Summertime in North America is traditionally a season of momentum for the home improvement industry. Construction crews take advantage of warm weather to build new homes and offices. Families spend more time outdoors, discovering small projects—a doorknob to replace, pavers to upgrade—that prompt a trip to the local home improvement store.

COVID-19 has upended traditions. Since March, when many states and provinces began enacting stay-at-home orders, the novel coronavirus has disrupted almost every facet of the home improvement industry: from supply chain stability and product availability to the basic ways you greet your customers. Home improvement retailers have persevered, serving customers with strapped wallets and frayed nerves. The effects of COVID-19 on home improvement have been staggering, but not insurmountable.

High Performance Retailing spoke to three experts representing three fields critical to home improvement success to help you make sense of an unprecedented situation and learn more about the effects of COVID-19 on home improvement. Learn how new regulations for face masks are affecting retail, how U.S. homebuilders are contending with COVID-19 and the pandemic’s effect on the U.S. economy in the first half of 2020 and the months to come. Use their insight to guide your business safely and efficiently in the months ahead.

Uncovering New Guidelines

The Legal Implications of Protective Masks in Retail

Julie Schweber

Julie Schweber

Senior Knowledge Adviser

Society for Human

Resource Management

shrm.org

As home improvement operators balance a new set of health and safety guidelines alongside shifting customer service expectations, Julie Schweber, senior knowledge adviser for the Society for Human Resource Management (SHRM), offers clear guidance to retailers.

Many retailers are mandating masks be worn in stores. Does SHRM have guidance on the use of masks in retail?

Above all, an employer should check their state or county regulations. In some areas of the country, local or state governments are requiring public retail workers to wear masks. Some locations are even requiring customers to wear some type of face covering before entering a retail establishment.

By the same token, even if wearing a mask is not specifically required, OSHA regulation says business owners have a general duty clause, which applies to recognizing potential hazards in the workplace.

Employers have to be aware of potential hazards and act to prevent or minimize them in the workplace, so COVID-19 could meet that definition. OSHA requires business owners to assess those possible risks and develop an action plan. That means retailers must list the steps the employer is taking to minimize them, which can include revised cleaning protocols and employee training.

How should employers handle situations where an employee does not want to or cannot wear a mask?

If a state requires anyone in a public-facing job to wear a mask, an employer might want to start by training and educating employees to follow local guidance. Sharing the benefits of wearing masks and how to properly care for them will also be especially important. Sharing the rationale behind any decision an employer makes is crucial to help employees understand why it’s so important. Don’t present wearing a mask as an ultimatum. Help employees understand why you or your city are encouraging employees to wear them.

If someone has a preexisting condition that prevents them from wearing a mask, an employer should know that it might represent a potential disability, which would include Americans with Disabilities Act protection.

At that point, having a constructive conversation about what else could be done to accommodate an employee with a medical condition would be the right step. Maybe there is a certain type of mask that works better for their condition, or maybe their work could be done away from customers or other employees to limit interaction. It might have to be a one-on-one conversation with every employee to gauge their comfort level.

Housing Struggle

COVID-19 Disrupts Construction Momentum

Robert Dietz

Robert Dietz

Chief Economist

National Association

of Home Builders

nahb.org

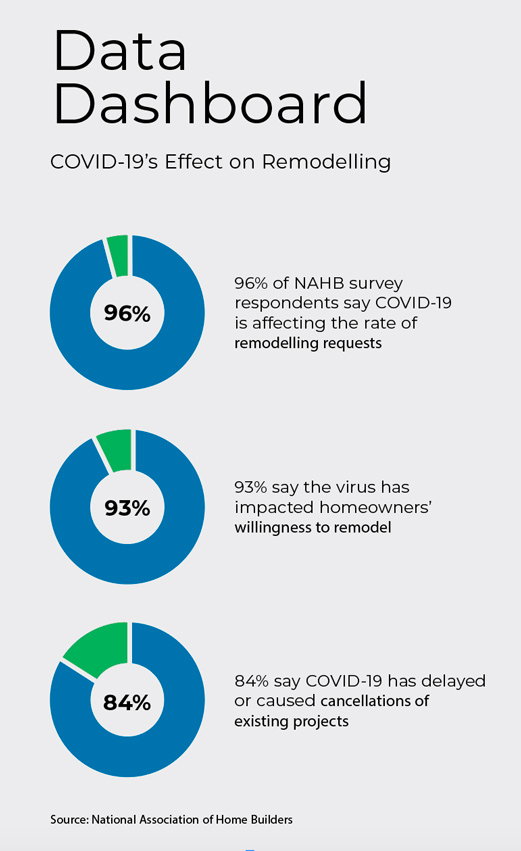

The National Association of Home Builders (NAHB) regularly surveys its members to gauge their confidence in getting new jobs. In December, that figure hit a 20-year high. In April, the same metric plunged to an all-time low as COVID-19 paralyzed home construction in the U.S.

