To view the complete PDF of this story, click here.

By Kate Klein, kklein@nrha.org and Sara Logel slogel@nrha.org

Earth’s biggest traditional retailer has an impressive resume: logistics powerhouse, everyday-low-price pioneer, global influencer and billionaire maker.

Starting in the 1960s, Walmart began turning retail upside down when it pioneered mass expansion of big-box discount stores. The company rapidly became an expert in buying huge amounts of merchandise, pressuring manufacturers to price products lower and lower and creating logistical efficiencies.

Today, Walmart is bigger than ever, and its 50-year-old retailing model still works.

The company, though, is no longer the innovator it was, trailing more nimble companies such as Amazon when it comes to capitalizing on e-commerce and using new technology in business. Plus, the company’s sales have been flat and, earlier this year, the retailer initiated its first large-scale closure of stores, shutting down 269 locations.

But Walmart is still a gigantic retailer, and regardless of what retail categories you sell, you are competing against this giant. Knowing how the company goes to market, as well as its strengths and weaknesses, could be critical to your success.

In the following pages, we’ll look at Walmart’s 1962 start as a fledgling business in Arkansas, its years of rapid growth and its newest initiatives. We’ll end the article looking to the future, with exclusive insight from Charles Fishman, world-renowned Walmart expert and author of “The Wal-Mart Effect.”

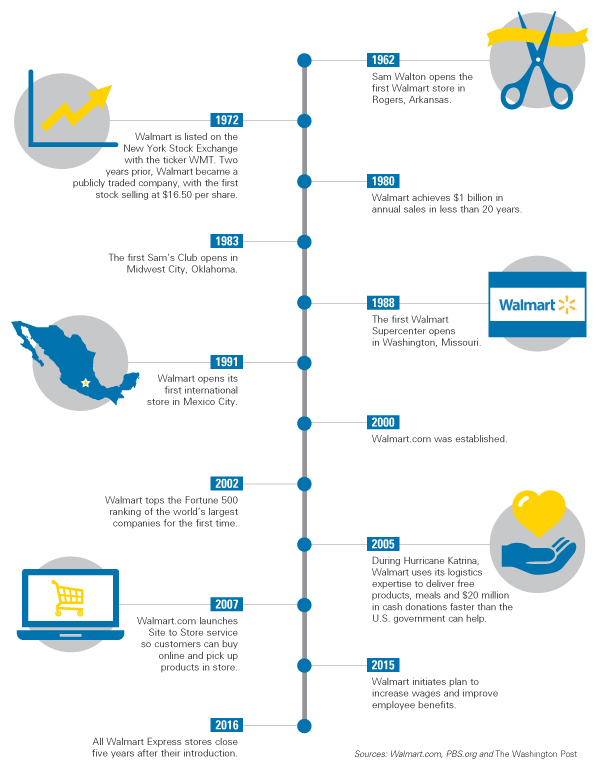

Walmart: A Brief History

A brief history of Walmart has to start with the story of Sam Walton, the entrepreneur who launched the phenomenon that, as of 2015, was still the world’s largest company.

Walton was a character who was known to pick up coins off the ground even after he was leading a multibillion-dollar company. He was an experimenter, thrifty money manager, a taker of opportunities and a dogged worker.

He had worked in retail for years when he opened the first Walmart store in 1962 that started out as a single-location underdog behind J.C. Penney, Sears, Kmart and Woolworth’s, while following the pricing lead of the era’s small discount stores.

“He decided to adopt a new strategy— discounting—dramatically cutting prices in hopes of undercutting his competition and making up the difference in price through a higher volume of sales,” Entrepreneur reports in a profile of Walton. “The practice wasn’t exactly new, but at the time, discount stores tended to be small, to be located in cities, and to only discount specialty items. Walton’s idea was to build big stores that discounted everything they stocked, and to place them in small towns.”

The model worked, and the company grew rapidly.

“I had no vision of the scope of what I would start. But I always had confidence that as long as we did our work well, and were good to our customers, there would be no limits to us,” Sam Walton said, according to a 1984 article from The New York Times.

In 1972, the company’s stock began trading on the New York Stock Exchange. In 1980, just 18 years after the first store opened, Walmart had spread across the U.S. and had more than 275 store locations. In 1991, Walmart began spreading around the world.

Consumers flocked to Walmart stores, where they could rely on getting the lowest prices on products they bought every day, instead of expecting the price markups other stores made using the high-low pricing model.

