The summer season is underway, which means two things for home improvement retailers. First, the Home Improvement Research Institute’s (HIRI) latest Size of Market report, a biannual update providing five-year market forecasts for materials and products used in home improvement projects, is now available. Retailers not yet members of HIRI should strongly consider joining to gain access to this invaluable resource.

Second, with summer in full swing, outdoor living spaces take center stage for homeowners. To capitalize on this seasonal shift, retailers should note some trends among homeowners, based on HIRI research.

Project Motivations Have Evolved

Back in 2021, respondents to HIRI’s Project Decision Study reported repairing or maintaining their homes, increasing property value and pleasing their families as top reasons for deck, patio or porch projects. By 2023, though, the focus had shifted toward updating or adding features to their homes, finding satisfaction in a job well done and enjoying working on their house.

Spending Behaviors Have Changed

Compared to 2017, fewer projects were financed with cash-on-hand in 2023 (60% to 49%), while savings account usage rose from 17% to 25%, reflecting an increased need to save up for outdoor prices. On average, homeowners spent $7,633 on patio, deck and porch projects, significantly more than the $4,207 average for all projects.

Shifting Popularity of Outdoor Additions

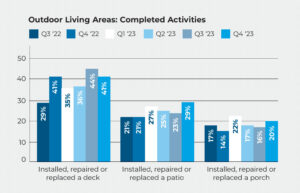

According to the HIRI Quarterly Tracker, deck installation, repair or replacement remains the most popular outdoor improvement activity among homeowners, followed closely by exterior painting. However, porch and patio installations or repairs experienced notable upticks throughout 2023. Conversely, the popularity of railing additions to decks, patios and porches has tapered off since 2017.

New Patios, Decks & Porches Take the Lead Over Replacement

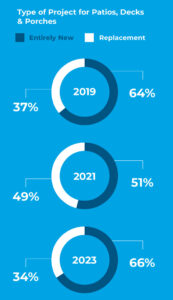

While 2021 saw a near-even split between replacement and new patio, deck and porch additions, 2023 witnessed a normalization in the number of new projects, with two-thirds falling into this category, mirroring the pre-pandemic figures.

Homeowners Seek Assistance

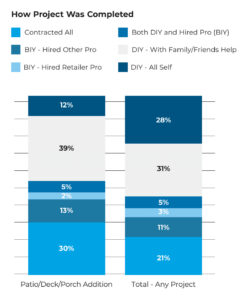

Only 12% of homeowners reported completing patio, deck and porch projects entirely by themselves. This is compared to an average of 28% opting to DIY entire other projects without support from family, friends or pros.

Extended Lead Times

Outdoor projects require an average of 17 months to materialize from project idea to completion, compared to 15 months for other indoor home improvement projects. The main hang-up occurs in the decision stage, when homeowners take three months longer than average to move from having the idea to starting on outdoor projects.

Retailers should be mindful of this longer lead time and tailor their strategies accordingly to expedite the decision-making processes. In fact, you can use all the data shared to optimize offerings for the summer surge in outdoor improvements. Knowing homeowners’ current behaviors will help you meet customers where they are, providing timely inventory and project tips.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information