This article was originally printed in the August 2014 issue of Hardware Retailing.

To view a complete PDF of the story, click here.

By the time you read this story, it might very well be outdated—but that’s the nature of today’s fast-paced e-commerce landscape. And arguably no company has made a greater effect on e-commerce, or retailing in general, over the past decade than Amazon.

From its beginnings as a small, Internet book retailer to the juggernaut it has become, Amazon has transitioned from a corporate curiosity to being anointed by many as the next evolutionary mile marker for the retail industry.

As much as has been written and discussed about the company, however, there still seems to be a basic lack of understanding of what exactly Amazon is, what it isn’t and what sort of effect it could have on home improvement retailers.

While there are a great deal of concrete facts about the company and its history, there are still many questions that remain unanswered about its future direction and the long-term effects of its products, programs and services.

On the following pages, we examine both some of these knowns and unknowns about Amazon and provide some perspective on how independent home improvement retailers can utilize this information to their advantages.

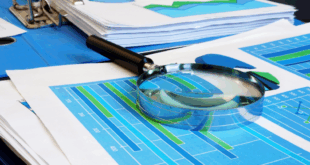

Amazon Awakens: A Competitor’s History

From books to goods, experiments with grocery delivery and drones, Amazon has a way of keeping itself in the headlines.

But before we examine what is fueling the world’s obsession with this corporation, we must begin with a discussion of its roots.

So, for a moment, let’s journey back in time— way back to the past century, when Bill Clinton was in the White House, “Seinfeld” was the top rated television program and people were listening to Sheryl Crow on a device known as a radio.

Sarcasm aside, Amazon only began its corporate journey in 1994 — a relative blink of an eye for many independent home improvement retailers who mark their histories in generations, not decades.

In that short span, however, Amazon has quickly reset the bar when it comes to retail growth.

The company was founded in 1994 in Seattle by former Wall Street investor Jeff Bezos who had a vision to harness the virtually limitless reach of the Internet as a means to sell books.

The concept was relatively simple—become “the world’s biggest bookstore.” Even the largest brick-and-mortar bookstores could only offer customers a finite inventory. Because these retailers had to physically stock the books on shelves, they also had to deal with costly and cumbersome supply chains. Bezos and Amazon would cut through both of these barriers. By simply categorizing titles and descriptions of books on the website, the company could list hundreds of thousands of titles.

Lastly, books represented the ideal starting point for Amazon. Consumers didn’t have to “try on” books like they would need to with clothing. Consumers didn’t have questions about whether a book was of “good quality” like they would with a tool. Consumers didn’t need to ask a live person questions about how to use a book, like they might with a stereo or TV.

An early filing made by Amazon with the SEC summed up this notion: “…Consumers can make educated book-purchasing decisions using online information. Books can be selected and sampled effectively through online synopses, excerpts and reviews and have consistent quality across retailers.”

Consumers liked Bezos’s model.

