You’ve felt the winds of change. In this new decade, retail realities that once seemed like figments of the imagination are now commonplace. Robots work alongside humans in big boxes, and customers can have an entire shopping experience on the same device they use to order a pizza and videochat with relatives.

As retail trends move faster and with more impact, adhering to business as usual can be a costly mistake for independent home improvement retailers.

J. Walker Smith serves as chief knowledge officer for brand and marketing at Kantar, a research and consulting firm. Smith and his team search for macro shifts in consumer behavior and interpret how those changes will affect retail and commerce at large, including independent home improvement businesses.

He was instrumental in the development of Kantar’s Uncomfortable States of Opportunity report, a panoramic survey of economic and consumer trends that highlights how certain demographic segments are neglected when companies stick to standard protocol.

On the following pages, Smith discusses five key takeaways from Kantar’s report. Discover how Smith says retail is changing, and doing business as usual is no longer an option in an increasingly interconnected marketplace.

“Brick and mortar has an opportunity around human touch.”

—J. Walker Smith, Chief Knowledge Officer, Kantar

1. Growth Opportunities Are Found in Niches

Kantar’s research finds that from 1980 to 2016, the average income for the world’s poor grew by 94 percent, the middle class’s income grew by 43 percent and the world’s top earners grew their income by 70 percent.

Smith says with income growth strongest at the top and bottom of the economic spectrum, the most powerful growth opportunities are outside the traditionally targeted middle class.

While the report notes the idea of an hourglass economy is not new, many brands have struggled to find new ways to reach new customers as middle class income shrinks. Smith says this splintering of the economy is creating fragmented niches, preventing companies from relying on “the straightforward efficiencies of mass production and mass marketing.”

“I think most companies can spot niches in their customer base,” Smith says. “I think business operators are aware of these niches, but these niches tend to reflect specific subgroups, which might have different tastes or require special products. Retailers have to find new ways to reach these customers.”

Smith points to companies that have flourished by finding new ways to make sales and meet consumer needs. Specifically, subscription services like Dollar Shave Club or HelloFresh have made inroads with budget-conscious consumers looking to add convenience to their lives.

Smith points to companies that have flourished by finding new ways to make sales and meet consumer needs. Specifically, subscription services like Dollar Shave Club or HelloFresh have made inroads with budget-conscious consumers looking to add convenience to their lives.

“Most companies have zeroed in on a certain way of doing business,” he says. “It’s the smaller players who are finding new ways to break down barriers and reach new customers by exploring their niches.”

2. Consumers Seek Personal Connections to Brands

Smith says research shows the public’s trust in government, media, businesses and organizations has declined recently.

“People don’t trust big institutions as much as they used to; it’s a fundamental social shift,” Smith says. “Trust hasn’t vanished, but it has shifted to smaller, more intimate networks.”

He says the impetus is on brands to find authentic ways to connect with customers in these smaller spaces, and they must venture outside their comfort zones to do so.

“Authority is no longer concentrated at the top,” Smith says. “Trust and influence are now bottom-up and found in smaller, more intimate worlds. If brands can authentically join these spaces, big opportunities will be found.”

3. The Future Is Digital and Analog

Brands put themselves at a disadvantage when they rely too heavily on digital possibilities, Walker says.

“We’ve lived through about 15 years of increasing digital immersion,” Smith says. “There’s now an ongoing pushback against sterile digital, and people want a balance. Fostering human connections will be pivotal in the years ahead.”

Brick-and-mortar retailers may have an advantage in finding the balance between digital efficiency and human touchpoints.

Embracing the shop-local movement is one key way of adding personal connections to your business, Smith says.

“Brick and mortar has an opportunity around human touch,” he says. “If retailers think of ways to improve the customer experience and deliver value for the time consumers spend in their stores, they’ll discover adding human interaction alongside digital connections will work to their advantage.”

