Click the picture to download a PDF of this story.

Hardware Retailing staffers Kate Klein, Melanie Moul and Todd Taber contributed to this article.

Winning Customers in a Price-Conscious Culture

Many independent retail businesses have an image problem. Consumers often think locally owned is synonymous with expensive.

Whether or not this perception rings true, in today’s highly price-sensitive and price-aware culture, this preconceived image about your business can do it harm.

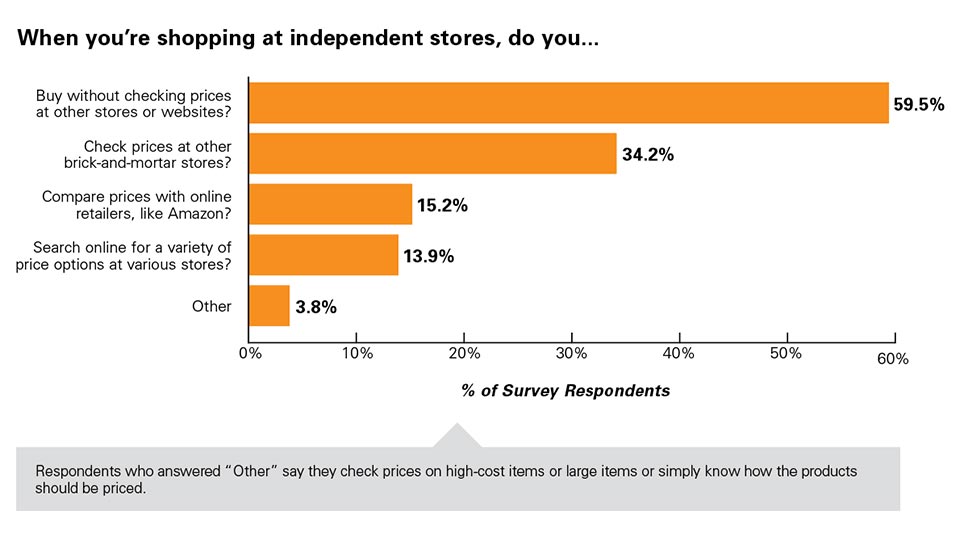

Consumers have at their fingertips more information about price than they ever have before. In fact, more than 60 percent of consumers surveyed for this report say they compare prices at other brick-and-mortar stores and online prior to making a purchase. According to the survey results, the general consensus is that independent retailers have a propensity to be higher priced than their big-box competitors. On a case by case basis, however, that doesn’t mean independents are left behind.

Pricing is a complex issue influenced by a range of factors, some of which are entirely outside a retailer’s control. But it’s important to stay vigilant on pricing. When an independent retailer is competitive on price, other differentiating factors help bring customers through the door, such as location and service.

To find out how customers’ price perceptions affect an individual operation, Hardware Retailing conducted an exit survey of shoppers at Palos Ace Hardware in Palos Heights, Illinois. Owner Dan Harris has Menards, Home Depot and Lowe’s competing within 3 miles of his store. The reality is that Harris’ co-op helps him buy and price products competitively in his market. Harris invests significant time in ensuring his prices are competitive in his market, yet he feels his customers don’t believe him when he says he’s offering the best price on a product.

You likely face similar frustrations. Your product prices may be very competitive in your market. You might price shop and run sales to beat your big-box competitors and price match on top of that. And yet, customers assume your prices are sky-high just because you run an independent business.

While consumer price perceptions certainly present challenges to independent retailers, the insights we gleaned from our research at Palos Ace show that a careful combination of vigilant pricing, targeted promotions and solid service can help overcome these obstacles.

Review the survey results from Palos Ace Hardware here and get expert advice from Jim Robisch, senior partner with home improvement research firm The Farnsworth Group, on how you can reshape your operation’s price image.

*All data was compiled from the Palos Ace Hardware Price Perception Survey conducted by Hardware Retailing.

An Inside Look at Palos Ace

Palos Ace Hardware is a 20,000-square-foot store in an upper-middle-income community near Chicago. The store sells the core home improvement categories, including electrical and plumbing, but also does good business with unique products in paint and housewares.

Harris runs a strong business. Most of his customers are DIYers who own their homes and complete home improvement projects, but about 20 percent of the store’s customers are professionals, such as building maintenance workers.

He allowed Hardware Retailing staffers to conduct exit interviews with customers shopping at his store on a Saturday this spring. Nearly 100 shoppers shared their opinions of the store’s pricing, providing a snapshot into what his customers think. About 96 percent of the participants say they shop at competing big-box stores in addition to Palos Ace.