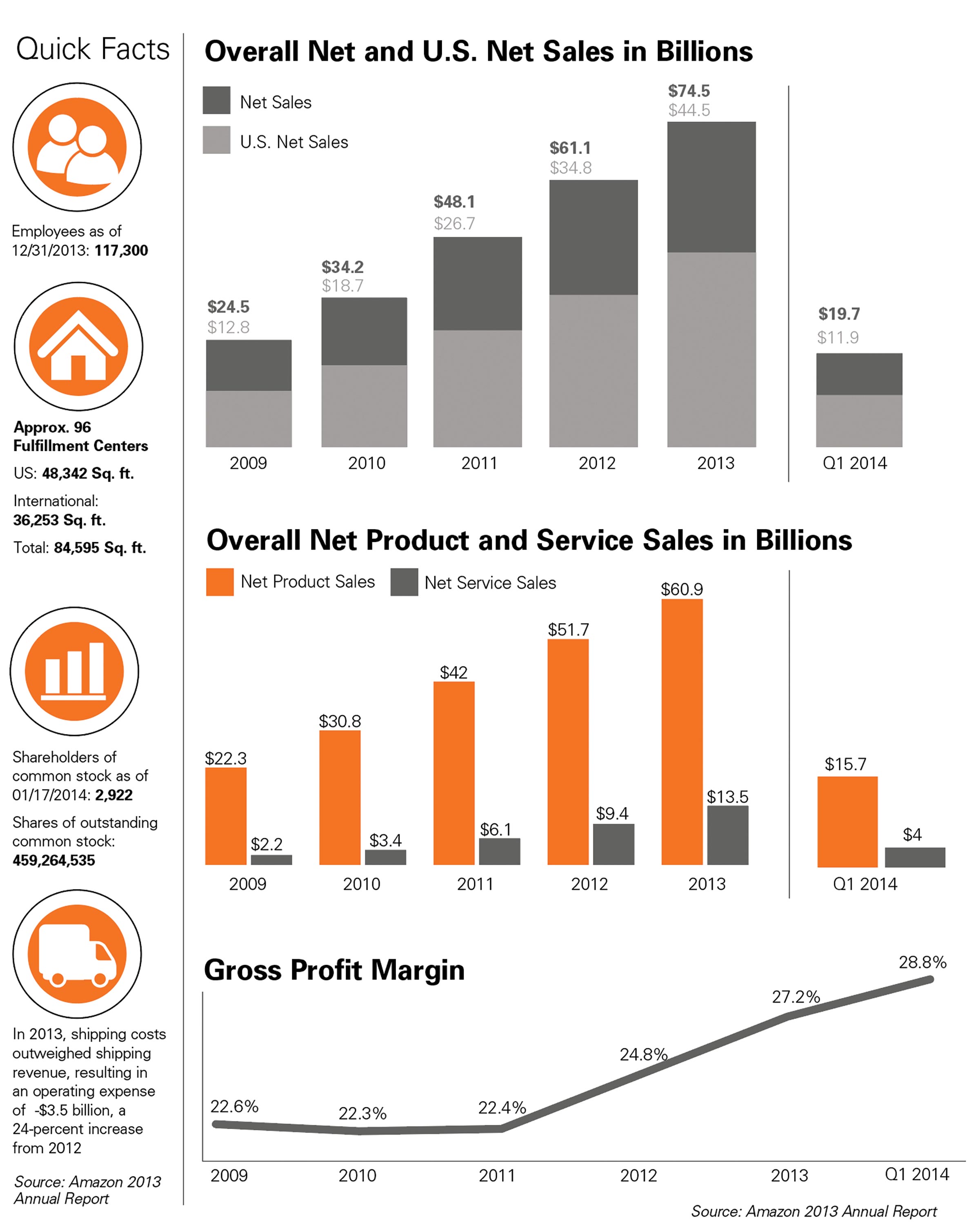

In 1995, the company reported annual sales of $511,000. By 1996 (the year before Bezos took the company public) those sales had reached $15 million. This past year, Amazon recorded net sales of nearly $75 billion. In just two short decades, this small Seattle startup had punched the retailing industry square in the face. Not only did it sound the death knell for large book sellers, but it also put all other retailers on notice that there was a new kid on the block.

Why do People Use Amazon?

Convenience

Amazon is a dominant online force, with more product searches starting at Amazon than at search engines. In fact, according to Mark Herbek, a research analyst at the Cleveland Research Company, 30 percent of U.S. product searches begin on Amazon.

Delivery

Amazon currently has no brick-and-mortar locations, saving a lot of money on the operating expense line. It does ensure distribution centers are strategically located throughout the United States. As of December 24, 2013, Amazon also has patent protection on its algorithm technology for “anticipatory shipping” that allows Amazon to prepare shipment for orders that have not been placed yet.

Digital Content

According to a global survey of online shoppers published by Pricewater-houseCoopers, over one-fourth of people in the United States shop online weekly. Amazon’s long-time tenure in the marketplace puts it at an extreme advantage. Due to its online origins, Amazon can perfect its consumer shopping experience rather than composing it. Just because it began online, however, doesn’t mean brick-and-mortar stores won’t be in Amazon’s future, particularly with the launch of the Fire smartphone and the popularity of its tablets. Amazon could very well create physical stores to potentially display its tech gadgets.

Pantry Loading

Amazon is a one-stop shop. People are willing to shop differently to stock up on products much like they would a Sam’s Club through Amazon. This way they take advantage of one shipping cost but have access to bulk items at great prices. Customers can find everything they need from toilet paper to a UFO detector.

Product Depth and Breadth

As mentioned in Amazon’s 2013 Letter to Shareholders, the company offers a wide product offering. Not only does Amazon sell a variety of products from third-party vendors, but it also has products it has developed over the years from its Prime member program, its variations of Kindle, Prime Instant Video, Fire TV, Amazon Game Studios, the Amazon App Store, Audible, Fresh Grocery and Amazon Web Services (Cloud computing).

