The array of green or eco-friendly home products available to most American consumers is vast, ranging from towels made from sustainably grown bamboo to house paint that is safe enough to eat.

But just because the number of green household goods available to the typical shopper is increasingly broad—and the internet makes even very niche products accessible—does that mean average consumers care?

The answer appears to be that it depends on the products and how they benefit the buyers. For example, healthy living has become more important than energy efficiency to many consumers, and that has changed their spending priorities.

In 2009, Hardware Retailing surveyed 250 consumers throughout the U.S. to see how much green products matter to them and which eco-friendly features they value most. In 2019, we again surveyed

a group of 250 shoppers to see if how consumers shop for and feel about eco-friendly home products has changed in 10 years.

The following article details the new data, which show some trends that have stayed consistent and others that have shifted.

What Matters Most

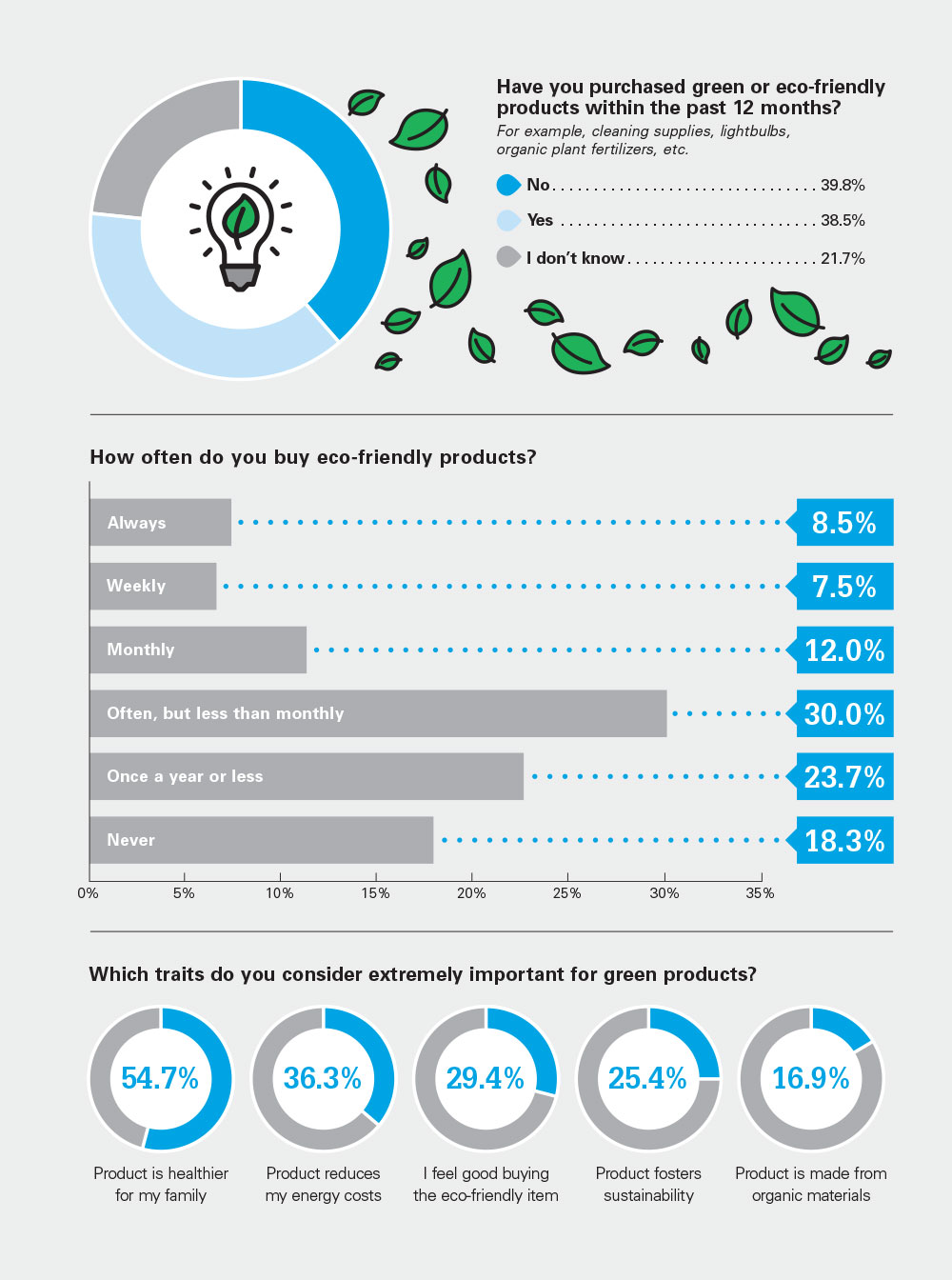

Hardware Retailing’s new research reveals a change in how much consumers prioritize eco-friendly items when they shop for home products, such as cleaning supplies, lightbulbs and plant fertilizers. An economy that has recovered in most ways from the economic upheaval of 2009 can explain some shifts in priority.

Ten years ago, consumers wanted to reduce their utility and energy costs, and for good reason. Economic instability, lost jobs and foreclosed homes made penny-pinching imperative for many people. Not surprisingly, the green products that mattered most to the 2009 survey respondents were energy-saving items that lowered their utility bills.

A decade later, products that contribute to healthy living matter more to consumers. In fact, the No. 1 priority for consumers who participated in the Hardware Retailing survey is products that are “healthier for my family and me.”