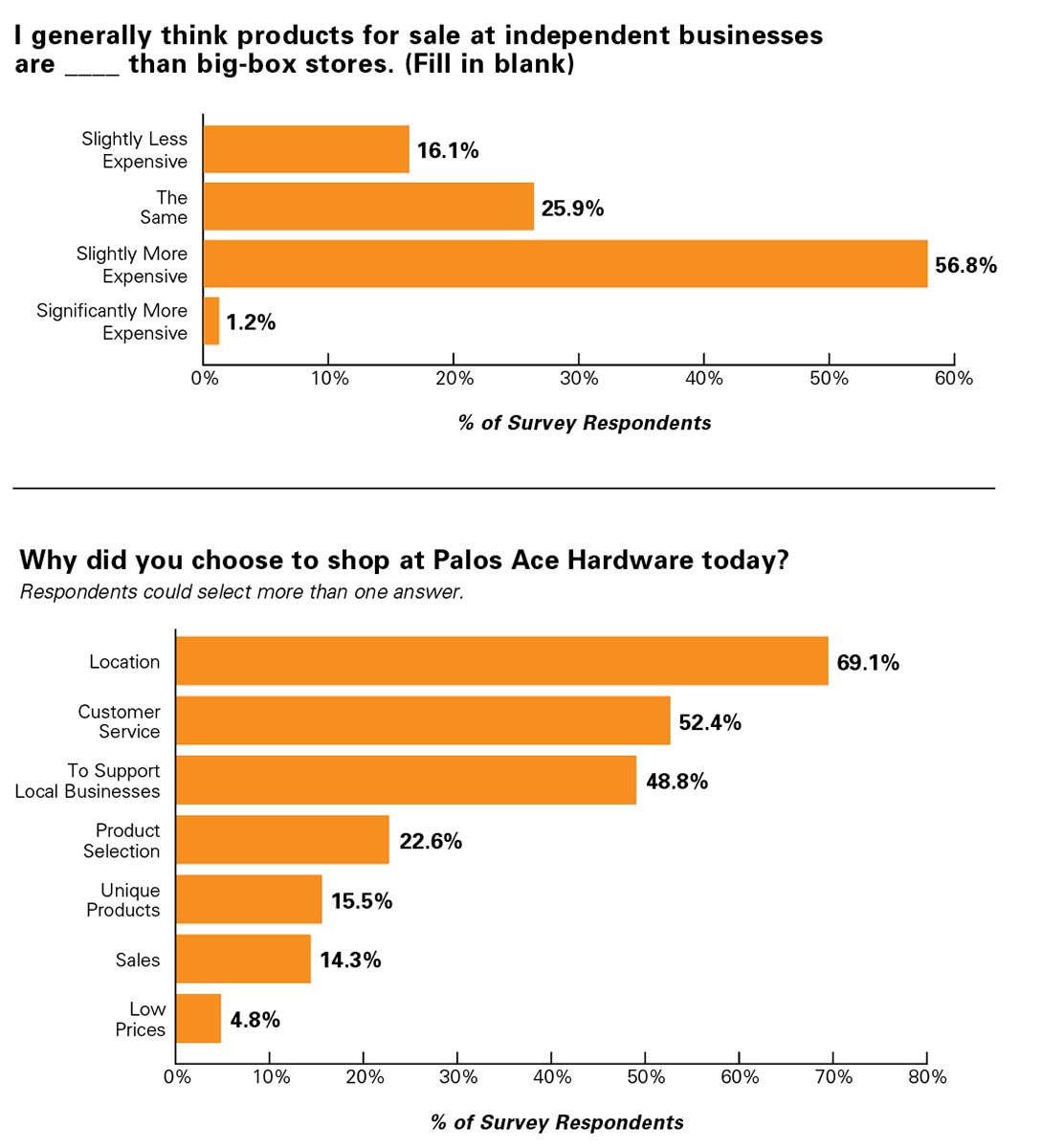

Their perspectives on pricing showed some of what Harris expected—many shoppers think the store is more expensive than the big boxes, and even more think independent stores overall are typically more expensive. However, the overall breakdown is close. While 58 percent think prices at independent stores are generally more expensive, 42 percent think prices at independent stores are about the same or cheaper.