“The reason Walmart is a success is because they gave people what they wanted,” says Charles Fishman, journalist and Walmart expert.

Walton was shrewd, and he was able to continuously beat competitors on pricing by using his growing company’s sales volume and financial clout to influence manufacturers. For example, he began requiring manufacturers to open offices near Walmart’s Arkansas headquarters. A conversation with a representative from Procter & Gamble exemplifies the power Walmart had acquired.

“He said, ‘Wal-Mart accounts for more of your business than the entire country of Japan, and you don’t even have anybody who will call on me in Bentonville, much less be based here. Everything’s going to change,’” John Huey, a journalist who helped Walton write his autobiography, told Fortune magazine. “‘You’re going to open an office here. You’re going to treat us like we’re Japan.’ And he pretty much did that to the rest of the world, and as a result, he ended up taking all the pricing power away from the manufacturers.”

The company’s complex logistics system—a strategy that combines moving huge quantities of product efficiently and understanding consumers’ buying habits to stock just-in-time quantities—is still one of the company’s greatest strengths.

And the company, which has stores around the world, is ubiquitous in the U.S. “Walmart has populated the whole country with stores,” Fishman says.

What Is Happening in the World of Walmart?

Re-Evaluating Neighborhood Market/ Walmart Express

In October 2015, Walmart shared that a review of its 11,600 worldwide stores was underway. In January 2016, Walmart announced it was closing 269 stores globally in the first large-scale closing in the company’s history.

Of the 269 stores, 154 were located in the U.S. and 102 were small-format Walmart Express stores.

The smaller-format Walmart Express stores were part of a pilot program that started in 2011. The stores were an average of 12,000 to 15,000 square feet, which is less than one-tenth the size of a typical, 180,000-square-foot supercenter.

The Walmart Express stores were doomed from the start, according to a Time article.

“The company hoped its price advantage would benefit the smaller-footprint stores, and that it would complement trips to Supercenters,” the article says. “However, the company overlooked two major obstacles in doing so.”

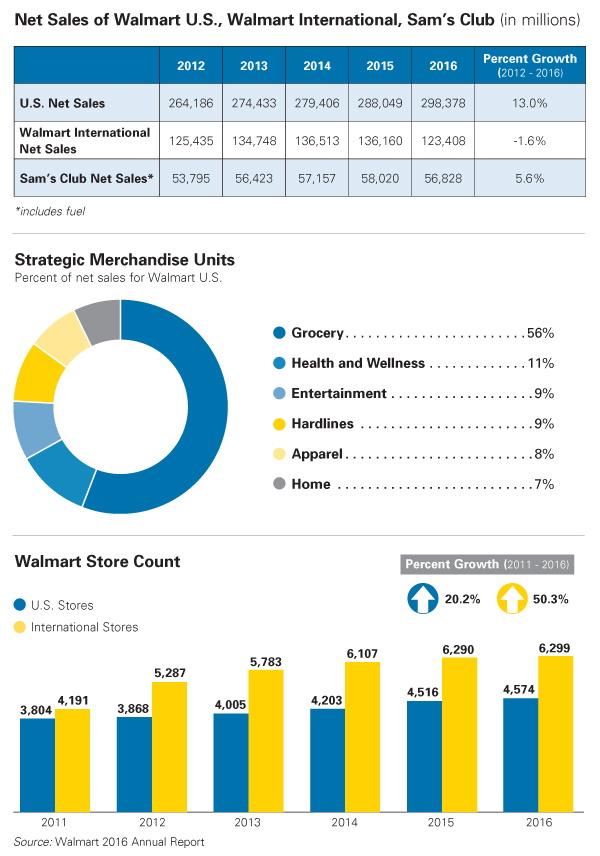

These two obstacles were that groceries have become Walmart’s dominant business–56 percent of its sales come from groceries–and the Express formats, similar in size to Walgreens stores, were too small to supply all of a consumer’s grocery needs.

“Instead of targeting urban areas as its dollarstore and convenience store rivals were doing, Wal-Mart opened Express stores in the rural Southern areas it already dominated, with the majority located within 10 miles of a Supercenter,” the Times article states.

This poor geographical targeting is different than what Walmart’s competitors are doing. Target, for example, is adding small format stores to urban areas and is selling products such as clothing and home goods.

Now that Walmart has closed all of the Walmart Express stores, the retailer will put more focus on its supercenters and Neighborhood Markets. Neighborhood Markets average 42,000 square feet and sell items found in typical grocery stores, such as food, household supplies and health and beauty items, according to Walmart. These midsized stores, which are similar in size to Whole Foods retail outlets, offer enough space for a full grocery store, unlike the Walmart Express format.

