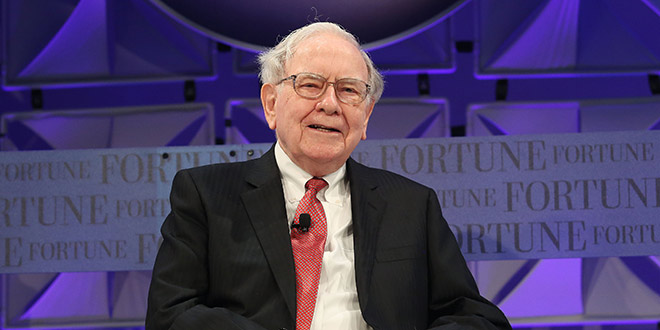

More than two years ago, Warren Buffett personally invested in the real estate empire spun out of Sears Holdings Corp. Now, his company Berkshire Hathaway Inc. is extending a $2 billion loan to the real estate investment trust that owns Sears stores, according to the Chicago Tribune.

Berkshire will provide the $2 billion loan to Seritage Growth Properties. The company is using a portion of the loan to refinance debt and add to capital, the Chicago Tribune reports.

Buffett bought 2 million shares of Seritage in December 2015 that are valued at about $85 million.

“I think he’s expressing confidence in their future profitability and growth,” David Kass, professor of finance at the University of Maryland’s Robert H. Smith School of Business told the Tribune. “Seritage gets the Warren Buffett seal of approval.”

Seritage was formed as a part of Sears CEO Edward Lampert’s efforts to turn around struggling retailer Sears and now owns 249 properties across the U.S.

“This new financing is a transformational step in the evolution of our company, which we started three years ago, and positions us to further accelerate our role as a leading retail and mixed-use developer across the country,” Seritage CEO Benjamin Schall says in a statement.

In the past, Seritage focused primarily on properties occupied by Sears, but it has shifted its direction as the department store chain shrank, the article reports. In the past year, Sears closed about 400 stores, and in June, the department store chain confirmed it was planning to close 63 additional locations, including Sears and Kmart stores, by September.

In June, Seritage reported that Sears Holdings is on track to eventually account for less than 35 percent of contractual rental income by the end of this year, down from 80 percent from when the business started three years ago.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information