How has COVID-19 impacted the 2020 housing market?

We entered the year with a pretty strong builder sentiment: We had seen greater new home sales and single-family construction. We were expecting 2020 to see about a 3 percent gain in single-family building starts, and some were even projecting up to 7 percent. We had low unemployment, and we had strong housing formations. Apartment construction in 2019 had the best year since the Great Recession, and remodeling continued to be solid. That all changed.

In April, builder confidence took a 42-point drop, the largest we’ve ever seen. It was the first reading below 50 since 2014 (and 50 denotes a neutral outlook). What that points to is a sharp decline in single-family home construction in the middle of this year. We anticipate single-family starts will be down about 20 percent through 2020, but we see the beginning of a rebound in the second half of this year.

If the economy can open up safely, and we can get through some additional economic weakness we anticipate in the third quarter, the construction industry could be on its way to a recovery in the coming months.

How does COVID-19 compare to the housing crisis a decade ago?

How does COVID-19 compare to the housing crisis a decade ago?

There are many differences between the Great Recession and what we’re experiencing now. COVID-19 is biological, while the Great Recession was largely due to a financial crisis. Going into 2008, we were overbuilt. There was a surplus of housing, which lowered overall home prices. Today, there’s a deep deficit of up to a million residences throughout the U.S. That shortage matters because while there could be some weakness in near-term home prices as demand falls off and unemployment goes up, in the long run, home prices will probably remain steady because of the limited supply of resale and new homes.

How can U.S. construction and the economy begin recovery?

Housing’s share of the U.S. GDP is right around 15 percent, so home building’s impact is huge in the overall U.S. economy. On average, every single-family home built supports the equivalent of three full-time jobs in the labor force. Every apartment is one full-time job and every $100,000 in remodeling is one full-time job. Then there are downstream benefits of construction: building supply manufacturers, home improvement stores and others. Real estate is high volatility, but it has a really high multiplier effect because that market stimulates construction and retail sales directly.

As we begin to open up local economies safely, most economists would agree construction and manufacturing are two industries where you can practice social distancing measures. These sectors have a huge impact on the U.S. economy and could eventually help lead an overall economic recovery.

What are homebuilders saying about jobs in their areas?

Homebuilding was considered an essential service and allowed to continue during most stay-in-place orders. Buyer traffic is down, but we witnessed more activity toward the beginning of May. As cities and states begin opening up as the pandemic subsides, you’re going to see more activity.

It’s important to remember construction doesn’t require a dense concentration of people in the same way a retail store might. The typical construction site has fewer than 10 people at any given moment, so they can spread out. We’re hearing some jurisdictions are being flexible and are allowing for virtual inspections or one-on-one tours of properties to reduce the number of people on a job site. We’re going to have to continue these kinds of measures for the foreseeable future, but when you think of an economic sector that can continue and provide a lot of economic impact, U.S. home construction is one of them.

What would you want home improvement retailers to know about U.S. construction in the months ahead?

It’s probable that home remodeling will fare better than construction in 2020. Remodeling did decline after the Great Recession, but nowhere near as sharply as multi- and single-family home construction. Our data suggests some homeowners are uncomfortable with having workers in their homes, but we are seeing relative strength for repair and remodeling done outside the home.

As we begin to open up and deal with a new reality, we’ll need to recognize a fundamental change in people’s perceptions of their homes and what they can do. More people work from home, and we don’t see that trend reversing. If that becomes permanent, they’ll want a true home office, even spaces for home gyms.

Based on NAHB surveys, some builders indicate they are concerned about access to certain building materials. They’ve mentioned certain lighting and plumbing fixtures and specialized window and door hardware, so ensuring retailers carry those products could directly benefit builders.

A Variable Situation

COVID-19 Dampens Consumer Optimism

James Bohnaker

James Bohnaker

Associate Director of Economics

IHS Markit

ihsmarkit.com

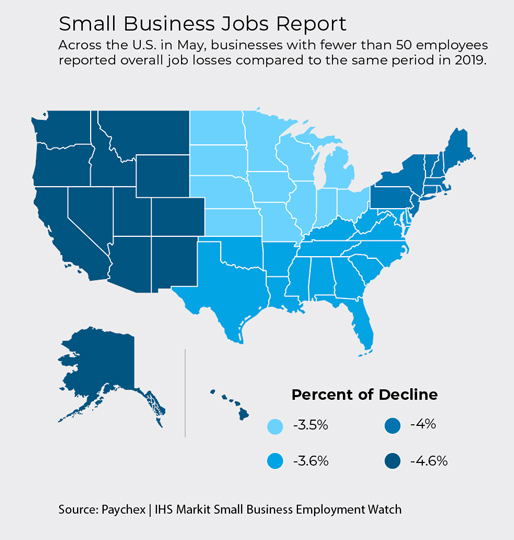

COVID-19 has brought economic instability not seen in generations. In response, the U.S. government has readied more than $2 trillion in economic aid through the CARES Act. As of June 2020, more than 40 million Americans remain unemployed, putting massive strain on the U.S. economy and the home improvement channel. James Bohnaker of IHS Markit walks readers through some of the leading economic indicators for U.S. retail.