Walmart Changes Its Fuel Sales Model

Walmart is ending a 20-year partnership with fuel company Murphy USA, which operated gas stations at more than 1,000 Walmart stores. Going forward, Walmart gas stations will have Walmart branding and Walmart employees. The big-box retailer will also pick up add-on sales from cigarettes and other convenience store items. Walmart’s plans, as announced in February 2016, will include adding additional gas stations at stores. Murphy USA will operate and expand its own business elsewhere, according to USA Today. Walmart has operated its own gas stations at Walmart stores since 1997, but Murphy USA has overseen the majority of them, USA Today reports.

The Collapse of Project Impact

With more than 1 billion square feet of retail space to manage, updates and changes are constantly being made in Walmart stores. Store updates were a main focus a few years ago.

The push to remodel stores began in 2009 and was known as Project Impact within the Walmart community.

“Aimed at reducing clutter, it eliminated around 15 percent of items in the stores, according to some analyst estimates. The project would create cleaner and friendlier stores since staff would have more time to help customers,” a 2010 DailyFinance article states.

The project also removed Action Alley, the main aisle and major walkway lined with pallets of fastselling items. In addition to creating a less cluttered store with better customer service, Project Impact was also meant to hone in on categories where the competition could be beat, such as toys and crafts, says a Time article.

However, Project Impact did not go according to plan. Sales decreased within the year. The decline happened for many reasons, including that Walmart tried to get wealthier customers, who purchase groceries, and convert them into clothing and jewelry buyers, as well. This move didn’t work because wealthy families go to Walmart for only that one reason: to purchase groceries at everyday low prices. Wealthy families were checking items off of grocery lists, not looking to browse clothing racks.

The removal of Action Alley was also credited with sales decreases, so Walmart added Action Alley back to stores, along with some of the merchandise that had been removed.

Placing an Emphasis on Employees

In October 2014, Doug McMillon, Walmart’s CEO, announced that changes to Walmart’s pay scale were coming. In February 2015, McMillon laid out the plan that began in April 2015.

April 2015

• Walmart increased its starting wage to $9 per hour in all markets, and any existing employee paid below that level increased to $9 per hour.

• In addition, more than 500,000 associates received raises. As a result, the average full-time hourly wage became $13 and the average part-time wage became $10.

February 2016

• All associates hired before Jan. 1, 2016, earn at least $10 per hour.

• A new hire continues to receive $9 per hour but will increase to $10 per hour upon completion of a new training program, which could happen in as quickly as six months.

• Walmart re-evaluated its pay scale for all levels of employees. The average full-time hourly wage became $13.38 and the average part-time hourly wage became $10.58.

• Walmart also altered its benefits program and implemented a simplified paid time off policy, giving employees more control over their schedules.

All of these changes accounted for a $2.7 billion investment between 2015 and 2016.

The change in pay scale is not reaching every employee equally, though.

“Some workers are complaining that new employees are receiving relatively big step-ups in pay, bringing the recent hires’ pay close to their own. Others aren’t seeing any raise at all,” a CBS News article reports.

In addition to the increase in pay and improved benefits, Walmart is focusing on training and helping associates set goals. The new training program, Pathways, will provide training in three areas: the retail business model, the basic skills needed to do their jobs and the soft skills critical to success, according to Walmart.

“Pathways is a unique combination of handson training and demonstration of skills mastery in the areas of teamwork, merchandising and communication,” states the Walmart 2015 Global Responsibility Report. “After completion of the first step of Pathways, associates have the opportunity to choose where they would like to go, whether it’s to an hourly supervisor role or a management position in one of our specialty departments like bakery or electronics, or elsewhere.”

Going Global

Walmart is located in 28 countries and therefore is susceptible to a variety of economic fluctuations felt in foreign markets. In addition to foreign currency fluctuations, economic turmoil, such as in Brazil, also affects Walmart’s international success.

• Global Women’s Economic Empowerment Initiative: The goal of this program is to provide more training, market access and career opportunities to nearly 1 million women around the world. This initiative also aims to increase sourcing from female-owned businesses.

• Global Women’s Economic Empowerment Initiative: The goal of this program is to provide more training, market access and career opportunities to nearly 1 million women around the world. This initiative also aims to increase sourcing from female-owned businesses.

