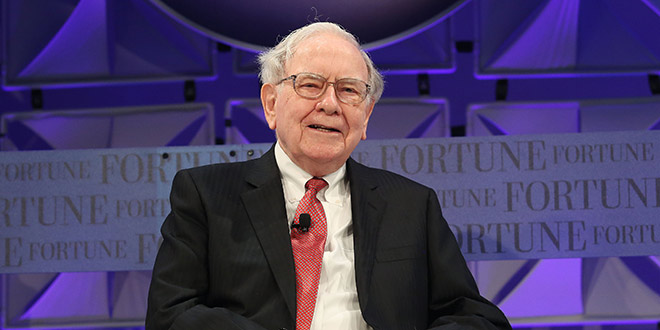

Investor Warren Buffett’s holding company recently cut back on its investment in Walmart and bought airline stock instead, reflecting pessimism about brick-and-mortar retailing, Business Insider reports.

Buffett’s company, Berkshire Hathaway, sold $900 million in Walmart stock by the end of 2016.

Buffett “acknowledged that traditional brick-and-mortar retailers were struggling in the face of competition” from Amazon, Business Insider says.

Even so, Buffett has demonstrated a commitment to independent retailers through his Benjamin Moore paint company, which still only allows independent stores to sell its paint.

However, Amazon “is a big, big force and it has already disrupted plenty of people and it will disrupt more,” Buffett says in an article from Bloomberg.

Choosing to sell most of Berkshire Hathaway’s Walmart stock may reflect business foresight Buffett has shown in the past, according to Business Insider.

“Buffett’s retail instincts have proved correct before when he predicted the downfall of Sears and Kmart in 2005,” Business Insider says.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information