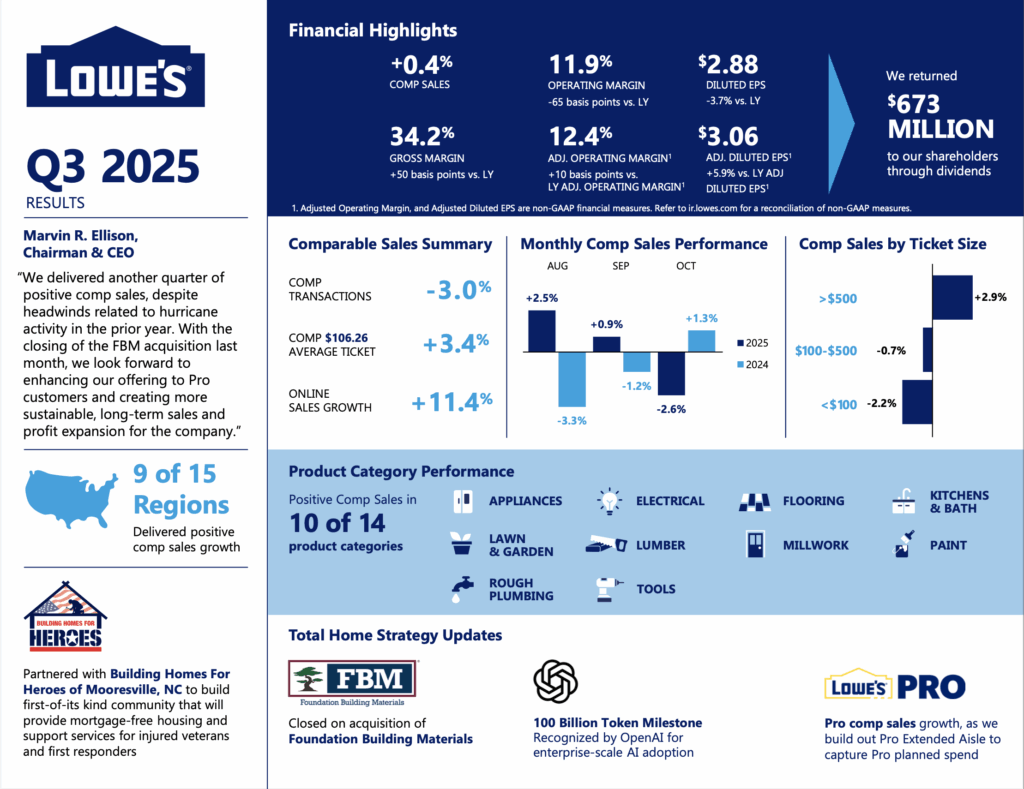

Lowe’s Companies Inc. recently released its financial results for the third quarter of 2025, reporting $20.8 billion in net sales, up from $20.2 billion in Q3 2024, an increase of. Comparable store sales for the quarter increased 0.4%, driven by 11.4% online sales growth and growth in home services and pro sales. Net earnings were $1.6 billion and diluted earnings per share for Q3 were reported at $2.88.

“The company delivered another quarter of positive comp sales, and we’re pleased to start November with positive comps as well, despite headwinds related to hurricane activity in the prior year,” says Marvin Ellison, Lowe’s chairman, president and CEO. “With the closing of the FBM acquisition last month, we look forward to enhancing our offering to pro customers and creating more sustainable, long-term sales and profit expansion for the company. I would like to thank our associates for their hard work and dedication to the business.”

As of Oct. 31, 2025, Lowe’s operated 1,756 stores, representing 195.8 million square feet of retail selling space.

Lowe’s also updated its outlook for the full year 2025. Total sales expectations were increased to $86.0 billion, up from previous expectations of $84.5 to $85.5 billion, while comparable store sales are expected to be flat, previously expected to be flat to up 1%.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information