores in China in 2006—a venture Home Depot abandoned in 2012 due to lack of success.9 Total sales grew with the added U.S. and Canadian stores,3 but same-store sales and stock values weren’t growing well in comparison to Lowe’s, despite the prerecession housing boom.8

Also, Nardelli’s rigid personality caused him to butt heads with shareholders and the company’s board of directors.10 “Earnings were adequate, but they were riding on the back of cost-cutting, not sales improvements,” Forbes reports.8 Home Depot developed a reputation for having workers who weren’t helpful.8 Sales fell in 2006.3

The company replaced Nardelli with a very different leader in Frank Blake, who became chairman and CEO in 2007.8 Blake ended Nardelli’s pattern of rapid-fire store openings, beefed up employee benefits9 and emphasized customer service11 instead of cutting costs by eliminating store-level jobs.

His efforts set Home Depot on a more stable trajectory for expansion, with measured growth in sales, well-performing stocks and a refreshed focus on meeting customers’ home improvement needs.

1 Fortune.com, Feb. 26, 2011

2 “Built From Scratch,” Bernie Marcus and Arthur Blank

3 Home Depot public filings

4 The New York Times, Feb. 9, 1994

5 hdsupplysolutions.com

6 The Wall Street Journal, May 23, 2002

7 Harvard Business Review, April 2006

8 Forbes.com, Aug. 21, 2013

9 Fortune.com, Oct. 26, 2012

10 nbcnews.com, Jan. 9, 2007

11 Fortune.com, July 9, 2014

Timeline: From 1979 to the Present

1979–Blank and Marcus, with help from Ken Langone and Patrick Farrah, open the first Home Depot stores.

1981–Home Depot starts trading on the Nasdaq Stock Market. The public stock offering raises nearly $4.1 million.

1991–The EXPO Design Center debuts. When Home Depot shutters the venture in 2009, EXPO has 34 locations.

1994–The company enters Canada by purchasing Aikenhead’s stores and rebranding them as Home Depot locations.

2000–Home Depot starts selling online for the first time, testing its e-commerce site in Las Vegas.

2001–The retailer enters the Mexico market by purchasing the Mexican company Total Home.

2014–A data breach exposes payment card information of more than 50 million Home Depot customers.

2018–Home Depot commits to investing $11.1 billion in internal upgrades, including supply chain improvements.

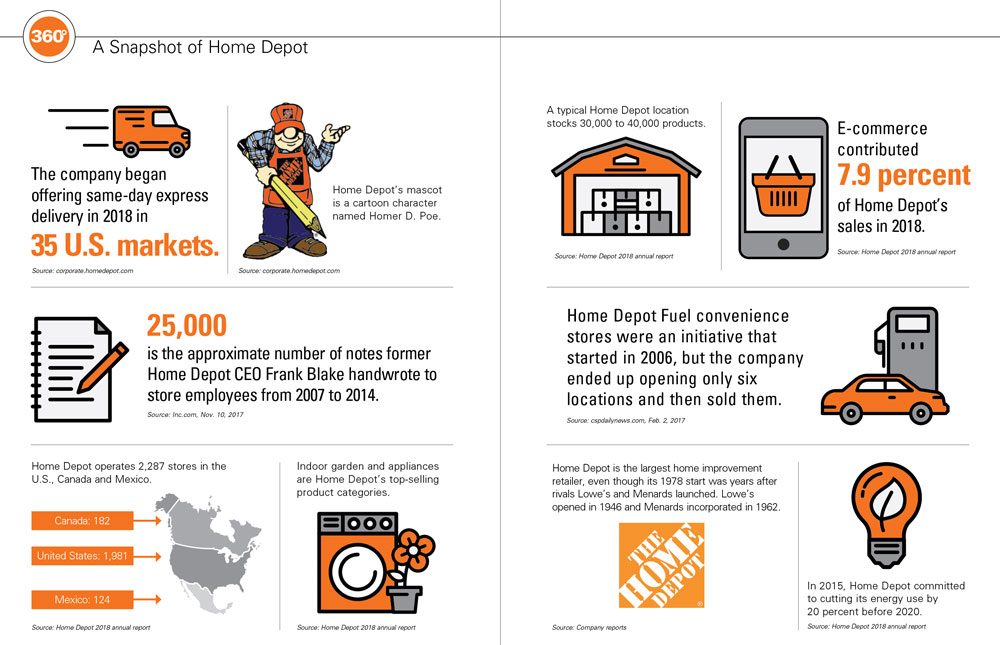

A Snapshot of Home Depot

Home Depot Today

Home Depot isn’t flashy.

The Atlanta-based company isn’t sending 3D printers into space like Lowe’s did, introducing an array of virtual reality experiences to customers in stores, testing new store formats or racing to build dozens of additional locations.