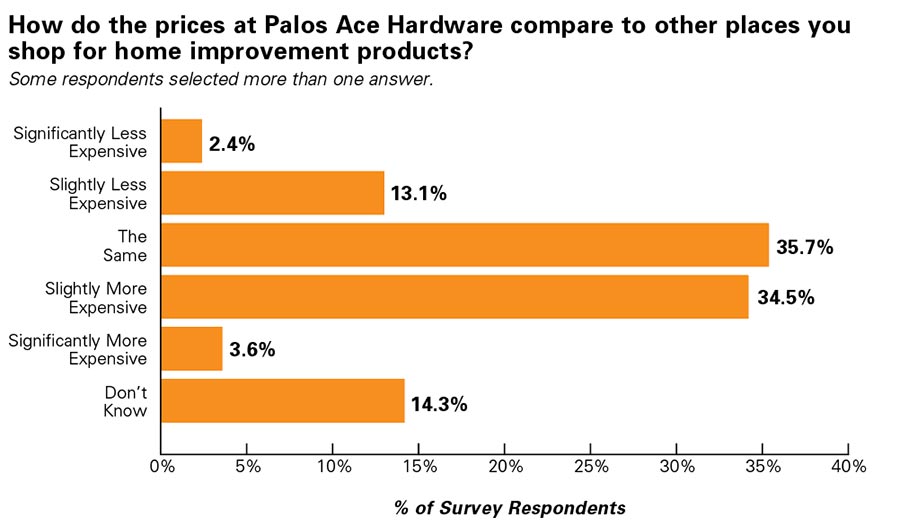

The numbers specific to Palos Ace are even better. About 38 percent of the customers surveyed think Palos Ace is slightly or significantly more expensive than other places they shop for home improvement products. But more than half of customers surveyed—52 percent—think the prices are the same or are slightly or significantly less expensive.

“The fact that a majority are saying prices are less expensive is very surprising,” Robisch says. “Slightly more expensive or significantly more expensive is typically what we see.”

A national online survey of 1,000 consumers Hardware Retailing conducted for this article showed similarly surprising results. More than one-third of survey participants think independent home improvement stores have cheaper prices than big boxes or are the same, and 29 percent believe independents are pricier.

The data from Palos Ace shows that Harris is doing a good job at pricing competitively and at strengthening a fair price image, Robisch says.

Although customers report that Palos Ace has competitive pricing, price isn’t a traffic driver for the business. The top three reasons customers say they came to Palos Ace the day of the survey were location, service and to support a local business. Competitive prices were the lowest ranked reason people chose to shop Palos Ace.

According to Robisch, many retailers believe good service and convenient store locations by themselves are enough to differentiate their businesses, but variable pricing has to be a priority.

Customers face a barrage of price messaging, and the ability to check prices online makes shoppers more price aware and price sensitive than ever before in retailing, Robisch says. Price can be a powerful reason why customers avoid a store or shop elsewhere first.

“You have to get your prices right,” Robisch says. “Convenience and customer service aren’t going to supersede price in the consumer’s mind.”

How Palos Ace Does Pricing Well

The fact that Palos Ace is attracting customers who also shop big-box competitors is a good sign, Robisch says.

Nearly all of the customers surveyed shop at Menards, Home Depot, Lowe’s or a combination of the three. Some of them also shop for home improvement products on Amazon.

And yet about 70 percent of them shop at least monthly, if not weekly or more often, at Palos Ace Hardware.

The frequency of the store visits means the customers are highly familiar with the store’s merchandising, pricing, product mix and when the store brings in fresh and new items, Robisch says.

Notably, 98 percent of the shoppers found what they were looking for at the store the day they were surveyed, and 92 percent made purchases—a closure rate that is above average, Robisch says.

“Palos Ace is either really good at matching their selection to their market, or they’re doing a really good job of communicating what it is they stand for in the market,” he says.

Plus, 14 percent of the survey respondents went to Palos Ace due to some promotional prices, which means Harris’ customers are responsive to special sales.

Robisch says that customers must believe they can get a good deal after seeing the store’s promotions, which motivate them to visit the store in person.

“There’s no doubt about that. We train our customers to look for our ads,” storeowner Dan Harris says. “The survey fortified in my mind that we’re doing the right things.”

His customers aren’t deterred by the store’s price image, even if some think big boxes are less expensive and 34 percent price shop other brick-and-mortar stores.

“Dan is doing a good job, since his customers are saying he’s cheaper on some things,” Robisch says. “That has to be because he’s aware of the market pricing. He’s not going crazy trying to maximize profit, and he knows what the market prices for products are.”