Subscribe and Save

Amazon’s loyalty program, Amazon Prime, offers members free two-day shipping for an annual fee of $99. According to an International Business Times article, Amazon Prime had around 16.7 million customers at the end of September 2013, up more than 70 percent from the previous year. The article goes on to cite a report from Consumer Intelligence Research Partners that estimates Amazon Prime members account for 56 percent of Amazon U.S. product sales and buy 50 percent more frequently than non-Prime members. Members also buy more expensive items spending around $1,340 per year, compared to $708 per year for non-Prime customers. Amazon Prime is actually rumored to lose Amazon money since shipping expenses Amazon incurs exceed the annual subscription fee.

Consumer Analytics

Well-known for its data mining and predictive shopping techniques, Amazon dominates in shopper recommendations and upselling.

Prices

Amazon prides itself on having the lowest prices by utilizing low overhead costs and leveraging volume buys with merchants.

Amazon Then and Now

Amazon 101: Features You Should Know About

Amazon Prime

This membership-based service was added as an option for Amazon users beginning in 2005. For an annual fee (currently $99 annually), Prime members secure access to a range of benefits, including free two-day shipping on eligible purchases, unlimited streaming of music, movies and videos; access to a “lending library” of Kindle book titles and the ability to use Amazon’s Prime Pantry feature, which allows users to ship groceries and other household items for a flat fee.

Amazon Marketplace

Amazon launched its Marketplace feature 14 years ago as a way to offer additional product categories through its web portal. Amazon Marketplace allows other retailers to offer fixed-price products through Amazon. The Marketplace is open to a range of merchants selling products from hardware and tools to SCUBA gear. Merchants, however, must apply and meet certain criteria to participate in the Marketplace. Marketplace merchants must also agree to pay a fee to be in the Marketplace as well as a per-transaction fee for each sale. To date, all sorts of retailers utilize the Marketplace as a way to augment sales through their own websites or brick-and-mortar stores including a range of home improvement retailers.

Amazon Supply

Amazon Supply

AmazonSupply.com is a B2B business site targeting the wholesale and distribution market. It is currently in beta state and stocks more than 750,000 products for business and industry. It provides benefits such as 365-day return policy, free two-day shipping on orders more than $50, and a customer service team that provides help over the phone. According to an article in Forbes, Amazon’s CEO, the selection is extensive, “covering 17 product categories from tools and home improvement to janitorial supplies, stocking everything from 12-packs of Hawaiian Punch to schedule-40 stainless steel pipe.”

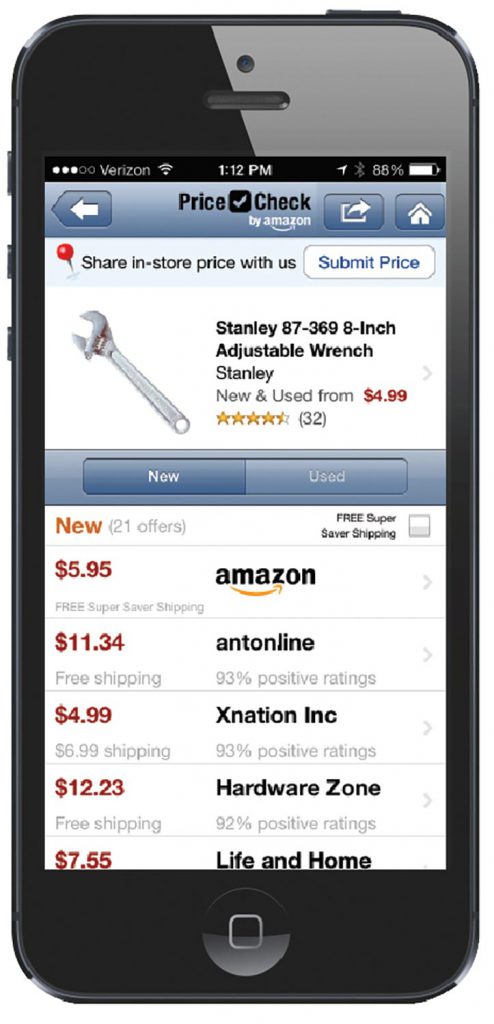

Amazon Local

This is a service Amazon users can subscribe to that provides them with special deals and coupons for retailers and service providers in their local trading areas. Consumers receive these periodic deals from local merchants who participate in the service as well. Consumers purchase the goods or service through Amazon, which then issues payment to the participating merchant twice each month. There is no up-front cost for merchants to participate in the service; however, merchants do have to pay Amazon’s “marketing fee” out of the purchases customers make through the website.

