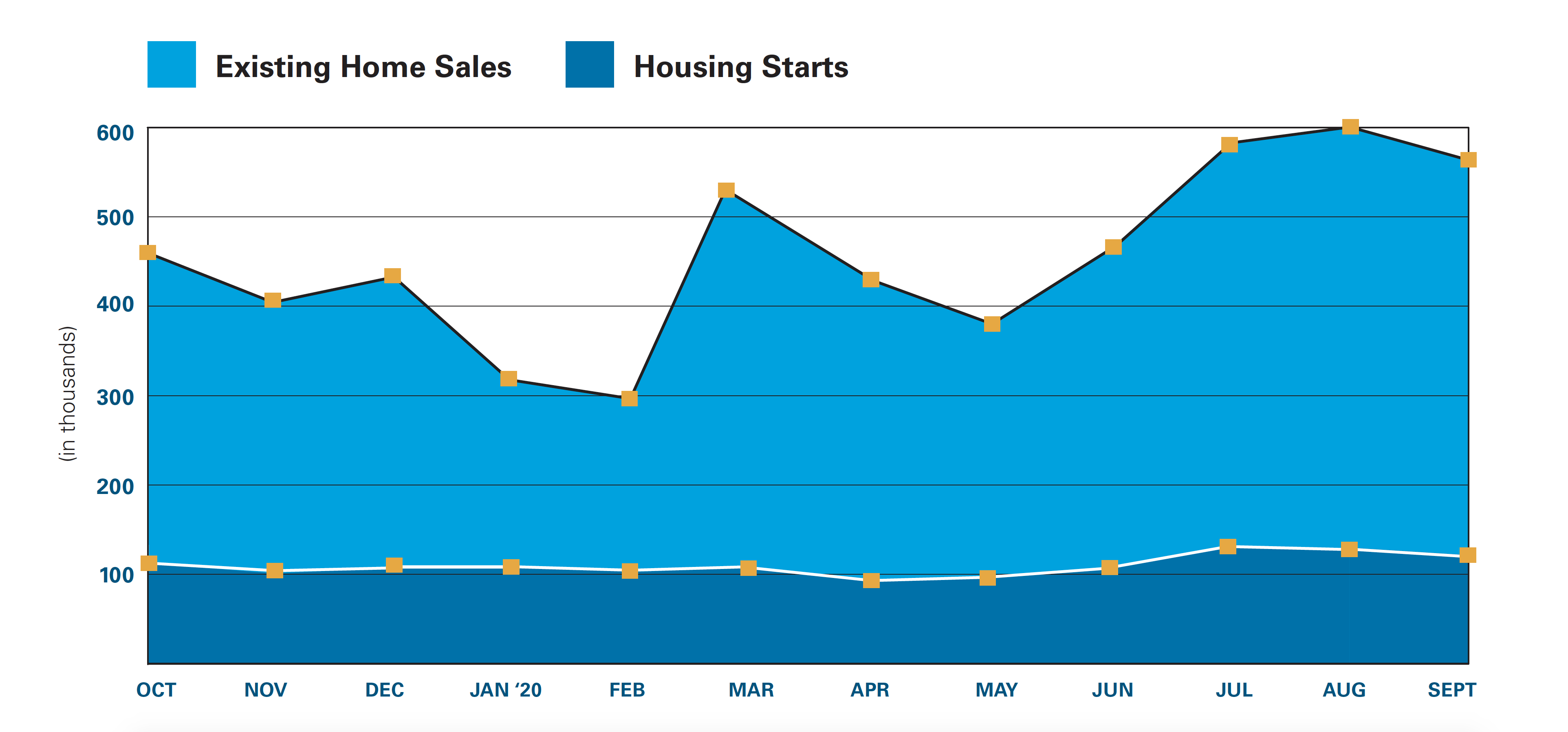

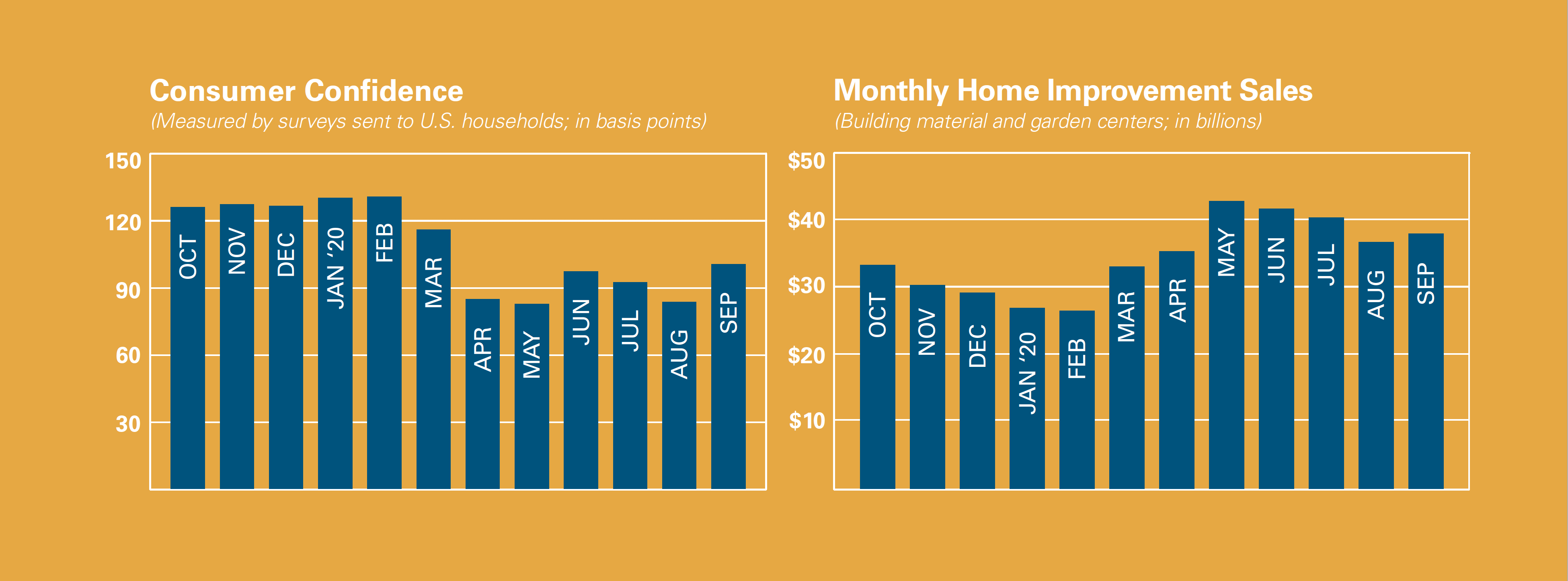

Monitoring market trends in consumer sentiment, home improvement rates and construction figures can help you anticipate emerging opportunities for your business. Use the tables below to get a deeper understanding of a few of the forces affecting independent home improvement. Data is not seasonally adjusted, meaning these graphs represent real-time shifts in the market.

- Understand consumers’ desire to save or spend by gauging overall consumer confidence levels.

- Analyze total retail sales for building material and garden equipment centers to track your business’s performance against national averages.

- Serve customers renovating or upgrading homes more effectively by observing housing starts and existing home sales.

Existing Home Sales and Housing Starts as of September 2020:

Existing Home Sales and Housing Starts as of September 2020:

Sources: National Association of Realtors; U.S. Census Bureau

Sources: National Association of Realtors; U.S. Census Bureau

Home Prices on the Rise

Total existing-home sales increased 4.3 percent from September to a seasonally-adjusted annual rate of 6.9 million in October. Overall, sales rose year-over-year, up 26.6% from a year ago, the National Association of Realtors concludes.

“Considering that we remain in a period of stubbornly high unemployment relative to prepandemic levels, the housing sector has performed remarkably well this year,” says Lawrence Yun, NAR’s chief economist.

Consumer Confidence and Monthly Retail Sales as of September 2020:

Consumer Confidence and Monthly Retail Sales as of September 2020:

Sources: The Conference Board; U.S. Census Bureau, NAICS 444

Sources: The Conference Board; U.S. Census Bureau, NAICS 444

Consumer Confidence Drops in October

Consumer confidence rose stridently in September, but was followed by a slight dip in October.

“Consumer confidence declined slightly in October, following a sharp improvement in September. Consumers’ assessment of current conditions improved while expectations declined, driven primarily by a softening in the short-term outlook for jobs. There is little to suggest that consumers foresee the economy gaining momentum in the final months of 2020, especially with COVID-19 cases on the rise and unemployment still high,” says Lynn Franco, senior director of economic indicators at The Conference Board.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information