• International Portfolio: Walmart is not only modifying its portfolio domestically with the closure of Walmart Express, but it is also trimming its portfolio abroad.

“Last month, the retailer announced 115 store closures in Brazil and Latin America, while planning to open 200-240 stores in other locations in fiscal 2017,” according to research firm Market Realist. “That’s similar to the reset strategy employed in China, where the company closed several stores in underperforming locations while opening others in new ones.”

Chasing Technology Trends

In October 2015, Walmart shared its strategic plan of investing $0.9 billion in e-commerce and digital initiatives in 2016 and $1.1 billion in 2017.

“The investments outlined are part of a framework designed to drive sales growth by strengthening the U.S. and e-commerce businesses,” according to Walmart.

A substantial amount of Walmart’s online plans are in direct competition with Amazon’s services. Walmart is playing catch up rather than innovating.

• @WalmartLabs: @WalmartLabs, originally known as Kosmix—a social media firm focused on e-commerce—was a 2011 acquisition. This research division develops technology retail solutions for Walmart and created Polaris, an internal search engine for Walmart.com that optimizes product searches on the website. Polaris boosted product views by 20 percent with a conversion increase of 10-15 percent, a Reuters article states.

• Walmart App: The app includes Walmart Pay so shoppers can check out in store via smartphones. About 22 million individual people use Wal-Mart’s mobile app in a month, according to analytics company comScore.

• Walmart App: The app includes Walmart Pay so shoppers can check out in store via smartphones. About 22 million individual people use Wal-Mart’s mobile app in a month, according to analytics company comScore.

• Shipping Service: In June 2015, Walmart piloted a delivery service called ShippingPass. This service has a $50 annual fee for unlimited, free three-day shipping, according to a Fortune article.

• Vudu Spark: An HDMI-streaming stick from Walmart that costs $25 and competes with Amazon’s Fire TV stick.

• Walmart Grocery Pickup: This initiative, which is only available in certain areas, is a new way to deliver customers’ groceries. According to a Fortune article, “After a customer has placed an order online, paid and scheduled a pick-up time, he or she can pull up to the kiosk at the designated time, and punch in a code that tells the customer where to pull up. A Walmart worker then delivers the order to the car and prints off a receipt, similar to a car rental check-out, before sending the customer on his or her way.”

• Walmart Marketplace: In 2009, Walmart Marketplace launched as an addition to Walmart’s e-commerce site. It allows select third parties to sell merchandise on Walmart.com.

SWOT Analysis

Strengths

• World’s Largest Company: In 2015, Walmart was still the largest company in the world, and with that rank comes extreme strategic benefits, such as economies of scale and massive buying power.

• Carries a Variety of Products: While more than 56 percent of Walmart’s sales are from its grocery category, the retailer also offers an assortment of other categories, including health and wellness, entertainment, hardlines, apparel and home. Some Walmart stores offer automotive services such as tire installation and oil changes.

• Convenience: There are 4,574 Walmart stores throughout the U.S. According to the U.S. Geological Survey, Walmart has 1.4 locations per county in the U.S. And, according to a Business Insider article, 90 percent of Americans live within 15 minutes of a Walmart.

• Recognized Global Brand: Walmart has 6,299 store units in 27 countries, not including the U.S. Apart from the U.S., Mexico has the most Walmart stores, followed by Central America.

• Supply Chain Management: Walmart has become a supply chain expert, as it has one of the largest supply chains in the world, and has benefited from using the cross-docking inventory management system.

• EDLP: Walmart pioneered the pricing strategy of Everyday Low Prices. “EDLP is our pricing philosophy under which we price items at a low price every day so our customers trust that our prices will not change under frequent promotional activity,” states the Walmart 2016 Annual Report. “Price leadership is core to who we are.”

Weaknesses

• Poor Public Image: Walmart has experienced image issues over the years due to employee complaints about working conditions and wages and the retail giant’s impact on small businesses.

• Multiple Formats: Walmart is in more than two dozen countries and has multiple store formats, which can inhibit specialization. Early in 2016, Walmart closed its Walmart Express stores due to poor performance. As Walmart tries to expand and open more formats, it may dedicate less time and development to other areas of the business.

• Wide Variety of Products: Walmart’s strength is also a weakness. Since the average Walmart supercenter carries 140,000 SKUs, according to Business Insider, it cannot specialize. Its inventory includes bicycles, toothpaste, milk, paint, socks, crayons, baby clothes and items from nearly every other category.