4. Consumers Value Unique Experiences

Consumer spending on services is growing. They account for 77 percent of all spending in the U.S., meaning retailers should find ways to add or enhance services to their offerings.

“The broader takeaway is that growth isn’t just found in traditional experience purchases like dining or travel; people are looking for a benefit to their lives,” Smith says. “This change suggests people want an intangible, experientially based benefit in their lifestyle and spending.”

Smith advises retailers to add value to the traditional shopping experience without commanding too much of a shopper’s time. “The consumer mindset these days is less about accumulation of products and more about experiences. That’s where retailers should put their strategic focus,” he says.

5. Entice Customers to Opt In

Smith points to a 1956 review of scientific experiments which determined the average human could remember about seven facts at a time in their short-term memory. As time has passed, the amount of data humans receive each day has grown exponentially. Kantar now estimates humans encounter about 74 gigabytes of information each day, roughly 25 episodes of your favorite Netflix series. Retail must break through the noise.

“For a long time, brands fought against people opting out of their online offerings, but the focus is changing. These days, retailers must encourage people to opt in—to deliver products and services that encourage engagement,” he says.

Smith says this notion has direct effects on marketing.

“Retailers understand that their marketing has to be simple and direct,” he says. “Our tendency is to try to overcontrol the retail experience, but instead, we should be requiring less from customers and making our systems more efficient.”

Smith says Amazon has found ways to leverage simplicity and encourage customers to opt in to new products and services.

“Each day, Amazon asks how they can make their customers’ shopping experience easier and less time-consuming,” he says. “It’s all about a seamless retail experience that we’ve lost sight of. We tend to overcomplicate customer outreach, but in this case, less is more.”

