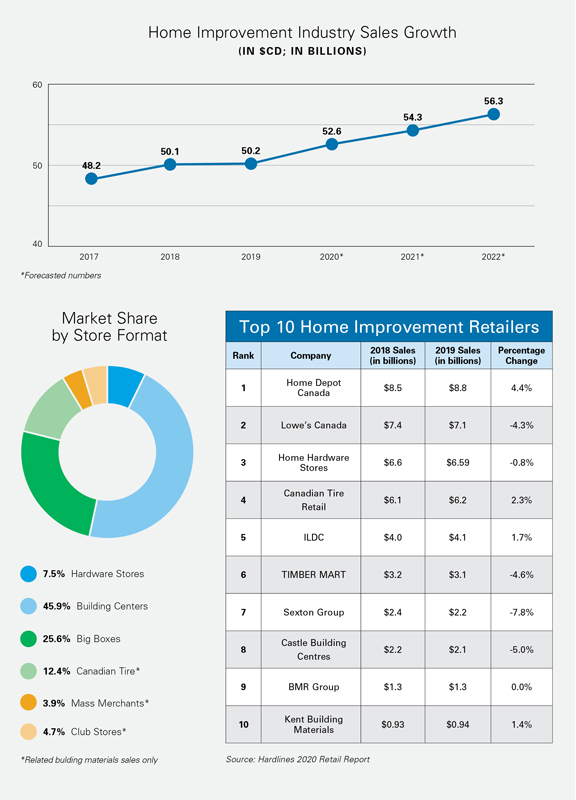

The Canadian retail hardware industry has weathered similar conditions to its southern neighbors through much of 2020. But before the pandemic, sales by the industry overall were facing negative growth at the end of 2019 for the first time since 2009. However, impacts varied from region to region and by store format.

Big-box retailers fared best during the uncertainty of 2019, growing in real terms and securing a larger portion of the entire market in Canada than ever before. Hardware stores showed great resilience, maintaining their role as an important part of the local communities they serve.

All these conditions set the stage for the industry’s response to a world crisis in Q2. As people were forced to stay home, uncertainty was the overriding sentiment for

retailers. Initial concerns about the health of the economy and the potential rise in unemployment gave way to a unique boom in home repairs and renovations. The result, much like in the rest of North America, was a huge surge in sales for retailers of all sizes.

While pandemic conditions certainly added to operational challenges, they did not diminish the overall buoyancy of the sector. The DIY boom started with paint and decorating projects, with retailers enjoying record increases—and vendors reporting empty warehouses. When people moved outdoors, they turned their sights and spending money to outdoor living products. People trying to adapt their homes to include office spaces, home schooling and recreation meant sales of everything from

furniture and kitchenwares to swing sets and pools.

Retail Success Stories Abound

In Quebec, Canac now has 30 outlets, with more on the way. Its low-cost business model has been immensely popular with customers and the company is set to exceed $1 billion in sales. Canac has been supporting its tremendous growth—averaging a new store every year for the past five years—with investments in distribution for both hardware and building materials.

Peavey Industries, a chain of farm and ranch stores across Western Canada, has successfully absorbed its takeover of TSC Stores in Ontario, converting them all to the Peavey Mart banner. In addition, it took over the license in Canada for the Ace Hardware brand. About 90 stores in the country with the Ace banner will get their hardware supplied out of Peavey’s distribution centres in Red Deer and in London, Ontario.

Home Hardware Stores Ltd., the country’s largest co-op retail group, has more than 1,000 retailers. Over the past two years, Home Hardware has been undergoing considerable changes internally under President and CEO Kevin Macnab, the first company outsider to helm the company. The initiatives under his direction have been reshaping the company as a retail-oriented organization rather than one that considers itself a wholesaler. The ensuing changes have affected every part of the business, from store presentation at the retailer level to how products are bought by the merchandising teams.

Continued Retail Consolidation

Along with Home Depot Canada, Lowe’s Canada, Home Hardware and Canadian Tire Retail comprise more than half of all sales by Canada’s home improvement retailers. Canadian Tire, a store format unique to Canada, sells hardware, sporting goods and automotive products. It is a key player in the retail home improvement

industry, and with more than 500 stores coast to coast, it is a significant competitor for most traditional retailers. Canadian Tire has undergone a great deal of restructuring of its retail business and is focusing on acquisitions and brand expansion—especially of private labels. It is also focusing heavily on its online sales.

Surviving COVID-19

Big boxes have done exceptionally well in recent years, gaining a record amount of market share. But independents have managed to fare well during the pandemic. One reason for independents’ successes during the pandemic has been their ability to pivot. As many provinces ordered retailers to move to curbside pickup, smaller local stores were often in the best position to execute that turnaround quickly.

On the other hand, forward-looking statements are a trickier proposition in the current climate. Retailers in every part of the country are concerned about just how long this boom can last. However, most retailers expected to come out of 2020 with positive sales gains, many of them in the double digits.

There are key trends to watch for guidance, such as an increased push by some major banners to woo pro customers, but plenty of uncertainty will continue before the Canadian market sees a new normal. In the meantime, a much-anticipated recovery is not expected to happen quickly, as retailers and vendors in Canada prepare for several more months of disruption. As a result, the industry is forecast to enjoy growth of 4 to 6 percent in 2020 and more moderate growth in the year ahead.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information