Amazon Coins

This is an Amazon- and Android-specific currency users can exchange for products using either service. Consumers can purchase these coins in bundles to receive discounts.

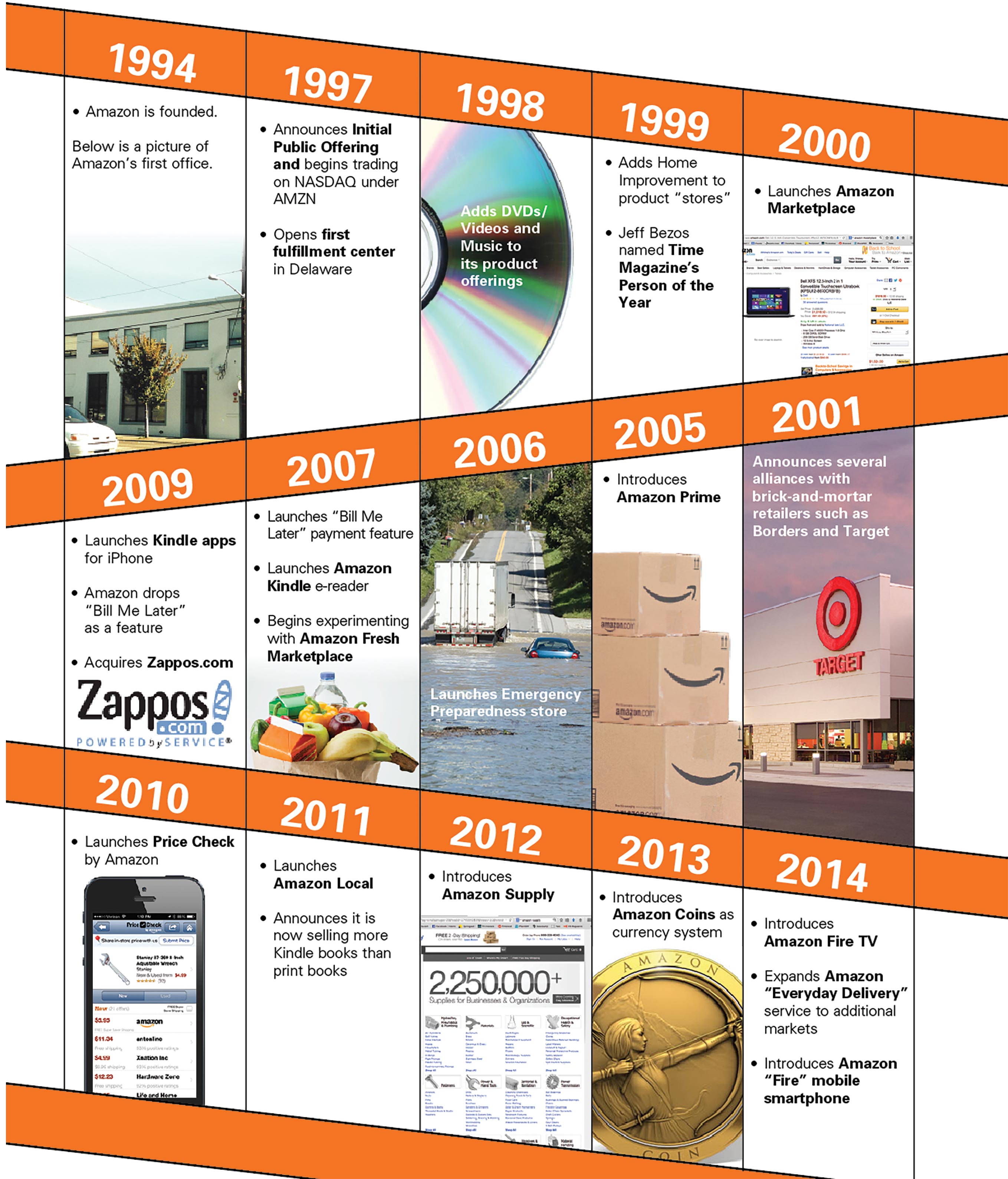

Amazon Price Check

This is a mobile app for both iPhone and Android users that is Amazon-branded. It functions like many other price-checking applications and allows users to scan a product’s barcode, type in a product name or snap a picture of a product. Then, the app will present the user with the different prices being charged for the product through Amazon and its merchant partners. The app will also provide additional information about a product or even allow users to share the “in-store” prices they are finding on an item to “ensure (Amazon’s) prices remain competitive for our customers.”

