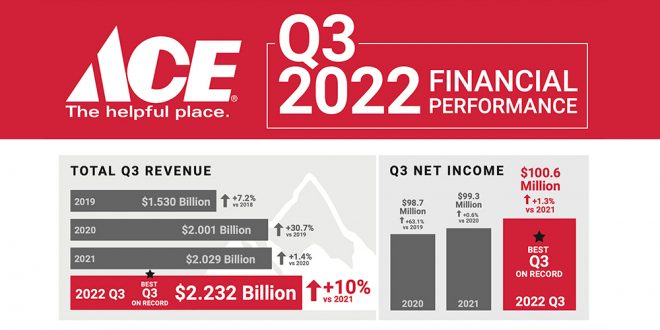

Ace Hardware Corp. reported record third-quarter 2022 revenues of $2.2 billion, an increase of $203.2 million from the third quarter of 2021. Net income was $100.6 million for the third quarter of 2022, an increase of $1.3 million from the third quarter of 2021.

“My sincere thanks to the entire Ace team for their determined and relentless pursuit of our three strategic imperatives—service, convenience, and quality—which delivered yet another quarter of record sales and profit,” says John Venhuizen, Ace Hardware president and CEO. “Revenue and income were up 10% and 1.3% respectively for the quarter. They now stand 44% and 66% higher than just three years ago. Despite, and in some cases because of rampant inflation, the Ace team continues to deliver superior financial results and exceptional customer service to and for our neighbors.”

The approximately 3,600 Ace retailers who share daily sales data reported a 5.8% increase in U.S. retail same-store sales during the third quarter of 2022. Estimated retail inflation of 11.2% helped drive the 9.5% increase in average ticket. Same-store transactions were down 3.4%.

Consolidated revenues for the quarter that ended October 1, 2022, totaled $2.2 billion. Total wholesale revenues were $2 billion, an increase of $198.9 million compared to the prior year’s third quarter. Increases were seen across several departments with holiday, paint and outdoor power equipment showing the largest gains. Wholesale merchandise revenues to new domestic stores activated from January 2021 through September 2022 contributed $51 million of incremental revenues during the third quarter of 2022, while wholesale merchandise revenues decreased $11.6 million during the third quarter due to domestic stores whose memberships were canceled. Wholesale merchandise revenues to comparable domestic stores increased $122 million for the quarter. All of this increase was the result of estimated wholesale price inflation of 12.7%.

Total retail revenues for the quarter were $193.4 million, an increase of $4.3 million. Retail revenues from Ace Retail Holdings were $192.1 million in the third quarter of 2022, an increase of $7.1 million. This increase was primarily the result of the inflation-driven same-store sales increase of 3.7% at Westlake Ace Hardware and the new stores added by Westlake and Great Lakes Ace Hardware, Inc. since the third quarter of 2021. Westlake and GLA together operated 216 stores at the end of the third quarter of 2022 compared to 209 stores at the end of the third quarter of 2021.

Ace added 35 new domestic stores in the third quarter of 2022 and canceled 10 stores. The company’s total domestic store count was 4,841 at the end of the third quarter of 2022, which was an increase of 82 stores from the third quarter of 2021. On a worldwide basis, Ace added 37 stores in the third quarter of 2022 and canceled 15, bringing the worldwide store count to 5,682 at the end of the third quarter of 2022.

Wholesale gross profit for the three months was $272.5 million, an increase of $34.4 million from the third quarter of 2021. The wholesale gross margin percentage was 13.4% of wholesale revenues, up from 12.9% in the third quarter of 2021. The increase in wholesale gross margin percentage was primarily due to increased delivery revenue and lower third-party delivery costs. Retail gross profit for the three months ended October 1, 2022, was $88.1 million, a decrease of $600,000 from the third quarter of 2021.

Wholesale operating expenses increased $24.9 million due to higher compensation and benefit expenses, greater lease expenses driven by the expansion of warehouse space and increased advertising expenses. Wholesale operating expenses as a percent of wholesale revenues increased to 9% in the third quarter of 2022 from 8.6% in the third quarter of 2021. Retail operating expenses increased $4.6 million, primarily driven by an increase in store payroll along with expenses incurred related to the new stores opened since the third quarter of 2021.

Receivables increased $100.3 million from the third quarter of 2021 due to higher sales volumes and datings for seasonal programs. Inventories increased $228.4 million from the third quarter of 2021. Approximately half of this increase is due to vendor cost inflation while the remainder is due to the intentional build-up of inventory as a hedge against supplier shortages and to increase fill rates to Ace Owners. The late arrival of spring weather in 2022 resulted in an overstock of patio and lawn, and garden inventory that will be carried over into the 2023 spring selling season.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information