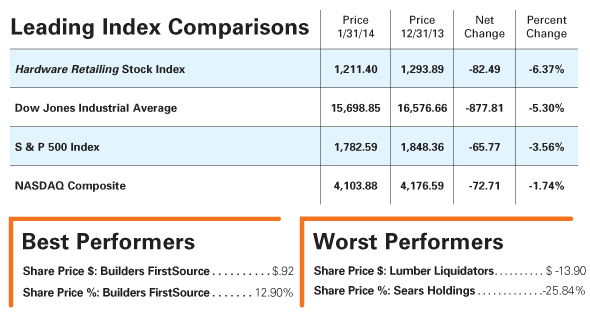

After a robust and record-setting 2013, markets headed south in January.

Stocks tanked when emerging markets fell overseas: A preliminary survey of a purchasing managers’ index of Chinese manufacturing dropped to 49.6, the lowest reading since July.

Consumer sentiment dipped in January as well with the Thomson Reuters/University of Michigan index at 81.2, down from 82.5 in December. With all that, the Federal Reserve cut its stimulus program by another $10 billion.

The Hardware Retailing Stock Index was not exempt as it tumbled, shedding 82.49 points, or 6.37 percent, and closing at 1211.91 for the period between Dec. 31 and Jan. 1. Declining issues nearly shut out advancing issues at a 16-to-1 count.

The Commerce Department reported, however, that the U.S. economy improved at a 3.2-percent annual rate in the fourth quarter of 2013, and consumer spending also grew in the period. “Even if there is a problem with these emerging market economies, we have plenty of evidence that shows that it doesn’t heavily impact the economic momentum of the U.S., and it only mildly impacts earnings for U.S. companies,” says David Kelly, chief market strategist with J.P. Morgan Funds. “People were looking for an excuse to sell.”

Sears Holdings (SHLD) had another rough month, losing 12.67 points, or 25.84 percent. SHLD said it expects to report a fourth-quarter adjusted loss of $2.01 to $2.98 per share and a full-year loss for 2014 between $7.64 and $5.61 per share. Consensus estimates for both quarter and year are $0.20 per share and $6.20 per share, respectively. SHLD closed at 36.37 and was the top percentage loser.

The Hardware Retailing Stock Index is a customized index which reports the stock activity of the leading home improvement retailers, manufacturers and builders influencing the industry. It is published monthly in Hardware Retailing magazine and on hardwareretailing.com. Use these quantitative metrics for a benchmark to compare your business’s operational performance. Please anticipate a two-month lag time for data reporting and collection.

The Hardware Retailing Stock Index includes the following tickers: BLDR, BZH, BXC, HD, LOW, LL, MAS, MHO, NWL, PHM, SMG, SHLD, SHW, SWK, TSCO, VAL and WDFC.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information