COVID-19 continues to have an enormous influence on the home improvement industry, affecting DIYers and professionals in unique ways. As part of its continuing COVID-19 Home Improvement Tracker, research firms The Farnsworth Group and the Home Improvement Research Institute (HIRI) are illuminating the latest impact the pandemic is having on the channel.

The latest edition of the report now incorporates year-over-year data to explore how the pandemic has created long-lasting repercussions for the market.

“Spring is here. This is good news … because it marks the beginning of a very active DIY season,” Grant Farnsworth, president of The Farnsworth Group, says. “We’ve already seen retail sales numbers and lawn and garden sales numbers very strong for January and February compared to last year.”

Browse some of the takeaways below to solidify a strategy for your operation to meet pro and DIY needs seamlessly.

Project delays are improving for pros.

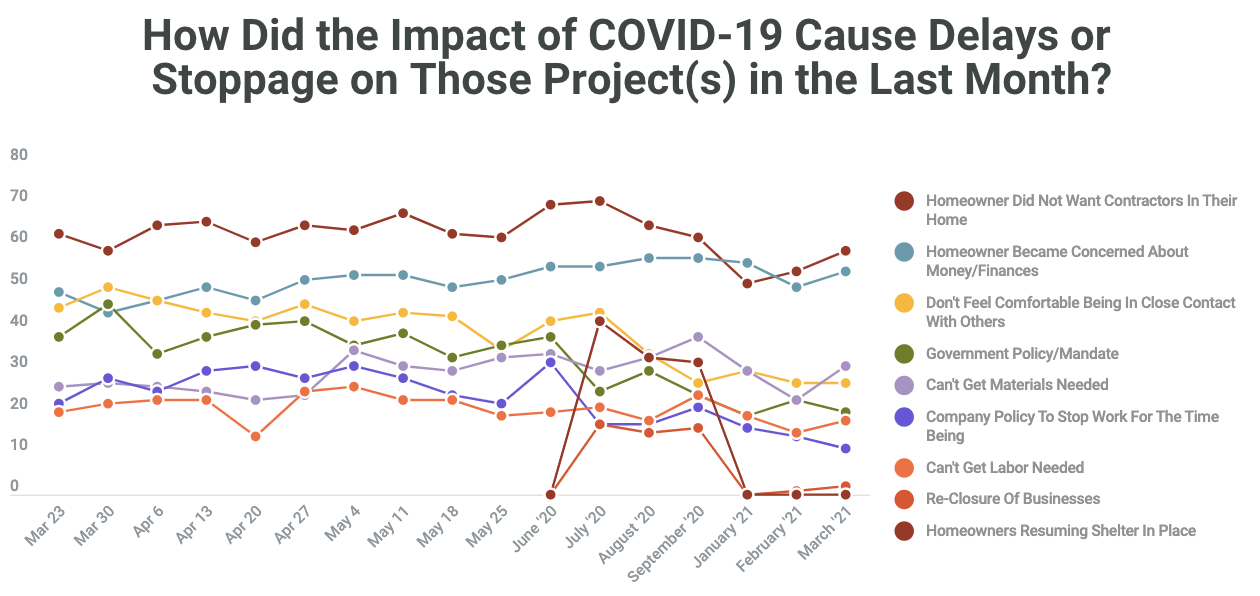

In March, 63 percent of pro contractors reported project delays associated with COVID-19, down sharply from March 2020 when 86 percent of pros cited the pandemic as resulting in project delays. The reason for these delays has remained consistent: homeowners did not want contractors in their homes, followed closely by homeowners’ financial concerns. Those delays are growing shorter, with most contractors reporting they will be “less than a month.”

COVID-19 still presents concerns for pros.

Roughly two-thirds percent of pro contractors are “extremely” or “somewhat concerned” about recent spikes in COVID-19 transmission negatively impacting their business over the next few weeks. Roughly 10 percent of pro contractors are not concerned about the possibility. Among pros, health and safety among staff is one of the top concerns regarding the pandemic.

DIY activity remains strong.

Sixty-six percent of DIYers have started a new project around their homes in the past month, up from 60 percent in March 2021. More than half of those homeowners say they did not plan to start these projects before the impact of COVID-19. Only 15 percent of DIYers stopped or canceled a project because of the impact of the pandemic in March.

Brick and mortar supports DIYers.

More than 8 out of 10 DIYers purchased home improvement products in store, but online sales are growing among these shoppers. DIYers who bought products online and had them delivered to their homes grew by 5 percent in March compared to the same period in 2020. More than 20 percent of DIYers purchased a product online, but picked it up at a home improvement store, an 8 percent increase from 2020.

On the Horizon

Farnsworth says DIY activity and pro confidence could be leading indicators for strong home improvement sales.

“March also saw 71 percent of DIYers planning to start a DIY project in the coming weeks,” he says. “This is a very positive sign and oftentimes a leading indicator for activity yet to come.”

Farnsworth credits lawn and garden projects as one of the strongest drivers of DIY activity, as well as increases in categories like lighting, flooring and smart home automation.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information