Cashless retail remains a divisive topic, a recent report from Bloomberg confirms. In the article, some retailers say that by eliminating cash transactions, they provide quicker service, enabling employees to focus on customer service and complete more transactions.

Opponents say it disenfranchises low-income customers or those with poor credit. According to Bloomberg, more than 24 million U.S. households have a bank account, but also use money orders, check cashing or payday loans.

Retailers should decide what’s best for business.

J. Craig Shearman, vice president of government affairs public relations at the National Retail Federation, says the organization believes retailers should make their own decisions. Cashless bans enacted in New Jersey, Philadelphia, San Francisco and other locations are largely unnecessary, he says.

“These laws are really a solution in search of a problem because cashless stores are relatively uncommon, and many businesses prefer cash to avoid credit card transaction fees,” he says.

Cash is almost universally accepted, and most retailers are always going to accept cash. We don’t foresee that changing in the near future.

—J. Craig Shearman, National Retail Federation

Cashless retail may be more marketing than mainstay.

Shearman says much of the focus on cashless retail has been due to a few high-profile companies experimenting with cashless payments.

“There have been a few isolated examples, but it’s not something that we’re seeing at most major national chains or at most mall stores. That’s not to say some retailers won’t experiment with it in the future—the payments landscape is evolving all the time—but it’s not an industrywide trend at the moment,” he says.

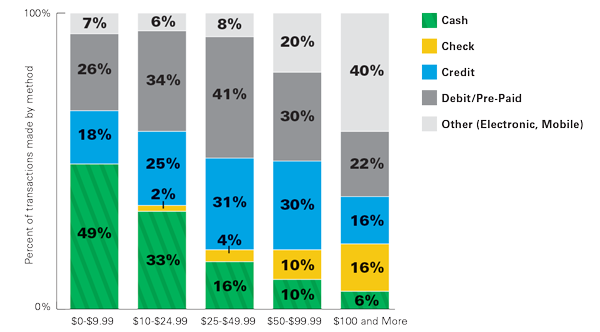

Payment Method by Transaction Size

(In Stores 2018)

Source: Federal Reserve Bank of San Francisco

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information