Saving money on their utilities was the second most popular priority to respondents, but 50 percent more participants value products’ potential health benefits.

The emphasis on healthier living is a global consumer trend, according to international research firm The Nielsen Co.

The firm reports that “products living in the sweet spot of ‘healthy for me and healthy for the world’ are growing in demand.”

Half of consumers worldwide are willing to pay extra for a product if it is high quality and safer for them, according to Nielsen. In the U.S. specifically, “consumers worry about the economy and their own health,” Nielsen says.

When it comes to products many retailers sell in the home improvement sector, cleaning supplies and housewares stand out as important categories that are growing in their emphasis on healthy, eco-friendly options, according to the International Housewares Association.

Influences on the Purchase

More than 60 percent of shoppers responding to the 2019 Hardware Retailing survey say they didn’t buy or don’t know if they bought green home products in the past year. That doesn’t mean they don’t ever buy them—only about 18 percent say they never do.

However, shoppers reveal their priorities with how they consciously spend their money. In the 2019 survey, nearly 22 percent of respondents weren’t sure if they had purchased eco-friendly products in the past year.

The 38.5 percent of shoppers who knowingly bought green products in 2018 and early 2019 represent a change from a decade ago, when 83 percent of survey respondents had purchased a green product within the prior 12 months.

The changes reflect that many eco-friendly products have become mainstream, so shoppers likely don’t have to think about finding green options. For example, cleaning aisles now offer a variety of natural products alongside chemical cleaners.

In addition, federal regulations have heightened efficiency standards for household lightbulbs, reducing the availability of flourescent and incandescent bulbs. In addition, many retailers have phased out harmful neonicotinoid pesticides, so the chemicals are less available for purchase.

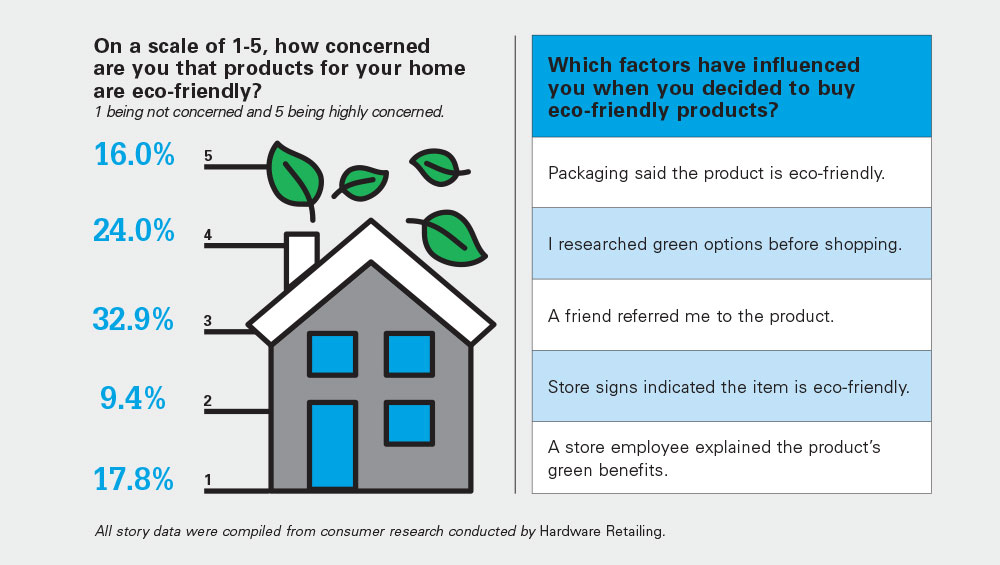

Other impacts to consumers’ green-buying decisions in stores have also changed, though not as dramatically.

In 2019, the top influence on shoppers’ purchase choices remained the same as in 2009: “The packaging told me it was eco-friendly.”

But consumers are much more reliant now on their own research than they were 10 years ago. During the first study, consumers’ research was less important to them than their friends’ referrals and store signage that highlighted eco-friendly products.

In 2019, consumer-initiated research influenced spending decisions more than their friends, store signs and conversations with store employees. Because customers rely heavily on their own research when making choices about purchases, they can serve as resources for retailers who ask what they need.

Asking questions could pay off. About 64 percent of the 2019 survey respondents are willing to pay more for the eco-friendly versions of products that matter to them—and 45 percent are willing to spend an extra 6 percent or higher.

Whether they regularly buy green products or not, consumers care that stores where they shop carry eco-friendly items. About 70 percent of survey respondents say it’s at least somewhat important to them that retail companies offer a sizable selection of green products.

The Numbers and Retail

Retailing best practices apply to how store owners should interpret the 2019 survey results from Hardware Retailing.

Retailers need to check regularly with their customers about which eco-friendly products matter to them and why. Point-of-sale data won’t tell a retailer why customers’ values are shifting and what their new priorities are, so it’s important to pay attention to national trends, ask questions and survey current shoppers.

Changes in customers’ values over time could be reducing the importance of some products in a store while creating opportunities to expand or add other categories.

As always, shopper needs vary by market. In some areas, eco-friendly products are the expected norm for many home improvement store categories. In other markets, retailers may not realize they have a customer base that is interested in a spectrum of items that contribute to healthier homes and lifestyles.

“Sustainably minded consumers still make up a significant portion of the population and sales say consumers are committed to buying specific types of sustainability,” Nielsen concludes.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information