What is your greatest economic concern amid COVID-19?

Given the unprecedented nature of this situation and knowing that it’s tied to a health pandemic, my biggest concern is that we won’t get a handle on the disease and that it will last for much longer than we expect, or we have recurring outbreaks. That would cause a situation where we’re in an uncertain mode where we don’t know if businesses can only reopen temporarily: that would be the worst-case scenario for a lot of businesses, especially nonessential retail.

Have stimulus payments sent to U.S. families had a tangible effect on the economy?

Have stimulus payments sent to U.S. families had a tangible effect on the economy?

Stimulus payments and the extension of unemployment insurance benefits have had a bit of an impact. Pretty much all of those payments were sent out April 15, and in the week following, we did see a rise in consumer spending. We saw increased spending in grocery sales (which were already high), a little bit in health care and general merchandise stores, which includes big-box and hardware stores.

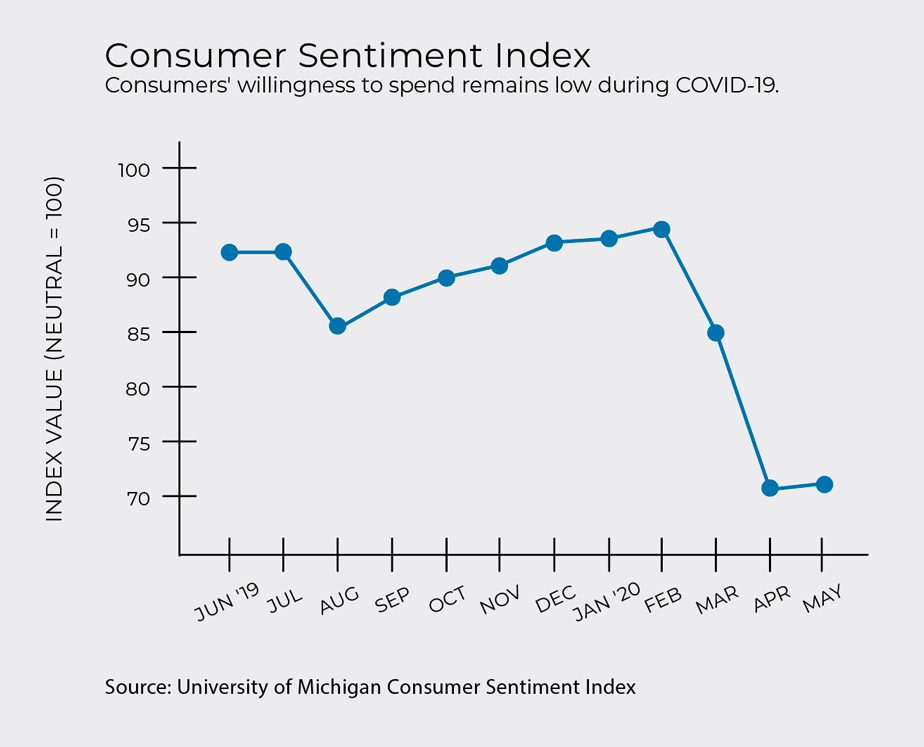

Consumer confidence has fallen according to several organizations that track that metric. What does that drop mean for retailers?

Overall consumer sentiment doesn’t always translate directly into spending, but it certainly is a negative indicator for consumers’ mood and willingness to spend. It’s definitely a leading indicator of what we expect to be an extended period of weak spending. We’ve already seen that because many stores have been closed necessarily, but even once the economy truly reopens, you’ll need to see a rebound in consumer sentiment before people are willing to spend on discretionary items.

All consumer confidence readings are pointing to the fact that people are feeling nervous about their economic prospects going forward. Twenty million people lost jobs in April alone; that’s mind-boggling. That’s going to have a very real impact on their bank accounts and psychology.

“I think it’s important to know that a V-shaped economic recovery is unlikely. A true recovery will probably be much more nuanced.” —James Bohnaker, IHS Markit

What would you want home improvement retailers to know about their role in the U.S. economy in the months ahead?

I think it’s important to know that a V-shaped economic recovery is probably unlikely. A true recovery will probably be much more nuanced. I think the number of positive COVID-19 cases and the fear factor both have to decrease quickly to hope for a V-shaped recovery, especially for industries that are predicated on having close contact with others, like travel and entertainment.

I think it’s important to understand that retailers will be operating with uncertainty for some time. They should set their own standards for how they want their businesses to function in this time, using guidance from federal, state and local governments. It would be a good idea for retailers to talk among their peers and set the standards they want to see for their industry going forward.

Hardware Retailing The Industry's Source for Insights and Information

Hardware Retailing The Industry's Source for Insights and Information