Amazon Supplying Solutions

From school supply closets to factories, Amazon identified a tremendous growth niche for its services in the business-to-business arena. Its next step was the creation of Amazon Supply, a service tailored to meet the needs of B2B users.

The B2B user, who doesn’t necessarily need something right away, doesn’t covet a trip away from the office to buy supplies and cares about ease and convenience perhaps even more than price, was an ideal customer for the Amazon model.

The B2B user, who doesn’t necessarily need something right away, doesn’t covet a trip away from the office to buy supplies and cares about ease and convenience perhaps even more than price, was an ideal customer for the Amazon model.

To appeal to these users, Amazon Supply offers a host of benefits targeting their unique demands from a supplier, including:

- Free two-day shipping on orders more than $50.

- A dedicated phone-support team for users.

- 365-day return policy (versus 30-day for the traditional site).

- A focus on goods such as janitorial, light safety, sanitation and consumables.

According to Mark Herbek and the Cleveland Research Company, there are several factors that could work to AmazonÕs advantage when servicing the B2B market.

First, according to Herbek, is the sheer breadth of Amazon’s SKU assortment, which measures in the millions. Second, the B2B supply market is large and fragmented and a consumer segment whose use of the Internet for order fulfillment is growing at a rate that is 1.5 to 2 times as fast as other industry sales.

On the other hand, Herbek notes that the B2B market can also be very difficult to service without a local resource that can deal with issues or that has a knowledge of a specific business’s needs. He also points to the difficulty of Amazon to manage and implement services these customers are typically accustomed to, such as higher volumes or frequency discounts.

Amazon Gets Local

Amazon Local is a growing marketplace of businesses promoting everything from daily deals to unique experiences, similar to Groupon; however, Amazon acts more as an aggregator of these services than an initiator. In fact, some of the deals are actually offered directly through popular daily deal provider LivingSocial.

Part of the lure of Amazon Local for merchants is the service’s ability to help small businesses get discovered. Amazon helps market businesses and services through various channels, including the Amazon website, its mobile app and email lists. Sophisticated software allows Amazon to target customers that fit demographic and geographic information. The service even offers metrics to help merchants measure their promotions’ success.

Daily deals are as much about advertising as they are about commerce, and it is still yet to be seen if Amazon can compete with Google, Yelp and Foursquare in local advertising.

Amazon and Home Improvement

While e-commerce sales have grown exponentially for many consumer goods, the growth has been slower to affect home improvement and building supplies. There are many reasons for this slower path to growth, from consumers’ immediate needs for products (think toilet flush valves) to the costly nature of fulfillment on larger items (think drywall or wheelbarrows).

And even though consumers and professionals have been slower to turn to the Internet for their home improvement purchases, there is no doubt online sales (Amazon included) have still affected how and where consumers shop for their needs. According to a report from the Cleveland Research Company, online sales of building supplies in 2013 amounted to only 4 percent of overall industry sales. This doesn’t seem like much when compared to the 19 percent of sales in the consumer electronics market flowing through the Internet. However, Cleveland Research also predicts the online market share for home improvement goods could grow to as much as 19 percent over the long term.

For right now, Amazon continues to serve as just one option for consumers and pros when it comes to purchasing their home improvement products.

Currently, Amazon controls more than 30 percent of the total ecommerce sales for building supplies, according to The Cleveland Research Company. Home Depot and Lowe’s combined ecommerce sales in this category amount to slightly more than 40 percent.

Research does suggest, however, that consumers are indeed shopping more for home improvement products online. According to a recent study from the Home Improvement Research Institute, consumers shop for home improvement products online across nearly every category, from hand tools and accessories to building materials.

The HIRI study goes on to show that the top five categories consumers shop for online include: lawn and garden, hand tools, kitchen and bathroom accessories, power tools and electrical and lighting.