Recent growth has primarily come by improving operational efficiencies, increasing the productivity of existing stores and expanding online sales, according to the company’s public filings. As of early 2019, Home Depot operated 2,287 stores in the U.S., its territories, Canada and Mexico and employed about 413,000 people. The average store is 104,000 square feet and has 24,000 square feet of outdoor garden selling space.

Leading up to 2006, Home Depot’s growth wasn’t so moderate. At minimum, the company was adding 140 new stores per year in the U.S. By 2005, it had grown net sales to more than five times higher than in 1995. The company was also busy with acquisitions and operating retail locations under a variety of brands, such as HD Supply and EXPO Design Center.

Tumultuous Times

The 2007 recession markedly changed the home improvement industry, and Home Depot didn’t escape the financial tumult. From 2000 to 2005, the company had opened more than 700 U.S. stores and saw large sales increases due to new store growth.

However, the company started cutting back on store openings in 2006 and saw net sales decline for the first time after more than 20 years of steady growth. Sales ended up falling for four straight years.

When the economy tanked in 2008, Home Depot cut its new U.S. store openings down to 41 locations. In 2009, the company began a streak of years with few or no store openings at all.

Home Depot continued to grow modestly in Canada and Mexico, adding 46 stores from 2009 to 2018. During the same 10 years, the company opened a total of 20 new U.S. stores, including relocations of existing stores. The company’s net store increase during those years in the U.S. was only five locations.

And from 2006 to 2009, total net sales dipped more than 16 percent overall for the company.

Frank Blake, Home Depot’s chairman and CEO from 2007 to 2014, was new to the top executive role when the economic crisis hit. He carried the weight of leading the company back to health during years of financial hardship that hurt pro customers’ businesses and forced myriad homeowners to postpone home improvement projects indefinitely.

Under Blake’s leadership, Home Depot stopped the rapid store openings, assessed the value of its smaller businesses and closed, sold or consolidated what wasn’t core to the company, Fortune magazine reported in 2014.

For example, Home Depot had purchased a home improvement operation with 12 stores in China, according to the company’s public filings. Home Depot ended up shedding the Chinese stores and other businesses, including its large U.S. professional supply chain, HD Supply.

Former chairman and CEO Blake wanted to change the company culture. He revived the founders’ inverted pyramid model of leadership, establishing the CEO’s role as the peak of a pyramid turned upside down, with customers and store associates outranking the CEO in importance. Blake’s job was to serve the rest of the company by empowering employees to excel in their work, he said. He handwrote thousands of letters to store-level employees, thanking them for their efforts.

Blake was about to retire when a data breach in 2014 exposed payment information of more than 50 million customers.

He took the lead in apologizing to consumers and offering immediate credit monitoring, according to Fortune magazine.

As a result, the breach didn’t alienate shoppers enough to cause sales declines, Fortune reports.

By the time Blake retired at the end of 2014, he had led the company to stability and growth again. Home Depot’s retail sales had increased for five consecutive years and were more than 25 percent higher than in 2009, the company’s lowest point during the recession.

Blake’s replacement, Craig Menear, is Home Depot’s current chairman, president and CEO. Menear has kept the retailer’s growth streak going for nine straight years, with retail sales hitting $108.2 billion in 2018—or an increase of nearly 65 percent since 2009.

That sales growth has come with the addition of only five more U.S. stores and 48 new locations in Canada and Mexico in 10 years.

Under Menear, Home Depot has also grown by buying other operations, allowing the company to expand its pro business and bolster some of its product categories, such as soft goods.

Two recent acquisitions have been aimed at improving how the company serves professionals. The company’s purchase of Interline Brands in 2015 was an especially large investment, ringing in at $1.6 billion. Interline is a national distributor and direct marketer of maintenance, repair and operations (MRO) products.

“Addressing the needs of our pro customers is a top priority for The Home Depot,” Menear said in a 2015 statement. “Interline is a well-run company that has achieved impressive financial results over the last few years. With their seasoned leadership team, we will enhance our ability to serve the pro—both in the store and at any desired location outside the store.”

In 2017, Home Depot made another investment in serving professionals by buying Compact Power Equipment, a national company that provides equipment rental and maintenance.

“The acquisition allows us to further improve the customer experience—in particular for pros—through enhanced equipment and tool rental offerings. It also allows us to grow Compact Power’s best-in-class building services capabilities,” Menear said after Home Depot confirmed the $265 million deal.

The same year, the retailer announced its acquisition of The Company Store’s e-commerce operation, which sells bedding, bath and decor products online.

The goal of buying The Company Store was to help Home Depot gain “product development and sourcing capabilities to help us expand our online decor business into broader categories across the entire home,” Menear said in a statement from the company.

