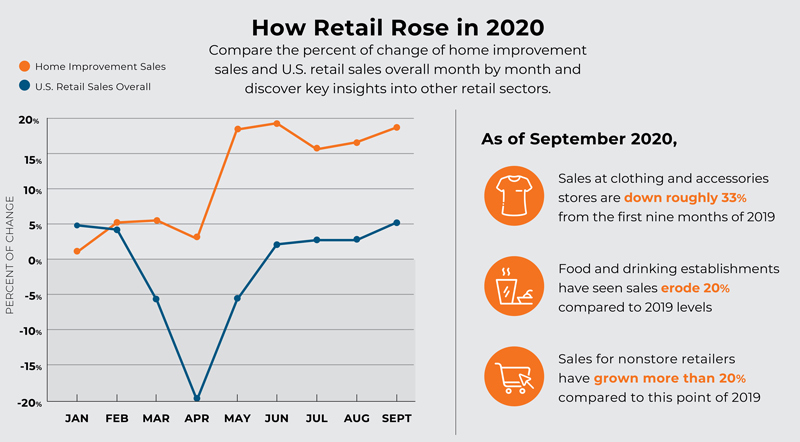

Despite uncertainty early in the year, retail sales have remained strong across sectors, including historic sales for home improvement (NAICS 444) and nonstore companies (NAICS 454) like Amazon.

Referencing retail sales for September, National Retail Federation president and CEO Matthew Shay says throughout the COVID-19 pandemic, retailers and consumers alike have adapted to a shifting landscape by embracing new modes of customer contact.

“While it’s been a challenging year for everyone, there’s been an enormous amount of innovation within the retail industry,” Shay says.

Jack Kleinhenz, chief economist for NRF, says retail sales built on summertime momentum and were further improved by declining unemployment rates and rising savings for many Americans.

“All in all, these numbers and other economic data show the nation’s economy remains on its recovery path,” Kleinhenz says.

“Although sales growth is strong, it will slow through the rest of this year and into next year,” says Gus Faucher, chief economist at PNC Financial. “The slowing will be even larger if Congress does not pass another stimulus bill. Unemployment remains pervasive throughout the U.S. economy.”

As 2020 draws to a close, review how retail sales for home improvement and the economy overall shifted compared to 2019 levels and discover key insights into strong and weak retail sectors heading into 2021.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information