When it comes to Amazon’s sales in home improvement products, they seem to range all over the spectrum as well. Though Amazon doesn’t report sales figures by segment, a quick look at the home improvement and tools store on Amazon shows items ranging from water filters and flashlights to stud finders and batteries among its list of current best-selling products.

When it comes to Amazon’s sales in home improvement products, they seem to range all over the spectrum as well. Though Amazon doesn’t report sales figures by segment, a quick look at the home improvement and tools store on Amazon shows items ranging from water filters and flashlights to stud finders and batteries among its list of current best-selling products.

When Amazon first began a push into home improvement product sales several years back, speculation about how successful it would be swirled around whether it would be able to drive beyond the sales of the occasional Father’s Day gift or replacement part. The key to Amazon’s ability to really affect the home improvement category would be whether it could utilize same- or next-day delivery to meet homeowners’ immediate needs.

To date, Amazon still hasn’t cracked this barrier. Though quicker delivery and Prime membership can get products to consumers quickly and inexpensively, there still seems to be a challenge delivering on these “immediate-need” items.

Even with Amazon’s success in the home improvement category yet to be decided, most analysts believe its growth in the category will be felt by the big boxes.

“Other than Amazon, small hardware stores stand to gain in the retail shakeout sure to come,” Laura Heller wrote in a 2012 Forbes article. “As anyone who’s ever taken on a home improvement project knows, there are the inevitable return visits for missing parts and tools. The small things Home Depot and Lowe’s rarely even stock. Amazon’s gain is Home Depot and Lowe’s loss, and it could help to resurrect the neighborhood hardware store.”

Combating Amazon’s Allure

For home improvement retailers, one of the most important takeaways you can get from any review of Amazon is a better understanding of what consumers find appealing about the model. Armed with this information, retailers can better evaluate how these consumer demands can be addressed in their own businesses. Below are a list of suggestions from Cleveland Research Company, NRHA and others about how to translate some of Amazon’s attractive features into your operations.

1. Improve your website.

A study from the Cleveland Research Company shows 80 percent of survey respondents agree that a physical store is an advantage versus e-commerce competitors.

2. Personalization.

According to a global market study by research group McCann Truth Central, 57 percent of people worry they will not discover new products if companies always show them exactly what they are shopping for (not limited to online shopping). Sixty-six percent of shoppers are looking to be inspired while shopping. These two data points prove product knowledge and human interaction are key in providing a personalized shopping experience.

3. Offer buy online, pick up in store.

Even something on a website that can trigger an order to be pulled and waiting for a customer when they stop by after work can enhance a retailer’s convenience-based value proposition.

4. Help consumers shop in-store quicker.

Act as the Amazon shopping cart by making recommendations and becoming familiar with your customers. According to WalkerSands Communications, 44 percent of consumers want product recommendations based on past purchases.

5. Be right on the floor and in the ad.

Pricing has to be sharper than ever, defensible, flexible and consistent. Aggressive adoption and promotion of variable pricing is key here.

6. Customer reviews.

Monitor online customer reviews from different platforms and have a plan of attack for negative reviews. Also be willing to share customer-provided product reviews.

7. Focus on value-add services.

Amazon’s loyalty program, Amazon Prime, provides a host of premium services including free shipping. Customers find value in this program and are willing to pay the annual subscription, even when the price increased by $20 this past year.

8. Utilize seasons and immediacy of certain categories.

One-day buys, closeouts and items that customers need right away are areas that Amazon cannot necessarily compete in.

9. Consider more exclusives and brands.

Private-label products or channel exclusives that aren’t available through Amazon can obviously help reinforce a unique brand.

10. Use more local and regional inventory.

Not only is this merchandise often unavailable through larger chains and online outlets, it also helps send the message to customers that a store is part of the community.

Source: Cleveland Research Company contributed to this section.

Amazon at a Glance

Amazon SWOT Analysis

Strengths

1. Go-to online retailer: Amazon is dominating online sales across several industry sectors. What’s more, Amazon returns more product searches than any other search engines.

2. Wide product offering: In addition to selling third-party products, Amazon continues to grow its market share by venturing into its own new product lines such as Prime Instant Video, Fire TV, Amazon Game Studios. In addition, Amazon is starting to explore new services such as grocery delivery and cloud computing services. This growth is calculated and purposeful as the company explained the growth as part of its strategic plan in its 2013 Letter to Shareholders.