Internal Investment

Another major announcement in 2017 revealed Home Depot’s growth priorities for the next several years—internal improvements, technology and a bigger distribution network to serve a growing e-commerce business and expanding product delivery needs.

E-commerce now accounts for 7.9 percent of company sales.

“Customers are looking for a smooth, omnichannel shopping experience that integrates online and in-store interactions,” Menear said during a 2017 shareholder conference call.

“We will invest in our physical stores, our associates, product and innovation, our professional customers, our services business and our supply chain,” he says.

“And underlying all of these investments is our continued investment in IT to create the seamless One Home Depot interconnected experience.”

The company’s planned investment is $11.1 billion, including $1.2 billion in supply chain upgrades that will allow for same-day and next-day product delivery to most of the U.S.

Adding 170 warehouses and distribution centers is among the planned improvements, which will help Home Depot speed up delivery.

Home Depot also planned to hire 1,000 IT professionals in 2018 to support the technology needed to manage a complex supply chain with direct fulfillment centers for online orders and a variety of other initiatives, such as the company’s mobile app, consumer e-commerce site and a website for professional customers.

“We will remain laser focused on driving productivity,” Menear said during the conference call. “Our approach to technology development will drive productivity and speed. Our focus on the elimination of waste across the value chain, improved processes, enabling those processes through simplified systems, will support the virtuous productivity cycle.”

In Home Depot’s Words

Understanding where Home Depot is headed in the years ahead may be best answered by reviewing its own podcast, “Give Me an H.”

The podcast launched in December 2017, and since then, has included interviews with an array of Home Depot executives, shining light on the different initiatives the company values and the culture it cherishes. Each episode is hosted by Arlette Guthrie, vice president of human resources, and aims to “explore the culture of Home Depot through the eyes and experiences of our associates, who live it every day.”

Review some of the latest episodes here to discover insightful quotes from Home Depot executives and key takeaways you can apply to your own business immediately.

The Evolution of Sustainability

Guest: Ron Jarvis, vice president of environmental innovation and social environmental responsibility.

In 2000, more than 600 environmental protests erupted around Home Depot locations. By 2017, Jarvis says the company had reduced its carbon emissions in the U.S. by 6 million metric tons.

“We approach sustainability like we approach customer service—with a passion,” Jarvis says.

Explore ways your store can reduce its energy consumption to become a credible eco-friendly ally for customers looking to embrace green living. Read How In-Store Recycling Programs Can Boost Business for more information on the steps you can take to establish an in-store recycling program to help customers safely dispose of their used home improvement goods.

Supply Chain Speed

Guest: Mark Hollifield, executive vice president of supply chain and product development.

Home Depot’s supply chain workforce has grown from 2,000 associates to 15,000 associates in the last decade.

“In 2006, we were very focused just on how we can get product to the Home Depot store. Customers … want products delivered, so we need to be able to deliver to customers when, how and where they want,” he says.

Explore opportunities to deliver products to customers within your immediate service area. DIYers and pro customers alike are increasingly relying on delivery to save time on their projects. Discover how offering a delivery service can strengthen your relationships with local contractors by reading 5 Ways to Start Business with Commercial Customers.

Technology and Retail

Guest: Matt Carey, executive vice president and chief information officer.

Carey oversaw the development of Home Depot’s app and is now overseeing its new tech initiative called

The Orange Method, a 12-week program that takes people looking for a second career or recently out of the armed forces and teaches them the basics of coding. He says the program will soon aim to recruit current store associates to combine their knowledge of the company with newfound tech skills.

“It doesn’t matter what path you take, once you get in, you have unlimited opportunity,” Carey says.

Consider offering a summer internship program at your store for local computer science college students. Collaborate with the interns to create an app for your company that gives information on your products and services. Through the program, interns will gain real-life skills, and your business can reach customers and boost sales all at once. Discover how Matt Woods, president and CEO of Woods Hardware in Cincinnati, is using technology to bring new e-commerce opportunities to his business by reading Reimagine Retail Winner Matt Woods Explores Tech Opportunities.

Investing in Trades Training

Guest: Stacey Tank, vice president of corporate communications and external affairs.

Tank leads The Home Depot Foundation, which focuses on supporting veterans and helping fill the skilled labor shortage.

“There are a lot of folks who do not want to sit at a desk every day in front of a computer. They want to be out creating things, working with people, starting their own businesses and doing something with their hands. These are honorable professions. I hope over the next decade we will see a shift in how the trades are perceived in the U.S.,” Tank says.

Connect with local trade programs in your community to help support the home improvement industry’s future workers. Consider giving discounts to local companies that offer apprenticeships to tradespeople to encourage more companies to support students interested in filling the skilled labor gap. By positioning your operation as a hub for skilled local tradespeople and interested students, you can strengthen not only your business, but also the community and the entire industry.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information