Facing Uncomfortable Truths

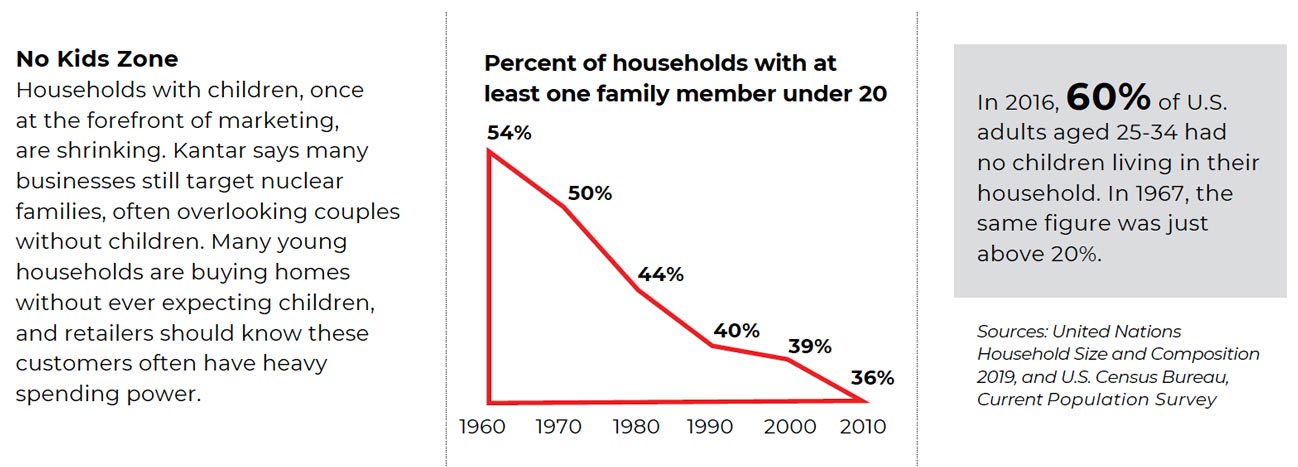

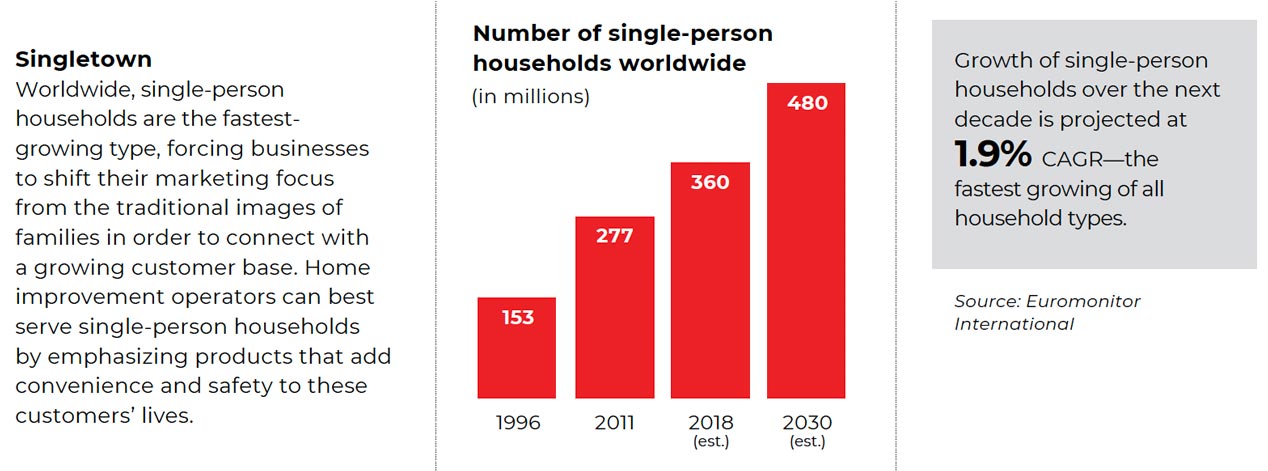

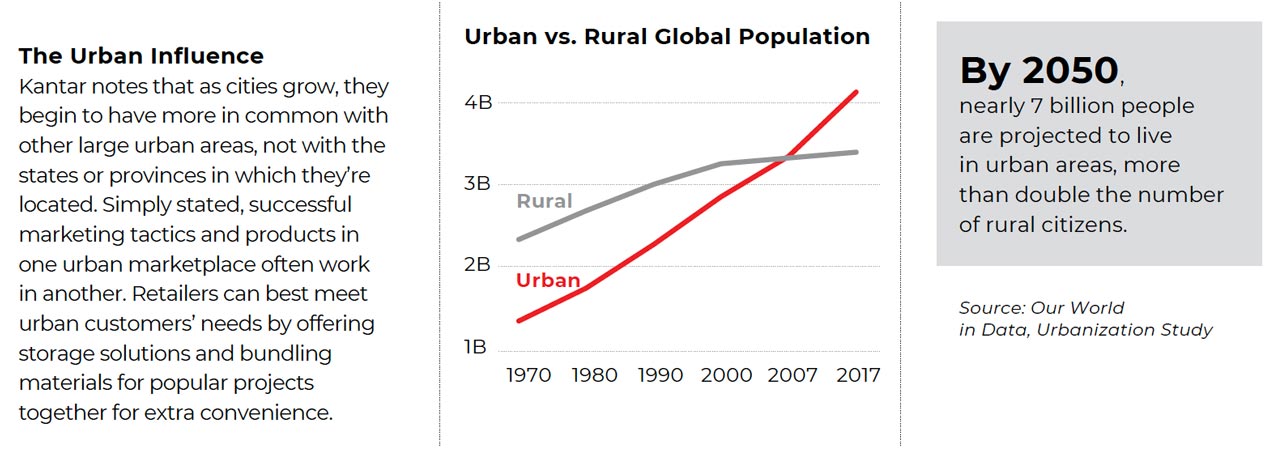

As part of the Uncomfortable States of Opportunity report, Kantar has identified several consumer profiles that are gaining new retail power. Explore a few of these emerging customer demographics below, and learn more by visiting kantar.com.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information