3. Customer satisfaction: Many critics to online retailing cite challenges in customer service and satisfaction; however several reports indicate Amazon ranks the highest in customer satisfaction.

4. Marketing: Amazon has redefined shopper recommendations and upselling, making it easier than ever for consumers to read what others are saying about products. Amazon has become well-known for its data mining and predictive shopping techniques and is even in the process of patenting its algorithm technology for “anticipatory shipping” that allows it to prepare shipment for future orders.

5. Loyalty program: Amazon Prime has become a benchmark in customer loyalty programs. As mentioned previously, Amazon Prime offers members free two-day shipping for an annual fee of $99. While it is rumored that Amazon Prime actually costs Amazon money, the program has redefined customer loyalty and created new anticipations for customers on what loyalty programs should be.

6. No physical retail stores, but with warehouses everywhere: Because Amazon currently has no brick-and-mortar locations, it is able to save on expensive overhead and operational costs. Coupled with strategically located distribution centers, Amazon is still able to deliver products quickly and efficiently.

Weaknesses

1. Low net profit margin: According to an article in The Guardian, the net profit margin Amazon generates is alarmingly low compared to the amount of annual sales generated. Maintaining a steady growth in sales that reached $74.5 billion in 2013, Amazon only generated a net profit margin of .37 percent ($400 million in profits), compared to Home Depot’s 6.83 percent net profit margin, according to Hoovers Database.

2. Bad publicity: Amazon has recently been exposed for its alleged poor working conditions in warehouses.

3. Limited to online presence: Amazon has no brick-and-mortar presence like its top competitors Apple and Wal-Mart. While this is beneficial on the operational cost side, many consumers still value physical shopping experiences.

Opportunities

1. Online shopping: More consumers are turning to online retailers as a viable option for shopping. Amazon’s tenure in the marketplace puts it at an extreme advantage compared to its competition. Amazon has spent more than a decade building up trust with its current customers. It has also used that time to perfect the online experience. Considering its current financial state, it would not be required to immediately open physical stores, so it can explore the option in a calculated and precise manner; where many consumers are demanding online shopping alternatives forcing many competitors to pump resources and time into e-commerce prematurely.

2. Profit margins: Earlier this year, Amazon increased its Prime membership fee from $79 to $99. This small increase translated into millions of dollars of additional revenues from its current customer base. Either the increase was nominal enough for consumers or Prime offered enough value that membership numbers did not show a substantial decrease due to the rate hike.

3. International expansion: Currently Amazon operates in a handful of countries outside of the United States. This infrastructure could create more opportunities for customer growth and delivery efficiencies.

4. Amazon Product Development: As of June 19, Amazon began releasing its own product lines including Amazon Fire TV, Kindle Fire and e-reader, and now the Amazon Fire Phone.

Threats

1. Intense competition: As mentioned previously, the competition Amazon faces is fierce. Amazon’s 2013 Annual Report states, “Our businesses are rapidly evolving and intensely competitive, and we have many competitors in different industries, including retail, e-commerce services, digital content and electronic devices and web and infrastructure computing services.” It recognizes customers’ ability to comparison-shop, which is becoming more plausible with technological advancements. Hoovers Database recognizes Apple, Barnes and Noble, and Wal-Mart as Amazon’s top competitors with Best Buy, Costco, and Home Depot later down the list. These diverse competitors illustrate the array of products Amazon offers.

2. Fluctuating market: Consumer spending correlates to the economic environment, leading to a fluctuating and variable marketplace. Amazon’s success depends on how accurately it can predict consumer demand and then stock those products. Its product offering must align with future trends. Seasonality also threatens Amazon, due to 35 percent of yearly sales occurring in the fourth quarter.

3. Supplier relations: Amazon works with thousands of suppliers and third-party sellers. If these relationships falter, it could greatly affect Amazon’s supply chain and product offering.

4. Security breach: As seen previously with Target’s big data breach, security is a prevalent issue within this technological age. Amazon is vulnerable to security breaches, as all transactions occur online. Protecting customer data is vital in maintaining a functional and trustworthy retail establishment.

5. Freight costs: Even though Amazon is known for its exceptionally fast shipping, increasing shipping costs may hurt the company’s bottom line in the future. As of September 2013, 9 percent of net sales was tied up in shipping costs, and postage has since increased for USPS, UPS and FedEx. Logistics will be key to ensuring shipping costs stay low as the number of two-day shipments imparted by Amazon Prime members increases.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information