• Size and Position: Walmart’s size has made it sluggish when it comes to adapting to technology and retail industry changes in recent years, and also allowed the company to get a little sloppy when expanding. That means the company has kept unprofitable stores open and allowed some product categories to become stale.

• Customer Base: While Walmart’s customers help it thrive, many of its shoppers are lower income consumers who don’t have checking accounts, let alone the ability to shop online. The company is trying to draw Amazon customers with its e-commerce platform, but has been limited by its focus, as a business, on customers looking for cheap, consumable products at the lowest prices.

Opportunities

• Expand Into More Countries: While Walmart is currently in 28 countries, there is still plenty of room for growth via mergers, acquisitions, strategic alliances and other growth methods. For example, China currently only has 432 stores throughout the country, but has a population more than four times bigger than that of the U.S.

• Various Store Formats: Walmart is not confined to supercenters. According to the Walmart 2016 Annual Report, its overseas operations include a variety of formats such as supercenters, supermarkets, hypermarkets, warehouse clubs, cash and carry, home improvement, specialty electronics, apparel stores, drug stores and convenience stores, as well as digital retail.

• Better Treatment of Employees: Walmart is changing the way it compensates and manages employees. Employees have received improved pay scales over the past two years, more training and have more flexibility with paid time off, which could positively impact customer service.

• Improvement of Online Presence: Walmart strives to offer a seamless shopping experience, be it online or in store. While it is not an online innovator like Amazon, Walmart is making strides to remain competitive.

• Refocus on Categories: Walmart’s main focus is on grocery, however it stocks substantial offerings in a variety of other categories, such as home improvement goods. Improving the customer service offered in its home improvement aisles could make Walmart more competitive in this product set.

Threats

• Change in Preferences: As consumers increasingly pursue green and healthier lifestyles, they may rethink their shopping patterns and stray from the low-cost, low-quality perception of Walmart.

• Vendor Relationships: Walmart has to consistently communicate with its product vendors to ensure it can provide customers with everyday low prices. Starting in June, Walmart will charge new fees to its vendors for the use of its distribution centers and will alter payment schedules, meaning vendors could get paid months later than in the past.

• Protecting Customers’ Information: With the recent data breaches at Target and Home Depot, along with many other retailers, Walmart could be susceptible to large-scale data theft.

• Continued Deterioration of Image: As the shoplocal movement grows, Walmart may experience some backlash as it expands in the U.S., especially through its Neighborhood Markets. Its expansions have put small stores out of business, negatively impacting Walmart’s public image.

• Competitors: Walmart’s new direct competition is online. Amazon can compete directly with Walmart on everyday low prices.

• Economic Improvements: As the economy returns to pre-recession levels, customers who may have shopped at Walmart during the downturn to save money, may not stay loyal to Walmart. Now that consumers have more money in their pockets, they are more focused on retailers that have a “competitive price” rather than the “lowest price,” according to research from The Farnsworth Group.

The Financials

Expert Perspective: Walmart’s Future

Walmart Today

Walmart has led the way on logistics and low prices and added massive stores at a breathtaking pace—but the company’s growth doesn’t look like a straight arrow upward anymore.

“Walmart, even five years ago, and certainly as recently as 2005, was dominant and felt almost undefeatable. Walmart is almost twice as big as it was 10 years ago, but it doesn’t feel indomitable anymore,” says Fishman, author of “The Wal-Mart Effect.”

Sales have been flat and, in January, the company announced its first large-scale closing of stores, shuttering all of the stores in its small-format Walmart Express pilot program, as well as some supercenters, Sam’s Clubs and Neighborhood Markets.

Those 269 closed stores were located in the U.S. and some Latin American markets, and represented less than 1 percent of store square footage and revenue in the U.S. and internationally, according to the company.

The closures weren’t financially significant, Fishman says.

“It’s significant symbolically,” he says. The closures were an acknowledgement of the company’s need to shut down what doesn’t work and run a leaner operation, but also an admission that the company makes mistakes and needs some changes, Fishman says.

And though Walmart plans to open more stores in 2016 than it closed, the closures show a cultural shift for the company, Fishman says.

“Closing stores means you sited it wrong. All the analysis of the business you were doing was wrong,” he says. “The willingness to close them, to me, indicates a certain clear-eyedness that is hard.”

The years of building blitzes and opening five locations per week are over.

The reasons include that, in the U.S., the company has saturated the market with stores and also sells from every category, so opportunities for growth are fewer, Fishman says.