Harris relies on price recommendations from his co-op and his own research to stay competitive. For nonseasonal merchandise, Harris price shops competitors at least every three months. For seasonal products, especially in the spring, he checks on the competition’s prices every week. And he’s always closely watching the prices in advertisements.

“You can drive all over the city, but our prices are still competitive,” Harris says.

Palos Ace also price matches advertised prices from other businesses on equivalent products.

Convenience stores that sell products such as small bags of mulch also impact Palos Ace Hardware’s price image. Customers want to buy a larger bag of mulch at Palos Ace for the same price as the convenience store sells a small bag for and don’t understand there’s a difference in products, Harris says.

Menards has the lowest price reputation in the area, according to Harris. However, he sees the ads for all of his competitors and knows that, at times, his prices aren’t just competitive—they beat the competition.

“It’s kind of disheartening that sometimes when you do have the low price, customers don’t believe it,” he says. “Recently, I put a competitor’s ad side by side with ours, and we were $2 per item cheaper.”

Harris’ business success requires perpetual strategizing. He has to keep working hard at pricing because his competitors are good at it, prices are widely available online and fighting the high-price image of independents is uphill work.

Putting prices and his product inventory on the store website are the next steps for improving price image, Harris says. His customers are savvy shoppers, and they’re already comparing his in-store prices against what they see on the big-box stores’ websites, Harris says.

“Online is where we have to be. That’s my reason for pushing really hard on it,” he says.

What About Your Prices?

Surveying shoppers at Palos Ace Hardware helped Dan Harris better understand what his customers think about prices at this business. You can use exit surveys during the checkout process to learn more from your customers about your store’s price image.

You can download the survey here to gauge your customers’ perceptions about price. Ask customers to complete the surveys before they leave the store, and offer small cash or gift card incentives to encourage participation.

4 Expert Tips on Pricing

Competitive variable pricing requires vigilance, and independents must make it a high priority if they want their businesses to thrive and grow.

“Price was, is and will remain one of the most important management responsibilities,” says Jim Robisch, senior partner of home improvement research firm The Farnsworth Group. He believes many retailers haven’t communicated a fair or competitive price image to their customers, and even the ones who work at it need to be improving all the time.

In a world where dynamic online pricing has become the norm, a brick-and-mortar retailer’s variable pricing strategy needs to be strong.

Implementing a disciplined strategy to improve a store’s price image is difficult, and it takes about three years to change customers’ perceptions. However, it’s absolutely necessary for an independent store’s growth, Robisch says. He offers the following advice for getting started or improving your current strategy.

1. Make Price Guarantees

Does your store offer a price-matching guarantee? If it doesn’t, it’s time to implement one. Make sure your customers understand that if they see an advertised price on a product that’s lower than what you’re offering, you’ll match it. That dedication will help cement your reputation as an affordable alternative to big-box competitors. It also positions your business as a versatile company that’s ready to serve its customers fairly and progressively.

2. Use Margin Builders

Diversifying a product mix with unusual items, whether they are handmade housewares, specialty snacks or local items, allows room to build in additional margins. Attend buying shows and shop your competitors to discover new margin boosters.

You can also take advantage of opportunities to increase prices if you notice areas where some products are particularly underpriced compared to competitors, according to Robisch.

3. Price Shop Competitors

Robisch recommends going to competing stores routinely to compare prices. Walk the aisles, cellphone to your ear, and record yourself reading product brands, descriptions and price stickers. Retailers also need to check store websites for quick comparisons and watch for ads online and in print.

“There will be items retailers will say they can’t buy as cheap as a big-box store sells them for,” Robisch says. “But they’ll also likely find a lot of items they’re underpriced on.”

For the most price-sensitive, high-ticket items, retailers should check competitors’ prices at least monthly, Robisch says. For seasonal products, retailers need to verify competitors’ pricing in the area right away.

“The more items audited more frequently, the greater the impact on your profits and price image,” Robisch says. “I think it has to be a disciplined, ongoing process.”

4. Shout Price Loudly

Retailers who are doing a good job at competitive variable pricing aren’t always good at telling their customers they’re getting a good deal.

“They have to get the prices right. Then they have to do a really good job of shouting price in the store,” Robisch says.

Use price tags and signage in stores to draw attention to great deals. If you slash a price, then use a tag that calls out the price change. Promoting special buys, manager’s specials, new prices and newly lower prices on signs, dump bins, endcaps and price tags goes a long way, Robisch says. The more frequently customers see good prices promoted, the more they believe them.

A few terrific buys can change customers’ price perceptions, Robisch says.

“If they know they got a great deal, it makes them feel good when they get home,” he says.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information