“If you already sell everything, how are you going to grow? You only grow as the economy grows,” he says. Walmart hasn’t figured out how to rule the evergrowing world of e-commerce, trailing far behind online retailers like Amazon and Alibaba.

“Walmart is scrambling to catch up instead of forcing everyone else to catch up. I wouldn’t count them out, but it’s a much different position to be in to sort of look around and say, ‘We’ve got to catch up.’ In 1971, they were coming from behind, too, but they were the ones setting the agenda,” Fishman says.

Other new experiments, such as Walmart’s efforts to offer mobile payment to customers and its request for federal approval to use drones for product delivery, sound like attempts to keep up with Amazon and other brick-and-mortar big boxes, such as Target.

“To me, it’s a defensive mechanism and a learning mechanism,” Fishman says.

Opportunities for Growth

Being on the defensive, though, doesn’t mean Walmart isn’t still a gigantic player in the world’s retail future—but growth will have to look different going forward.

“One of the ways Walmart thinks it can do this is by doing much better with e-commerce, but they don’t know what they’re doing,” he says. “Their stores do literally in nine days what the website does in a year (in sales). The good news is there’s room for growth. The bad news is that they’ve been working on it for 16 years.”

Amazon is expanding subscription-style shopping for consumable goods, which is a method Walmart should know thoroughly because of the way it uses data to understand and predict customer buying patterns. Walmart excels at selling consumables, such as diapers, toothpaste and deodorant, that people buy repeatedly.

“If you are a Walmart shopper, Walmart kind of has you on a monthly payment plan” for those products, Fishman says. Yet the company isn’t making a subscription-style service work well online.

Trying in-store pickup for online orders and experimenting with other delivery methods are good areas for Walmart to be testing, and it is.

However, the company is coming from behind when trying to figure out those opportunities, especially for website sales.

“Why haven’t they figured out a way to do that in a brilliant, innovative, frictionless way?” Fishman says.

The company could also improve what it is already doing in stores, he says. “Once you’re everywhere and in every line of business, then the only way to grow is innovating in stores, then taking business away from someone else,” he says.

Walmart has run many specialty businesses, such as stationary shops and toy stores, out of business.

Now, Walmart could benefit from taking a fresh look at some of the categories it has won in, he says. The company could also improve on hardware and lawn and garden—particularly if it shifted its culture to offer more service in departments, such as hardware, where customers need help, he says.

“I think if they picked two or three departments strategically, they could really light them up,” Fishman says.

Walmart and Home Improvement

Walmart hasn’t made itself a shopping destination for home improvement products, and that has worked in the favor of independent store owners.

“I think Walmart has completely let the hardware section wither, if it ever was an important section,” Fishman says.

A typical supercenter offers some patio furniture, a few types of lawn mowers, outdoor grills and a basic selection of fasteners, hand and power tools, paint, plumbing, small electrical and storage products.

The department is weak because its product offering isn’t deep, but also because Walmart doesn’t hire knowledgeable employees to answer project questions, consistently staff the paint counter or assist customers in the aisles, Fishman says.

Consumers go to home improvement stores to solve problems, and they can only find solutions in the Walmart hardware aisles if they know what they need and can help themselves, he says.

“How do you compete? You do what Walmart doesn’t do,” he says. The home improvement marketplace has space for independent retailers for that reason, he says.

“Half the time I go to Ace Hardware, they say, ‘No. That’s not what you want. You want this.’ They redirect you,” he says. “I think that especially the smaller retailers have done a great job of competing with Walmart by helping people.”

The owner of a hardware store Fishman used to visit as a child built a business finding home improvement solutions.

“When you walked in there, he solved your problem,” Fishman says. “That world, God bless you guys, still exists. You’ve won.”

Where Is Walmart Headed?

When commenting on Walmart’s recent store closures, CEO Doug McMillon addressed growth.

“Closing stores is never an easy decision, but it is necessary to keep the company strong and positioned for the future,” he says. “It’s important to remember that we’ll open well more than 300 stores around the world next year. So we are committed to growing, but we are being disciplined about it.”

Walmart’s focus is on strengthening supercenters, Neighborhood Markets and e-commerce, and expanding pickup services, according to the company.

Experimenting and running a leaner operation are going to be key for Walmart going forward, Fishman says. Sam Walton was willing to take risks and lose money to innovate, he says.

“You’re going to have to stumble around and make some mistakes, and I think McMillon is pressing hard,” he says. “They’re going to do a lot of experiments and lose money.”

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information